Mercedes-Benz 300-Series for Sale

1987 mercedes-benz 300sdl base sedan 4-door 3.0l(US $7,500.00)

1987 mercedes-benz 300sdl base sedan 4-door 3.0l(US $7,500.00) 1982,mercedes 300d turbodiesel, with the coversion kit, grease car

1982,mercedes 300d turbodiesel, with the coversion kit, grease car Rustfree, 2 owner, rare colors, leather, documented low mile 1985 300d

Rustfree, 2 owner, rare colors, leather, documented low mile 1985 300d

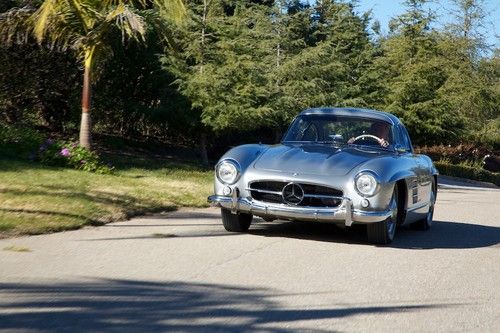

Rare 1955 mercedes 300sl gullwing coupe!!! factory restored!(US $1,900,000.00)

Rare 1955 mercedes 300sl gullwing coupe!!! factory restored!(US $1,900,000.00) 1991 green excel cond overall new brakes&tires runs perfectly!

1991 green excel cond overall new brakes&tires runs perfectly!

Auto blog

As US exports top 2 million, is America becoming the world's source of cheap cars?

Mon, Feb 9 2015North American auto production is booming with 2014 figures just shy of the of the 17.3-million vehicle record set in 2000. With more models being built on the continent, even more are being shipped overseas. Factories in the US exported 2.1 million cars last year – the highest number ever. About half of those went to Canada and Mexico, but more than ever have been heading to places like the Middle East and China. The upswing comes in part from from after-effects from the Great Recession, according to The Wall Street Journal. With a weak dollar and lower production costs after the financial crisis, building vehicles in the US was relatively cheaper and more competitive in the world. At the same time buyers around the world are going crazy for crossovers. According to the WSJ, BMW and Mercedes-Benz are already exporting the majority of their US production of these models overseas. Both automakers have also announced investments to expand production further here to send more vehicles abroad. Even Honda has been shipping more models out of the country than it imported here. There is a concern this international strength could start slowing because the dollar is strengthening against other currencies, though it's too early to know what the actual effect of this could be, according to the WSJ. "Of course, we closely watch currency exchange, but we don't make changes in production or allocation based on temporary fluctuations in the exchange rate," Ford North American boss Joe Hinrichs told the newspaper. Related Video: News Source: The Wall Street Journal - sub. req.Image Credit: BMW Plants/Manufacturing BMW Ford Honda Mercedes-Benz exports us auto production

Luxury car brands scrambling to avoid a blue Christmas

Thu, Nov 2 2017DETROIT — When financial markets surge to new records, sales of luxury cars usually rise, too. Instead, October U.S. auto sales reports on Wednesday showed that a collapse in sales of luxury sedans is accelerating. Consumers have gradually shifted over to luxury sport utility vehicles from sedans in the past decade, but the trend — which has occurred in both the non-luxury and luxury sedan segments of the auto market — was particularly pronounced in October. Sales of Daimler AG's Mercedes-Benz S-Class, long a global benchmark for large, premium sedans, plunged 49 percent in October, and are down 24.8 percent for the year to date. General Motors' Cadillac brand said it sold just 779 of its CTS sedans in October. Demand for that car, designed to compete with German luxury sedans, is down nearly 33 percent for the year. "There's still a significant portion of the market that wants a car, but I'm sure there were people who preferred a horse to a car at one point." Cadillac's best-selling model this year is the XT5 compact SUV, which has more than doubled sales from a year ago. The shift within the luxury vehicle market away from sedans toward SUVs of all sizes is forcing some of the most prestigious brands to scramble to add SUV models to their lineups or boost SUV production to meet demand. "In the short term, there will be pressure to add (consumer) incentives, cut production or both," said Cox Automotive analyst Michelle Krebs. "And we just don't see an end in sight to this trend." The Dow Jones Industrial Average has been trading at all-time highs, usually a good sign for luxury sedans, but as major automakers reported new U.S. vehicle sales for October on Wednesday, sales for passenger cars continued their slide while luxury SUV and crossover sales rose again. According to Kelley Blue Book data, in 2007 luxury sedans made up 7.6 percent of U.S. new vehicle sales, while luxury SUVs made up 4.2 percent. Through September this year, luxury SUVs made up just over 7 percent of the market, compared with 4.9 percent for luxury sedans. In the short term, luxury brands could use holiday season sales promotions to clear slow-selling sedans off dealer lots, analysts said. Toyota's Lexus brand said on Wednesday it will launch its "December to Remember" year-end sales promotion for the 18th straight year.

Dealers mobilize to protect their margins from automaker subscription services

Fri, Aug 24 2018Six individual auto brands — Lincoln, Cadillac, Porsche, Mercedes, BMW and Volvo — have established or are trialing a vehicle subscription service in the U.S. Three third-party companies — Flexdrive, Clutch and Carma — run brand-agnostic subscription services. And three automakers — Mercedes-Benz, BMW, and General Motors — have also launched short-term rental services. Dealers, afraid of how these trends might affect their margins, are building political and lawmaking campaigns to protect their revenue streams. So far, three states are investigating automaker subscriptions, and Indiana has banned any such service until next year. It's certain that those three states are the first fronts in a long political and legal battle. Powerful dealer franchise laws mandate the existence of dealers and restrict how automakers are allowed to interact with customers to sell a vehicle. On top of that, Bob Reisner, CEO of Nassau Business Funding & Services, said, "Dealers and their associations are among the strongest political operators in many states. They as a group are difficult for state politicians to vote against." In California earlier this year, the state Assembly debated a bill with wide-ranging provisions to protect against what the California New Car Dealers Association called "inappropriate treatment of dealers by manufacturers." One of those provisions stipulated that subscription services need to go through dealers, but that item got stripped out when dealers and manufacturers agreed to discuss the matter further. In Indiana, Gov. Eric Holcomb signed a moratorium on all subscription programs by dealers or manufacturers until May 1, 2019, to give legislators more time to investigate. Dealers in New Jersey have taken their campaign to the state capitol, asking that the cars in subscription programs get a different classification for registration purposes. Automakers run the current subscription services and own the vehicles. Sign-ups and financial transactions happen online or through apps, leaving dealers to do little more than act as fulfillment centers to various degrees, with little legal recourse as to compensation amounts when they're called on to deliver or service a car. That's a bad base to build on for business owners who've sunk millions of dollars into their operations.