Jeep Wrangler Unlimited Rubicon Sport Utility on 2040-cars

Avon Park, Florida, United States

Body Type:Sport Utility

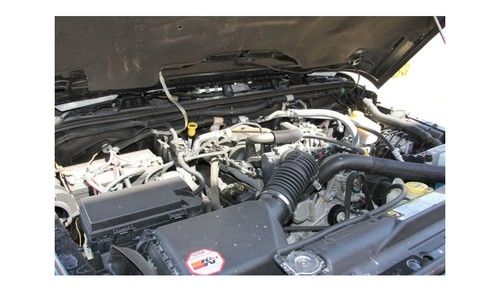

Engine:3.8L 3778CC 231Cu. In. V6

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Gray

Make: Jeep

Number of Cylinders: 6

Model: Wrangler

Trim: Unlimited Rubicon Sport Utility 4-Door

Drive Type: 4WD

Mileage: 37,000

Sub Model: RUBICON

Disability Equipped: No

Exterior Color: Black

Warranty: Vehicle has an existing warranty

Jeep Wrangler for Sale

Starwood custom! smittybilt bumpe! half doors! kevlar liner! leather! 4 lift!(US $55,888.00)

Starwood custom! smittybilt bumpe! half doors! kevlar liner! leather! 4 lift!(US $55,888.00) Project jeep needs tlc kmh odometer no md sales

Project jeep needs tlc kmh odometer no md sales 1990 jeep wrangler base sport utility 2-door 2.5l(US $5,900.00)

1990 jeep wrangler base sport utility 2-door 2.5l(US $5,900.00) 2003 jeep wrangler sport offroad tires lifted suspension 4.0l 5 speed no reserve

2003 jeep wrangler sport offroad tires lifted suspension 4.0l 5 speed no reserve 2012 jeep wrangler unlimited rubicon sport utility 4-door 3.6l(US $38,000.00)

2012 jeep wrangler unlimited rubicon sport utility 4-door 3.6l(US $38,000.00) 1988 jeep wrangler

1988 jeep wrangler

Auto Services in Florida

Zych Certified Auto Repair ★★★★★

Xtreme Automotive Repairs Inc ★★★★★

World Auto Spot Inc ★★★★★

Winter Haven Honda ★★★★★

Wing Motors Inc ★★★★★

Walton`s Auto Repair Inc ★★★★★

Auto blog

Jeep and Ram diesel owners get $3,075 in lawsuit settlement

Tue, May 7 2019Owners of certain Ram 1500 and Jeep Grand Cherokees equipped with diesel engines will get up to $3,075 in compensation for repairs under a settlement of a class-action lawsuit against Fiat Chrysler over illegal emissions-cheating software. The roughly $800 million settlement was first announced in January and approved by a federal judge in California last week, according to Consumer Reports. The affected vehicles are 2014 to 2016 Ram 1500 pickup trucks and Jeep Grand Cherokee SUVs equipped with 3.0-liter EcoDiesel V6 engines. FCA will update the emissions control software, provide an extended warranty covering up to 10 years or 120,000 miles, and provide cash compensation. Eligible owners will get as much as $3,075, while eligible lessees, former lease holders and former owners will get up to $990, and partial owners will get up to $2,460. FCA has established an EcoDiesel Settlement website where affected owners can find more information on how to submit and track a claim and sign up for updates. Customers with questions can also call 833-280-4748. Vehicle owners will have 21 months to submit a claim, with a deadline of Feb. 3, 2021, and two years to complete the repair and receive compensation for it. Former owners and lease holders must submit claims by Aug. 1, 2019. The EPA in early 2017 issued a notice of violation to FCA after Jeep and Ram installed eight emissions control devices on diesel vehicles. FCA's settlement includes $311 million in total civil penalties to U.S. and California regulators, up to $280 million to resolve claims from diesel owners, $105 million in extended warranties, $72.5 million in state civil penalties and $33.5 million in payments to California for excess emissions and to resolve consumer claims. Auto supplier Robert Bosch GmbH, which provided emissions control software, is paying $27.5 million to resolve claims, plus $103.5 million to settle claims with 47 states. The federal court also approved consent decrees between FCA, the EPA and the California Air Resources Board, plus agreements with all 50 stats and the U.S. Customs and Border Protection. In a statement, FCA said, "The settlements contain no findings of wrongdoing, nor admission of any wrongdoing, by FCA US" and added that the software fixes will have no affect on average fuel economy, performance or other characteristics of the vehicles.

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

Stellantis lays off salaried workers, cites uncertainty in EV transition

Sat, Mar 23 2024DETROIT — Jeep maker Stellantis is laying off about 400 white-collar workers in the U.S. as it deals with the transition from combustion engines to electric vehicles. The company formed in the 2021 merger between PSA Peugeot and Fiat Chrysler said the workers are mainly in engineering, technology and software at the headquarters and technical center in Auburn Hills, Michigan, north of Detroit. Affected workers were notified starting Friday morning. “As the auto industry continues to face unprecedented uncertainties and heightened competitive pressures around the world, Stellantis continues to make the appropriate structural decisions across the enterprise to improve efficiency and optimize our cost structure,” the company said in a prepared statement Friday. The cuts, effective March 31, amount to about 2% of Stellantis' U.S. workforce in engineering, technology and software, the statement said. Workers will get a separation package and transition help, the company said. “While we understand this is difficult news, these actions will better align resources while preserving the critical skills needed to protect our competitive advantage as we remain laser focused on implementing our EV product offensive,” the statement said. CEO Carlos Tavares repeatedly has said that electric vehicles cost 40% more to make than those that run on gasoline, and that the company will have to cut costs to make EVs affordable for the middle class. He has said the company is continually looking for ways to be more efficient. U.S. electric vehicle sales grew 47% last year to a record 1.19 million as EV market share rose from 5.8% in 2022 to 7.6%. But sales growth slowed toward the end of the year. In December, they rose 34%. Stellantis plans to launch 18 new electric vehicles this year, eight of those in North America, increasing its global EV offerings by 60%. But Tavares told reporters during earnings calls last month that “the job is not done” until prices on electric vehicles come down to the level of combustion engines — something that Chinese manufacturers are already able to achieve through lower labor costs. “The Chinese offensive is possibly the biggest risk that companies like Tesla and ourselves are facing right now,Â’Â’ Tavares told reporters. “We have to work very, very hard to make sure that we bring out consumers better offerings than the Chinese.