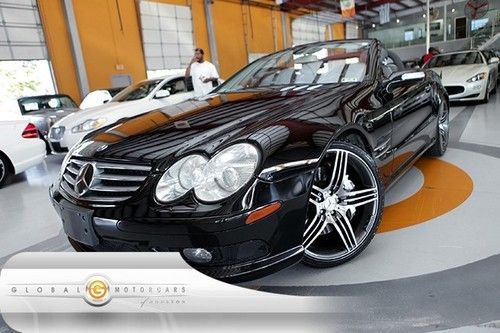

2007 Mercedes Benz Sl550 Amg Sport Navigation Convertible on 2040-cars

Carol Stream, Illinois, United States

For Sale By:Dealer

Engine:5.5L 5461CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Make: Mercedes-Benz

Model: SL550

Disability Equipped: No

Trim: Base Convertible 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 29,746

Exterior Color: Silver

Number of Cylinders: 8

Interior Color: Black

Mercedes-Benz SL-Class for Sale

05 mercedes sl600 amg-sport auto bose navigation active-comfort-sts keyless-go(US $29,995.00)

05 mercedes sl600 amg-sport auto bose navigation active-comfort-sts keyless-go(US $29,995.00) 1972 mercedes 350 sl lots of newer stuff

1972 mercedes 350 sl lots of newer stuff 1995 mercedes-benz sl600 v12,great car for parts sale(US $4,450.00)

1995 mercedes-benz sl600 v12,great car for parts sale(US $4,450.00) 2dr roadster coupe convertible nav cd 4-wheel disc brakes a/c abs air suspension

2dr roadster coupe convertible nav cd 4-wheel disc brakes a/c abs air suspension 560sl roadster / 60628 miles / hard top(US $12,700.00)

560sl roadster / 60628 miles / hard top(US $12,700.00)

Auto Services in Illinois

Wolf and Cermak Auto ★★★★★

Wheels Of Chicagoland ★★★★★

Urban Tanks Custom Vehicle Out ★★★★★

Towing Solutions ★★★★★

Top Coverage Ltd ★★★★★

Supreme Automotive & Trans ★★★★★

Auto blog

Recharge Wrap-up: BMW i8's Engine of the Year, biodiesel producer guilty

Fri, Jun 19 2015BMW has won International Engine of the Year for the hybrid system in the i8. The i8 PHEV uses a 1.5-liter, three-cylinder gasoline engine with a hybrid drive unit including a 96-kilowatt electric motor. BMW beat Ford's 1.0-liter EcoBoost engine by a small margin to win the award for best overall engine. It also took the award for the 1.4-liter to 1.8-liter category, as well as best new engine. Tesla beat BMW to win the green engine category for the electric powertrain of the Tesla Model S. Read more at Green Car Congress, or see all of the results from the International Engine of the Year Awards. The head of Audi powertain development is quitting as the automaker steps up electrification. Stefan Knirsch has worked at Audi since late 2013, and previously worked at Porsche as the head of quality management and engine development. Germany's Auto Motor und Sport magazine had reported that Knirsch was leaving Audi, which Audi confirmed without giving a departure date or saying if he would be working elsewhere. Audi has been feeling pressure from its competitor Mercedes-Benz, and has been working on improving its EV offerings and autonomous vehicle technology. Read more from Reuters. The owner of a biodiesel company has pleaded guilty to fraud. Philip Joseph Rivkin, aka Felipe Poitan Arriaga, took part in a scheme to defraud the EPA, falsely claiming to be producing millions of gallons of biodiesel. This allowed his company, Green Diesel, to receive renewable fuel credits and sell them to oil companies and brokers. "These crimes are a serious threat to an important program that helps combat climate change," says Cynthia Giles of the EPA. "Companies and individual managers should get the message that there are serious consequences for breaking the rules and undermining the integrity of this program." Rivkin faces over 10 years in prison and $51 million in restitution. Read more in the press release below. Biodiesel Fuel Company Owner Pleads Guilty to Fraud and Clean Air Act Crimes Connected to Renewable Fuels Scheme Philip J. Rivkin faces more than 10 years imprisonment and $51 million in restitution WASHINGTON – Philip Joseph Rivkin, a.k.a. Felipe Poitan Arriaga, 50, today pleaded guilty to a Clean Air Act false statement and mail fraud as part of his role in a scheme to defraud EPA by falsely representing that he was producing millions of gallons of biodiesel fuel.

Ram 1500 Rebel TRX and Jeep Grand Wagoneer | Autoblog Podcast #642

Fri, Aug 28 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by News Editor Zac Palmer. The big news this go-around is the reveal of the 2021 Ram Rebel TRX and Jeep previewing the 2022 Grand Wagoneer. They also discuss a mysterious BMW M8 mule and the F1-inspired Delage D12. Next, they talk about driving the Lincoln Navigator and Mercedes-AMG C 63 S Coupe before revisiting a recent "Spend My Money" segment with an update from the sender. Autoblog Podcast #642 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2021 Ram Rebel TRX debuts as a Hellcat-powered, desert-running Raptor killer Jeep previews 2022 Grand Wagoneer again What's hiding beneath this mystery BMW M8 mule? (Update) Historic French brand Delage returns with the D12 Cars We're Driving: 2020 Lincoln Navigator 2020 Mercedes-AMG C 63 S Coupe Spend My Money update Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Mercedes-Benz engines with 48-volt systems coming in 2017

Tue, Jun 14 2016As part of a big green push announced yesterday, Mercedes-Benz is jumping into the world of 48-volt power. The company will launch a new family of efficient gasoline engines next year and will begin rolling out 48-volt systems with it, likely in its more expensive cars first. Mercedes will use the 48-volt systems to power mild-hybrid functions like energy recuperation (commonly called brake regeneration), engine stop-start, electric boost, and even moving a car from a stop on electric power alone. These features will be enabled through either an integrated starter-generator (Mercedes abbreviates it ISG) or a belt-driven generator (RSG). (RSG is from the German word for belt-driven generator, Riemenstartergeneratoren. That's your language lesson for the day.) Mercedes didn't offer many other details on the new family of engines. There are 48-volt systems already in production; Audi's three-compressor SQ7 engine uses an electric supercharger run by a 48-volt system, and there's a new SQ5 diesel on the horizon that will use a similar setup with the medium-voltage system. Electric superchargers require a lot of juice, which can be fed by either a supercapacitor or batteries in a 48-volt system. Why 48-volt Matters: Current hybrid and battery-electric vehicles make use of very high voltages in their batteries, motors, and the wiring that connects them, usually around 200 to 600 volts. The high voltage gives them enough power to move a big vehicle, but it also creates safety issues. The way to mitigate those safety issues is with added equipment, and that increases both cost and weight. You can see where this is going. By switching to a 48-volt system, the high-voltage issues go away and the electrical architecture benefits from four times the voltage of a normal vehicle system and uses the same current, providing four times the power. The electrical architecture will cost more than a 12-volt system but less than the complex and more dangerous systems in current electrified vehicles. The added cost makes sense now because automakers are running out of ways to wisely spend money for efficiency gains. Cars can retain a cheaper 12-volt battery for lower-power accessories and run the high-draw systems on the 48-volt circuit. The industry is moving toward 48-volt power, with the SAE working on a standard for the systems and Delphi claiming a 10-percent increase in fuel economy for cars that make the switch.