1979 Jeep J10 on 2040-cars

Tucson, Arizona, United States

Vehicle Title:Clean

Fuel Type:Petrol, Gas

VIN (Vehicle Identification Number): J9A25NN010266

Mileage: 98000

Make: Jeep

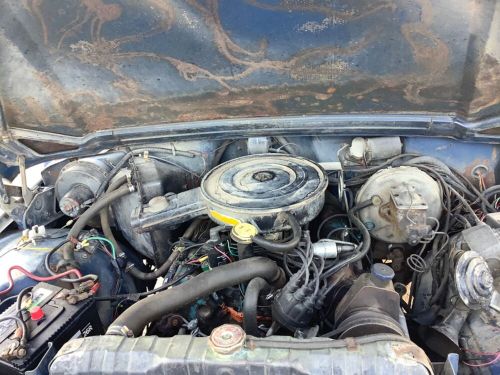

Number of Cylinders: 8

Engine Size: 5.9 L

Model: J10

Jeep J10 for Sale

1978 jeep j10(US $10,000.00)

1978 jeep j10(US $10,000.00) 1978 jeep j10(US $9,500.00)

1978 jeep j10(US $9,500.00)

Auto Services in Arizona

Village Automotive INC ★★★★★

Victory Auto Body ★★★★★

Thunderbird Automotive Services #2 ★★★★★

Thiem Automotive Specialist ★★★★★

Shuman`s Auto Clinic ★★★★★

Show Low Ford Inc ★★★★★

Auto blog

2018 Jeep Wrangler JL spotted playing offroad in the sand dunes

Wed, Jul 26 2017The videos above and below, among other things, highlight some of the reasons why it's so terribly difficult for Jeep to introduce a new Wrangler. Needless to say, the ute has got to work offroad. Not only that, but the engineers need to make sure the vehicle is at least semi-content on the road and in the emissions and safety labs, and they have to make sure it pleases the diehards by keeping vestigial bits like external hood latches. Oh, and it can't be priced out of the reach of the average car buyer. That's a tall order. Nevertheless, we're pleased to see that Jeep is taking its offroad testing seriously. These videos were reportedly shot at the Silver Lake Sand Dunes near Lake Michigan. You'll see some splashing through puddles, some steady-state medium-speed cruising, and even some Hazzard-style fishtailing. And you can rest assured that the Toledoans at Jeep have been busy testing their latest Wrangler in other off-road scenarios, like rock crawling at the Rubicon Trail. These three clips are short, and it's difficult to draw conclusions on the suspension action since we can't really tell how flat or bumpy the terrain may be. Still, they're fun to watch and important to Jeep fans. We expect to see plenty more spy footage of the 2018 Wrangler before its likely debut at the LA Auto Show later this year. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Related Video: News Source: JL Wrangler Forums Spy Photos Jeep SUV Off-Road Vehicles Videos jeep wrangler jl sand dunes

Dongfeng and PSA extend Chinese joint venture

Thu, Dec 19 2019BEIJING/PARIS — China's Dongfeng and Peugeot maker PSA are extending their business cooperation, despite the Chinese company reducing its stake in PSA to help smooth the French carmaker's merger with Fiat Chrysler Automobiles (FCA). Dongfeng said on Thursday it had agreed with PSA to extend the duration of their joint venture Dongfeng Peugeot Citroen Automobiles (DPCA). Under the deal, the venture could get the rights to PSA's new brands in China and will benefit from new technologies and intellectual properties, the Chinese company said. PSA was not immediately available for comment. The announcement comes a day after the companies said Dongfeng would reduce its 12.2% stake in PSA by selling 30.7 million shares to the French company. Analysts said the move could smooth U.S. regulatory approval for PSA's roughly $50 billion (GBP38.97 billion) merger with Italian-American carmaker FCA. The sale of Dongfeng's shares in PSA, worth around 680 million euros ($757 million), will leave the Chinese group holding around 4.5% of the merged PSA-FCA, which is set to become the world's fourth-biggest carmaker by sales volumes. "As the cooperation between Dongfeng and PSA deepens, we expect the joint venture to continue making good progress in China," a Dongfeng representative said. On a conference call, Dongfeng said DPCA would have exclusive rights to PSA's Opel cars should the partners agree to bring the brand to China, and enjoy lower prices on car parts imported from PSA. Earlier this year, a document seen by Reuters showed Dongfeng and PSA plan to cut jobs at Wuhan-based DPCA and reduce its number of car plants to try to make the venture more profitable. Chrysler Dodge Fiat Jeep RAM Citroen Peugeot China FCA PSA Dongfeng

Jeep brings quartet of concepts to Beijing to show its Chinese style

Mon, 21 Apr 2014Jeep is making a big play for the Chinese crossover market at the 2014 Beijing Motor Show. It has a quartet styling concepts for the Renegade, Cherokee and Wrangler that are inspired by Chinese culture at the show.

Among them is the newest member of the Jeep lineup - the Renegade. Its Zi You Xia concept (pictured above) comes from the Mandarin for "rebel," and it's painted in Warm Chocolate Gray with Dark Anodized Bronze trim, including the 20-inch wheels. The roof, grille surround, and mirror caps are done in a complimentary Dark Charcoal color as an accent. The interior is a mix of dark brown leather and Anodized Copper trim. This is one swanky compact crossover.

The Cherokee Sageland and Urbane concepts are meant to show to different sides of Chinese style. With inspiration from the Shangri-La Region, the Sageland has Ivory Pearl tri-coat paint with bronze trim on the outside, and the interior is covered in Gray Nappa leather with red and blue stitching. The Urbane's look comes from the nightlife in the country's cities. The exterior is a color called Maximum Steel with Hyper Black trim. Inside, it combines Piano Black trim with dark red leather seats.