Latitude 2.4l Traction Control - Abs And Driveline Front Seat Type - Bucket on 2040-cars

Indianapolis, Indiana, United States

Vehicle Title:Clear

For Sale By:Dealer

Used

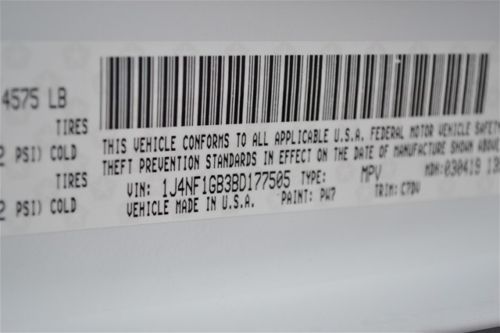

Year: 2011

Number of Cylinders: 4

Make: Jeep

Model: Patriot

Warranty: Unspecified

Mileage: 42,868

Sub Model: LATITUDE

Safety Features: Passenger Airbag

Exterior Color: White

Power Options: Cruise Control

Interior Color: Gray

Jeep Patriot for Sale

Sport 4x2 4d suv abs - 4-wheel active head restraints air conditioning armrests(US $12,475.00)

Sport 4x2 4d suv abs - 4-wheel active head restraints air conditioning armrests(US $12,475.00) Sport manual suv 2.0l cd front wheel drive power steering abs steel wheels

Sport manual suv 2.0l cd front wheel drive power steering abs steel wheels 2014 patriot *latitude* 4x4 - black on black(US $18,185.00)

2014 patriot *latitude* 4x4 - black on black(US $18,185.00) 2012 jeep patriot economical export welcome!! salvage runs!(US $7,500.00)

2012 jeep patriot economical export welcome!! salvage runs!(US $7,500.00) *high latitude* brand new 2014 - heated leather - sunroof - 17" alloy wheels(US $18,265.00)

*high latitude* brand new 2014 - heated leather - sunroof - 17" alloy wheels(US $18,265.00) 10 jeep patriot-19k-pwr windows-great on gas-alloy wheels-finance price only(US $12,995.00)

10 jeep patriot-19k-pwr windows-great on gas-alloy wheels-finance price only(US $12,995.00)

Auto Services in Indiana

Zamudio Auto Sales ★★★★★

Westgate Chrysler Jeep Dodge ★★★★★

Tom Roush Lincoln Mazda ★★★★★

Tim`s Wrecker Service & Garage ★★★★★

Superior Towing ★★★★★

Stan`s Auto Electric Inc ★★★★★

Auto blog

These are the cars with the best and worst depreciation after 5 years

Thu, Nov 19 2020The average new vehicle sold in America loses nearly half of its initial value after five years of ownership. No surprise there; we all expect that shiny new car to start depreciating as soon as we drive it off the lot. But some vehicles lose value a lot faster than others. According to data provided by iSeeCars.com, trucks and truck-based sport utility vehicles generally hold their value better than other vehicle types, with the Jeep Wrangler — in both four-door Unlimited and standard two-door styles — and Toyota Tacoma sitting at the head of the pack. The Jeep Wrangler Unlimited's average five-year depreciation of 30.9% equals a loss in value of $12,168. That makes Jeep's four-door off-roader the best overall pick for buyers looking to minimize depreciation. The Toyota Tacoma's 32.4% loss in initial value means it loses just $10,496. The smaller dollar amount — the least amount of money lost after five years — indicates that Tacoma buyers pay less than Wrangler Unlimited buyers, on average, when they initially buy the vehicle. The standard two-door Jeep Wrangler is third on the list, depreciating 32.8% after five years and losing $10,824. Click here for a full list of the top 10 vehicles with the least depreciation over five years. On the other side of the depreciation coin, luxury sedans tend to plummet in value at a much faster rate than other vehicle types. The BMW 7 Series leads the losers with a 72.6% drop in value after five years, which equals an alarming $73,686. BMW's slightly smaller 5 Series is next, depreciating 70.1%, or $47,038, over the same period. Number three on the biggest losers list is the Nissan Leaf, the only electric vehicle to appear in the bottom 10. The electric hatchback matches the 5 Series with a 70.1% drop in value, but since it's a much cheaper vehicle, that percentage equals a much smaller $23,470 loss. Click here for a full list of the top 10 vehicles with the most depreciation over five years.

Watch this R/C Jeep Wrangler plow snow

Mon, 06 Jan 2014There's no denying the fact that the Jeep Wrangler is one tough and rugged vehicle, and there is apparently little lost when the SUV is shrunk down for a 1:10th scale radio-controlled version. Proving that the Axial SCX10 Jeep Wrangler is not your run-of-the-mill R/C car, YouTube user Andrew Dykiel posted a pair of videos showing it clear about an inch of snow from his sidewalk and driveway during a snow storm last month.

Starting at $379.99, the Axial SCX10 costs more than most budget snowblowers, but other than paying a neighbor kid to shovel your snow, this might be the best way for a car guy to clear snow without the need for hot chocolate and ibuprofen. Better yet, it's electric, so it's zero-emission answer to snow removal! Scroll down to see how this R/C Jeep can help "shovel" snow from the warmth of your sofa. We've also thrown in a bonus video showing the mini Jeep negotiating the Rubicon Trail.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.044 s, 7949 u