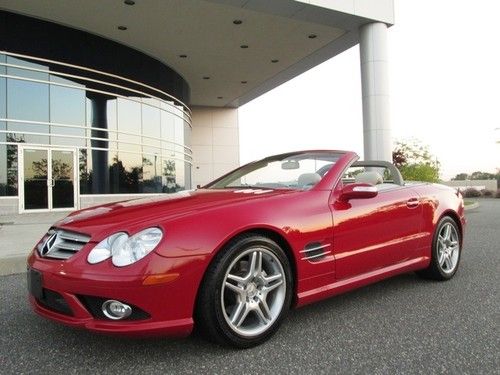

2009 Mercedes Sl550 Sl 550 Sport Damaged Wrecked Rebuildable Salvage Low Reserve on 2040-cars

Rancho Cordova, California, United States

Vehicle Title:Salvage

Fuel Type:Gasoline

Engine:5.5L 5461CC V8 GAS DOHC Naturally Aspirated

Transmission:Automatic

Make: Mercedes-Benz

Model: SL-Class

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 46,618

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: sl550

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Tan

Trim: Base Convertible 2-Door

Number of Cylinders: 8

Mercedes-Benz SL-Class for Sale

2005 mercedes-benz sl500 amg sport package hard top convertible!!(US $17,500.00)

2005 mercedes-benz sl500 amg sport package hard top convertible!!(US $17,500.00) Beautiful original condition(US $21,000.00)

Beautiful original condition(US $21,000.00) Fully-restored numbers-matching 190sl new leather/top/seals/tires etc etc superb

Fully-restored numbers-matching 190sl new leather/top/seals/tires etc etc superb 2003 mercedes-benz sl500 base convertible 2-door 5.0l

2003 mercedes-benz sl500 base convertible 2-door 5.0l

2007 mercedes-benz sl550 sport package red fully loaded stunning(US $29,995.00)

2007 mercedes-benz sl550 sport package red fully loaded stunning(US $29,995.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

Race recap: 2015 Abu Dhabi Grand Prix is Germany rising as sun sets

Mon, Nov 30 2015Mercedes-AMG Petronas driver Nico Rosberg Rosberg doesn't attribute anything mystical to the form that got him ahead of teammate Lewis Hamilton. He said simply, "Before it was close in the other direction, now it's close in this direction." Mercedes non-executive chairman Niki Lauda went further, saying Rosberg's "brain has switched." Under the desert spotlights it switched so far ahead that Lewis Hamilton qualified nearly four tenths behind the German. Kimi Raikkonen flew the scarlet for Ferrari in third position. Being three spots ahead of Valtteri Bottas gave Raikkonen a huge advantage in locking up fourth position in the driver's championship. Even if he doesn't care about it, as he's publicly stated, Ferrari probably does. Teammate Sebastian Vettel was classified 16th after the German slowed down after making a mistake on his final hot lap, and neither he nor his engineer realized how quickly times were falling on a cooling track. He'd be promoted to 15th when Lotus driver Romain Grosjean was penalized for a gearbox change. Sergio Perez knocked it out of the park for Sahara Force India, claiming fourth ahead of Daniel Ricciardo in fifth for Infiniti Red Bull Racing. Williams driver Bottas was in sixth, in front of the second Force India of Nico Hulkenberg and the second Williams of Felipe Massa in eighth. Daniil Kvyat ensured both Red Bulls were in the top 10 with his ninth position, and Carlos Sainz got the upper hand in qualifying over his Toro Rosso teammate Max Verstappen for the final time this year, rounding out the top 10. Beyond Nico Rosberg's mind, one of his weaknesses was his slow starts. Those are stronger, too, the German tearing off away from the field when the lights went out. Hamilton bogged enough to have to defend from Perez behind, the Mexican trying to slide between Hamilton and Raikkonen on the run to the first corner. Rosberg held the lead into Turn 1 and likewise held it through Turn 21 on the last lap of the race, only ceding it during pit stops. Rosberg's 14th victory gets him level with Graham Hill on the wins list – on the anniversary of Hill's death in a plane crash – and marks the first time in his 10-year F1 career that he's won three races in a row. More proof of his strength: the last few races we haven't heard Rosberg ask for regular updates about what Hamilton's doing, he just drives. Hamilton gave it his best but that wasn't enough.

Aston Martin tipped for F1 return with Red Bull, Mercedes

Mon, Jul 6 2015Aston Martin could be plotting a return to Formula One for the first time in over half a century. And not as a backmarker, either. That is, at least, if the latest rumors materialize. While most automakers that participate in F1 do so as either a team owner (like Ferrari and Mercedes) or as an engine supplier (think Renault or Honda), the rumored Aston Martin deal would take a different approach. According to Autosport, the proposal would have the Red Bull Racing team run Aston Martin branding – but not its engines. Those would be provided by Mercedes, just like the engines in the British marque's upcoming slate of road cars. In that regard, the deal would not be unlike the one which Red Bull currently has with the Renault-Nissan Alliance, which sees the team running Renault engines and Infiniti branding. Andy Palmer was a pivotal figure in brokering that unusual arrangement when he was working for Carlos Ghosn, and is now tipped to be brokering a similar deal in his new capacity as Aston Martin's CEO. Though Aston has found glory in sports car racing (including Le Mans and its various associated series), it was never much of a contender in grand prix racing. It competed in a handful of races in 1959 and 1960, but never achieved results worth bragging about. Aston was rumored to be plotting a return when David Richards sat as chairman of the company, having run Aston's racing program as well as Honda's F1 team previously. Those rumors, however, never materialized. Whether this time 'round gains any traction remains to be seen - Aston Martin declined to either confirm or deny the reports when reached for comment by Autoblog. Red Bull has been growing increasingly dissatisfied (and increasingly vocal about its dissatisfaction) with Renault engines over the past couple of seasons. Though the two parties won four back-to-back world titles together, things took a noticeable step backward after the new turbo engine regulations took hold for the 2014 season. Nissan/Infiniti and Red Bull are contracted to continue collaborating until the end of next season. After that is when the new Aston deal could take hold, and Mercedes is reportedly keen on the idea so that it could add another customer to its F1 engine supply business and offset the costs of development. That could effectively prove the end of Renault in F1 (at least for the time being). Aside from Red Bull, the French automaker currently supplies only that outfit's sister team Toro Rosso.

2014 Mercedes-Benz E-Class lineup shows its freshened face

Mon, 14 Jan 2013Mercedes-Benz showed us its redesigned 2014 E-Class more than a month ago, but the Detroit Auto Show finally gave us a chance to see the full family of mid-size luxury cars and wagons in the flesh. Dieter Zetsche introduced the cars, including sedan, coupe, convertible and station wagon, on stage showing the stylish new design direction.

The wagon and sedan versions (shown as the E400 Hybrid above) will go on sale this spring, while the coupe and cabriolet will hit showrooms over the summer. Check our new gallery of live shots for the entire 2014 E-Class lineup, as well as the previously released press release below.