Only 19k Mi, Prem Pkg, Bi-xenon, Keyless Go, Amg Sport, Navi, 310-925-7461 on 2040-cars

Mercedes-Benz CLS-Class for Sale

06 mercedes cls500 amg sport pkg comfort pkg

06 mercedes cls500 amg sport pkg comfort pkg Mercedes benz cls55 amg low miles 33k 20inch vellano wheels(US $35,995.00)

Mercedes benz cls55 amg low miles 33k 20inch vellano wheels(US $35,995.00) 08 cls63 amg navi-heated/cooled seats-hid headlights-financing!(US $31,995.00)

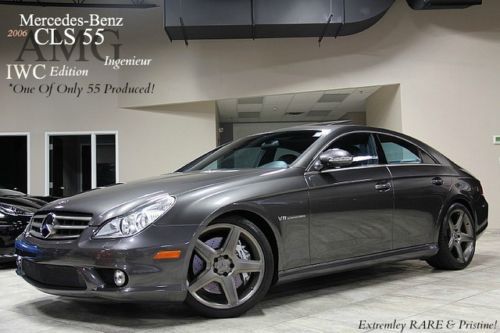

08 cls63 amg navi-heated/cooled seats-hid headlights-financing!(US $31,995.00) 2006 mercedes benz cls55 amg ultra rare iwc ingenieur edition - 1of only 55 made(US $39,800.00)

2006 mercedes benz cls55 amg ultra rare iwc ingenieur edition - 1of only 55 made(US $39,800.00) Black with black interior.plus one wheel and paddle sifter package.

Black with black interior.plus one wheel and paddle sifter package. 2007 mercedes cls63~amg~86,867 miles~silver~auto~clean

2007 mercedes cls63~amg~86,867 miles~silver~auto~clean

Auto blog

'55 Mercedes Gullwing racer expected to sell for $6 million

Mon, Nov 2 2015RM Sotheby's has a Gullwing up for auction. Not just any Gullwing, but one of just four prepared by the factory for racing. And it's expected to fetch $6,000,000, (give or take a million) when it crosses the auction block next month in New York. Chassis number 5500640 is billed as "the rarest and most desirable W198 Gullwing ever presented for public auction," and it's not hard to see why. It was used for both racing and testing purposes, including an entry in the notoriously grueling Tour de France by none other than Sir Stirling Moss. He placed it second only to the Marquis de Portago in his Ferrari 250 GT TdF, often outperforming the Ferrari in stages of the event. It was in the possession of one owner since 1966, who stored it for 40 years before passing it on to his son in 2008, who in turn underwrote a comprehensive three-year restoration project and has now put it up for auction. Gullwings are invariably the most sought-after post-war production Mercedes when they come up for auction. The highest price one has ever garnered, according to the records at Sports Car Market, was $4.62 million paid in early 2012 at Gooding & Company's Scottsdale auction. This example, however, stands to far surpass that amount to set a new record. It's just one of several notable lots consigned for the Driven By Disruption event, set to take place on December 10 in New York. Alongside it, RM has the Lamborghini Concept S (valued at over $2.4 million), a 1962 Aston Martin DB4 GT Zagato (over $16m), and a 1956 Ferrari 290 MM driven by Juan Manuel Fangio ($28m). In short, it ought to be a significant sale, and we'll report the results once they're in.

Geely chairman is now the single biggest investor in Daimler

Fri, Feb 23 2018Li Shufu, the chairman and main owner of Chinese carmaker Geely, has built a stake of 9.69 percent in Daimler AG, the German carmaker said in a regulatory filing on Friday. The stake, worth nearly $9 billion at the current valuation for Daimler shares, makes Li the biggest single shareholder in the maker of Mercedes-Benz cars, trucks and vans headquartered in the German city of Stuttgart. A Daimler spokesman called the stake purchase a private investment by Li. "We are delighted, with Li Shufu, to have won over another long-term investor who is convinced of Daimler's innovative prowess, strategy and future potential," the spokesman said in response to a request for comment. "Daimler knows and respects Li Shufu as a Chinese entrepreneur of particular competence and forward thinking." Li's stake purchase makes him the top shareholder in Daimler ahead of the Kuwait Investment Authority, which owned 6.8 percent as of Sept. 30, according to Thomson Reuters data. Earlier this month, the German newspaper Bild am Sonntag reported that the Chinese industry giant was seeking to become Daimler's biggest shareholder, likely exceeding the 6.8-percent stake of the Kuwait Investment Authority. The paper said Daimler had reportedly turned down Geely's $4.5 billion offer for a 5-percent stake via a discounted share placement, saying that Geely could buy shares in the open market. Institutional investors currently own 70.7 percent of Daimler, and the company already has strong ties to Chinese automakers BAIC and BYD. Bild am Sonntag said the move was intended as a strategic alliance against Apple, Google and Amazon on autonomous and connected cars. And Reuters reported that Daimler wants to have bespoke "robo taxis" on the road quicker than Google's Waymo, and views Geely as a strong partner for that. Geely conversely is interested in Daimler's electric car battery technology, and sources quoted by the German paper say there are plans to establish joint electric car manufacturing in Wuhan, China, to meet China's smog-reducing quotas. Geely is developing the Lynk & Co. brand of electric and hybrid cars. Geely owns Volvo, which has enjoyed a renaissance under the arrangement, as well as the maker of London's black cabs. In December, it bought a stake in AB Volvo, the maker of Volvo trucks.

Mercedes GLE-Class shows a new face for the luxury crossover in NYC

Thu, Apr 2 2015Segments don't get much hotter than luxury crossovers at the moment, and that makes for some perfect timing for Mercedes-Benz to unveil the GLE-Class at the 2015 New York Auto Show. As a replacement for the M-Class, the new model offers a more traditional looking alternative to the styling of its swoopy sibling, the GLE-Class Coupe. Mercedes' designers crafted a nose for the GLE that gives it a strong family resemblance to the Coupe, but the rest of the shape bears a chunky, more utilitarian appearance. Elsewhere, the new model sticks with the thick C-pillar and wraparound rear glass of the outgoing M-Class but with sharper edges for a slightly more muscular look. Stepping inside, occupants find all of the German luxury brand's latest styling cues. Mercedes is making a major commitment to adding more plug-in hybrids to its vehicles in the coming years, and the GLE is one step in that process. The lineup includes the GLE550e 4Matic that pairs a 3.0-liter, twin-turbo V6 with electric assistance to produce a total of 436 horsepower and 479 pound-feet of torque. The German brand isn't going entirely green, though, and the range also includes the Mercedes-AMG GLE63 and GLE63 S, powered by a twin-turbo 5.5-liter V8 that produces 550 hp or 577 hp, respectively. Check out the photos above from the show floor to get a full look at this upscale crossover before it arrives at dealers later this year.