Hse Fac Rear Dvd Luxury Pkg Navigation Camera Sat Ipod Usb Bluetooth Parktronic on 2040-cars

Vienna, Virginia, United States

Vehicle Title:Clear

Engine:5.0L 5000CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

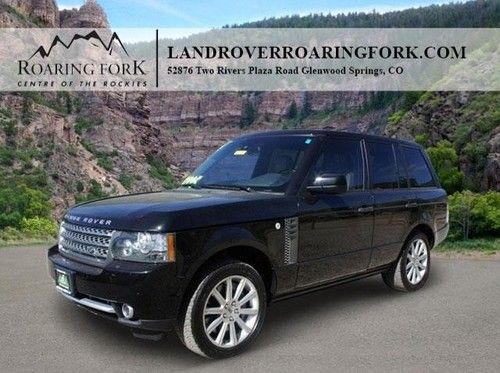

Make: Land Rover

Warranty: Unspecified

Model: Range Rover

Trim: HSE Sport Utility 4-Door

Options: Leather Seats

Power Options: Power Windows

Drive Type: 4WD

Mileage: 37,329

Sub Model: HSE LUX DVD

Number of Cylinders: 8

Exterior Color: Black

Interior Color: Tan

Land Rover Range Rover for Sale

Supercharged 510hp surround cameras 1200 watts sound 4-zone climate local trade(US $67,995.00)

Supercharged 510hp surround cameras 1200 watts sound 4-zone climate local trade(US $67,995.00) 4wd supercharged leather heated/cooled seats in warranty low reserve(US $73,000.00)

4wd supercharged leather heated/cooled seats in warranty low reserve(US $73,000.00) Land rover range rover supercharged awd navigation(US $37,495.00)

Land rover range rover supercharged awd navigation(US $37,495.00) 2004 land rover range rover hse awd red navigation sunroof xenon very clean(US $11,990.00)

2004 land rover range rover hse awd red navigation sunroof xenon very clean(US $11,990.00) Land rover range classic county ready for travel great car 3.9 auto

Land rover range classic county ready for travel great car 3.9 auto White,tan,(US $23,998.00)

White,tan,(US $23,998.00)

Auto Services in Virginia

Weaver`s Automotive ★★★★★

Wayne`s Auto Repair & Towing Service ★★★★★

Volvo Specialists Inc ★★★★★

Thomas Wheel Alignment & Tire Service ★★★★★

The Body Works of VA INC ★★★★★

The Body Works of VA INC ★★★★★

Auto blog

BMW and Jaguar Land Rover to jointly develop electric car tech

Wed, Jun 5 2019FRANKFURT – BMW and Jaguar Land Rover on Wednesday said they will jointly develop electric motors, transmissions and power electronics, unveiling yet another industry alliance designed to lower the costs of developing electric cars. Both carmakers are under pressure to roll out zero-emission vehicles to meet stringent anti-pollution rules, but have struggled to maintain profit margins faced with the rising costs of making electric, connected and autonomous cars. "Together, we have the opportunity to cater more effectively for customer needs by shortening development time and bringing vehicles and state-of-the-art technologies more rapidly to market," said BMW board member Klaus Froehlich. BMW and Jaguar Land Rover said they will save costs through shared development, production planning and joint purchasing of electric car components. Both companies will produce electric drivetrains in their own manufacturing facilities, BMW said. The BMW Jaguar Land Rover pact comes as rivals FiatChrysler and Renault explore a $35 billion tie-up of the Italian-American and French carmaking groups. Nick Rogers, Jaguar Land Rover's engineering director said, "We've proven we can build world beating electric cars but now we need to scale the technology to support the next generation of Jaguar and Land Rover products." BMW was in talks with rival Daimler about developing electric car components but was also in discussions with Jaguar Land Rover, a company it once owned, to explore an alliance on engines. BMW already has a deal to supply an 8 cylinder engine to Jaguar Land Rover. Carmakers are increasingly open to sharing electric car parts because the technology is expensive and because customers no longer buy a car based on what engine a vehicle has. "Carmakers are much less precious about sharing electric car technology because it is much harder to create product differentiation with electric car tech. They all accelerate fast, and everybody can do quality and ride and handling," according to Carl-Peter Forster a former chief executive of Tata Motors and a former BMW executive. Jaguar Land Rover is still run by former BMW managers, including Ralf Speth the company's chief executive who spent 20 years at BMW prior to joining JLR, and Wolfgang Ziebart, the engineer who oversaw Jaguar's I-Pace electric car program, who is a former head of research and development at BMW.

2020 Land Rover Defender, a pair of super wagons and watch talk | Autoblog Podcast #655

Fri, Dec 4 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They kick things off discussing what they've been driving this week. Greg has been spending time in the 2020 Land Rover Defender 110, and Zac has been driving a pair of super wagons in the 2021 Audi RS 6 Avant and 2021 Mercedes-AMG E 63 S Wagon. Greg follows that up with an interview of Blake Buettner, the managing editor at Worn & Wound, in the final segment. Autoblog Podcast #655 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving2021 Land Rover Defender 2021 Audi RS 6 Avant 2021 Mercedes-AMG E 63 S Wagon Watch interview with Worn & Wound managing editor Blake Buettner Feedback Email – Podcast@Autoblog.com Review the show on iTunes

The UK votes for Brexit and it will impact automakers

Fri, Jun 24 2016It's the first morning after the United Kingdom voted for what's become known as Brexit – that is, to leave the European Union and its tariff-free internal market. Now begins a two-year process in which the UK will have to negotiate with the rest of the EU trading bloc, which is its largest export market, about many things. One of them may be tariffs, and that could severely impact any automaker that builds cars in the UK. This doesn't just mean companies that you think of as British, like Mini and Jaguar. Both of those automakers are owned by foreign companies, incidentally. Mini and Rolls-Royce are owned by BMW, Jaguar and Land Rover by Tata Motors of India, and Bentley by the VW Group. Many other automakers produce cars in the UK for sale within that country and also export to the EU. Tariffs could damage the profits of each of these companies, and perhaps cause them to shift manufacturing out of the UK, significantly damaging the country's resurgent manufacturing industry. Autonews Europe dug up some interesting numbers on that last point. Nissan, the country's second-largest auto producer, builds 475k or so cars in the UK but the vast majority are sent abroad. Toyota built 190k cars last year in Britain, of which 75 percent went to the EU and just 10 percent were sold in the country. Investors are skittish at the news. The value of the pound sterling has plummeted by 8 percent as of this writing, at one point yesterday reaching levels not seen since 1985. Shares at Tata Motors, which counts Jaguar and Land Rover as bright jewels in its portfolio, were off by nearly 12 percent according to Autonews Europe. So what happens next? No one's terribly sure, although the feeling seems to be that the jilted EU will impost tariffs of up to 10 percent on UK exports. It's likely that the UK will reciprocate, and thus it'll be more expensive to buy a European-made car in the UK. Both situations will likely negatively affect the country, as both production of new cars and sales to UK consumers will both fall. Evercore Automotive Research figures the combined damage will be roughly $9b in lost profits to automakers, and an as-of-yet unquantified impact on auto production jobs. Perhaps the EU's leaders in Brussels will be in a better mood in two years, and the process won't devolve into a trade war. In the immediate wake of the Brexit vote, though, the mood is grim, the EU leadership is angry, and investors are spooked.