Jeep Wrangler Se on 2040-cars

Brooklyn, New York, United States

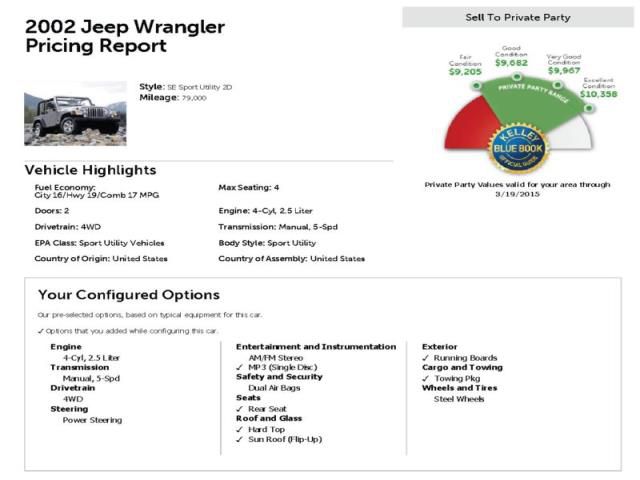

FOR SALE: 2002 Jeep Wrangler SE with about 79K miles. 2.5L 4 Cyl engine with 5-speed Manual Transmission.

Jeep Wrangler for Sale

2014 - jeep wrangler(US $18,000.00)

2014 - jeep wrangler(US $18,000.00) Jeep wrangler sahara sport utility 2-door(US $2,000.00)

Jeep wrangler sahara sport utility 2-door(US $2,000.00) Jeep rubicon sport utility 2-door(US $2,000.00)

Jeep rubicon sport utility 2-door(US $2,000.00) Jeep wrangler wrangler(US $2,000.00)

Jeep wrangler wrangler(US $2,000.00) Jeep wrangler sahara sport utility 2-door(US $2,000.00)

Jeep wrangler sahara sport utility 2-door(US $2,000.00) Jeep wrangler rubicon sport utility 2-door(US $2,000.00)

Jeep wrangler rubicon sport utility 2-door(US $2,000.00)

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Marchionne says no offers are on the table for Fiat Chrysler

Sun, Sep 3 2017MONZA, Italy (Reuters) - Fiat Chrysler (FCA) has not received any offer for the company nor is the world's seventh-largest carmaker working on any "big deal", Chief Executive Sergio Marchionne said on Saturday. Speaking on the sidelines of the Italian Formula One Grand Prix, Marchionne said the focus remained on executing the company's business plan to 2018. Asked whether FCA had been approached by someone or whether there was an offer on the table, he simply said: "No." The company's share price jumped to record highs last month after reports of interest for the group or some of its brands from China. China's Great Wall Motor Co Ltd openly said it was interested in FCA, but had not held talks or signed a deal with executives at the Italian-American automaker. The stock move was also helped by expectations that the company might separate from some of its units. Marchionne reiterated on Saturday that FCA was working on a plan to "purify" its portfolio and that units, such as the components businesses, would be separated from the group. He hopes to complete that process by the end of 2018. "There are activities within the group that do not belong to a car manufacturer, for example the components businesses. The group needs to be cleared of those things," he told journalists. Asked whether an announcement could come this year, Marchionne said it was up to the board to decide and that it would next meet at the end of September. He said the time was not right for a spin-off of luxury brand Maserati and premium Alfa Romeo and the two brands needed to become self-sustainable entities first and "have the muscle to stand on their feet, make sufficient cash". "The way we see it now, it's almost impossible, if not impossible, to see a spin-off of Alfa Romeo/Maserati, these are two entities that are immature and in a development phase," he said. "It's the wrong moment, we are not in a condition to do it." He said the concept of separating the two brands from FCA's mass market business made sense and did not rule out this happening in future, but not under his tenure, which lasts until April 2019. "If there is an opportunity in future, it would certainly happen after I'm gone. It won't happen while Marchionne is around," he said.

Jeep sets all-time sales record in 2012

Wed, 09 Jan 2013Last year was good to Jeep. Chrysler has announced its trail-rated brand set an all-time global sales record in 2012 by moving 701,626 units. That number easily surpasses the previous record set in 1999 when Jeep sold 675,494 models. All told, the brand saw a 19-percent sales increase worldwide over 2011, and much of that swell can be traced directly to the Wrangler. While the Grand Cherokee led Jeep sales, the Wrangler posted record numbers both globally and within the US, moving 194,142 and 141,669 units in each market, respectively.

Meanwhile, the Compass beat its previous global sales record with 103,321 units rolling off of dealer lots. In the US, Jeep sold 62,010 Patriot units, breaking that model's previous record as well. Jeep's impressive performance in 2012 marks the second year in a row the brand has seen double-digit percentage sales increases. Check out the full press release below.

470,000 Jeep Liberty, Chrysler 200, and Dodge Avenger models recalled for restraint defect

Sat, Oct 14 2017Fiat Chrysler Automobiles said on Friday it is recalling 470,000 vehicles worldwide to replace a component that may inhibit deployment of the vehicles' active head restraints in the event of a crash. Around 414,000 of those vehicles were sold in the United States. Apparently, "a component common to the modules of certain vehicles may degrade after extensive vehicle use." The recall covers 2012 Jeep Liberty sport utility vehicles and 2012-13 Chrysler 200 and Dodge Avenger midsize cars. FCA says a warning light may alert owners to the problem. The Italian-American automaker said it is unaware of any injuries or accidents related to the recall. The U.S. National Highway Traffic Safety Administration opened an investigation into the issue in June. (Reporting by David Shepardson; Editing by Steve Orlofsky) Related Video: