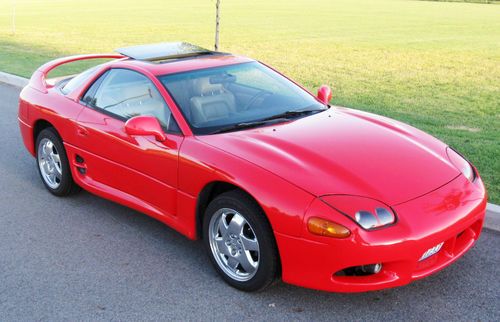

Body Type:Hatchback

Vehicle Title:Clear

Engine:3.0 l v 6 twin turbo twin intercooler

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Mitsubishi

Model: 3000GT

Trim: VR-4

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player, Convertible

Drive Type: AWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 154,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: 3000GT Vr-4

Exterior Color: White

Interior Color: Charcoal

Trading the love of my life for a WIFE!!!

-All wheel drive

-All wheel steering

-Active Aero (front active aero disengaged, rear still works)

-Active Exhaust

-Electronically controlled suspension

-ICE cold A/C

Glove box is also broken, and the windshield plastic vents.

New parts last year:

Both front Ball joints

Left Tie rod end

Front sway bar links

New spark plugs (0.36 gap)

New Shift boot

New custom embroidered 3000GT TWIN TURBO floor mats

Both diff, and trany fluid changed.

New climate controller changed this year.

Located in Brantford ON.

Car was etested Mar.27th/2013 (passed with flying colours).

Car is now safetied and etested

Mitsubishi 3000GT for Sale

1992 mitsubishi 3000gt vr4 w/ completely rebuilt engine

1992 mitsubishi 3000gt vr4 w/ completely rebuilt engine 1995 mitsubishi 3000gt base coupe 2-door 3.0l needs engine / rod knocking

1995 mitsubishi 3000gt base coupe 2-door 3.0l needs engine / rod knocking 1991 mitzubishi 3000gt vr-4 turbo(US $12,500.00)

1991 mitzubishi 3000gt vr-4 turbo(US $12,500.00) 1997 mitsubishi 3000gt sl manual 5 speed coupe red 2-door sun roof power 3.0l(US $4,900.00)

1997 mitsubishi 3000gt sl manual 5 speed coupe red 2-door sun roof power 3.0l(US $4,900.00) 1997 mitsubishi 3000gt sl coupe 2-door 3.0l

1997 mitsubishi 3000gt sl coupe 2-door 3.0l 1991 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

1991 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

Auto blog

Mitsubishi pondering $2B share sale?

Sun, 15 Sep 2013Mitsubishi makes the brilliantly fast, wonderfully fun Lancer Evolution. Outside of that road-going rally car, the rest of the range is pretty poor - the new Outlander isn't bad, but the subcompact Mirage looks like might've been competitive five years ago, while the Galant and Lancer have suffered from serial neglect.

This hasn't just lead to rumors of Mitsu's death in America; the subsidiary of the massive Mitsubishi Group has been in trouble at home, too. It was bailed out by three other Mitsubishi Group companies - Mitsubishi UFJ Financial, Mitsubishi Heavy Industries and Mitsubishi Corporation - between 2004 and 2005, according to Bloomberg. Now, it's attempting to extricate itself from "emergency mode," as analyst Koichi Sugimoto told the financial site, adding that "they're still in the very early stages of recovery."

As part of the bailout, Mitsubishi issued its three saviors billions of dollars of preferred shares, which don't have voting rights. The problem is, Mitsubishi hasn't issued dividend payments since 1998, and these stocks aren't exactly competing with Apple or Google, in terms of value. In other words, they're mostly worthless. With a public offering, Mitsubishi is expecting to raise 200 billion yen, or about $2 billion, in order to reduce the number of preferred shares. If all goes according to plan, it will wipe out preferred shares by March of 2014, or the end of fiscal year 2013.

10 automakers shack up in Detroit hotel to talk Takata airbags

Sun, Dec 14 2014Since Takata has decided not to take the lead concerning potential issues with its airbag inflators, the automakers have. Perhaps that's unsurprising, since it's the automakers, not Takata, that will take a beating on the dealership floor if consumers decide its models are a health hazards. The Detroit News reports that Toyota, Honda, General Motors, Ford, Chrysler, Mazda, BMW, Nissan, Mitsubishi and Subaru met in a hotel conference room near the Detroit Metropolitan Airport last week to sort out a way to understand the technical issues involved. So far, faulty airbag inflators have been ruled the cause of five deaths and 50 injuries around the world, but neither Takata nor investigators understands exactly why the inflators are malfunctioning. The National Highway Traffic Safety Administration recently asked Takata to issue a national recall, Takata declined, citing a minuscule failure rate and the fact that it's still investigating the issue. Toyota and Honda then made an industry-wide appeal for "a coordinated, comprehensive testing program" that would pinpoint the problem inflators and get them replaced, and that's what the Detroit meeting was about. Numerous issues, however, will make this a long row to hoe: simply getting the parts to replace the nearly 20 million inflators in cars recalled around the world so far - even working with other suppliers - will take a years, but more importantly, no one knows if the replacement inflators currently being installed will suffer the same issue. Answers will hopefully come quickly with Takata, the ten automakers and NHTSA all independently investigating the problem.

Mitsubishi and NTT to buy 30% stake in HERE digital mapping company

Sat, Dec 21 2019Digital mapping company HERE Technologies sold a 30% stake to Mitsubishi and Nippon Telegraph and Telephone Corp (NTT), diluting German carmakers’ stake to 54% amid uncertainty about the profit potential from autonomous cars. Mitsubishi and NTT will co-invest in the Amsterdam-headquartered company through their newly established, jointly owned holding firm COCO Tech Holding B.V. in the Netherlands, HERE said on Friday. “Their investment also means we are further diversifying our shareholder base beyond automotive, which is important given the appeal and necessity of location technology across geographies and industries,” HEREÂ’s Chief Executive Edzard Overbeek said. The Japanese companies said they would collaborate with HERE to develop services such as ways to tackle road congestion and improve supply chain efficiencies. High definition maps can also be used in fleet management, asset tracking, last-mile delivery, long-distance package delivery by drones and indoor mapping applications, Overbeek told Reuters. Financial details of the transaction, which they said would close next year, were not disclosed. German carmakers BMW, Audi and Daimler saw high definition mapping as a strategic asset and bought HERE from Finnish telecoms group Nokia for around 2.5 billion euros ($2.8 billion) in 2015 to avoid becoming dependent on AlphabetÂ’s Google. FridayÂ’s deal dilutes the stake held by each German carmaker from 25% to just under 18%, HERE said. REALITY CHECK Tech companies and automakers raced to develop self-driving vehicles after Google presented a prototype car in 2012, leading German manufacturers to develop robotaxis as a way to enter the ride-hailing business to take on Uber. However, the technology costs and regulatory hurdles have spiraled, and ride-hailing businesses have struggled to reach sustainable profitability, leading to a reassessment of the business potential of robotaxis and ride hailing. “There has been a reality check setting in here,” Daimler Chief Executive Ola Kaellenius said last month, adding that spending on robotaxis would be “rightsized.” The move comes as BMW and Daimler this week announced they will exit the North American car-sharing market, halting operations in Montreal, New York, Seattle, Washington D.C., and Vancouver, as they focus on the European market. Last year, GermanyÂ’s Continental and Bosch, the worldÂ’s largest automotive suppliers, bought a 5% stake in HERE.