2023 Jeep Gladiator Mojave 4x4 on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C6JJTEG4PL537608

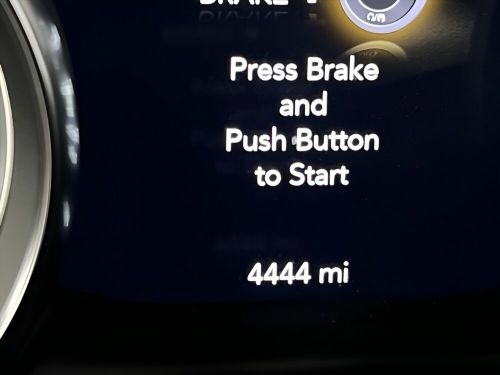

Mileage: 4444

Make: Jeep

Model: Gladiator

Trim: Mojave 4x4

Drive Type: 4WD

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Jeep Gladiator for Sale

2022 jeep gladiator sport s(US $66,172.00)

2022 jeep gladiator sport s(US $66,172.00) 2023 jeep gladiator sport(US $38,500.00)

2023 jeep gladiator sport(US $38,500.00) 2023 jeep gladiator mojave(US $39,988.00)

2023 jeep gladiator mojave(US $39,988.00) 2021 jeep gladiator mojave(US $34,520.00)

2021 jeep gladiator mojave(US $34,520.00) 2020 jeep gladiator sport s 4x4(US $35,997.00)

2020 jeep gladiator sport s 4x4(US $35,997.00) 2020 jeep gladiator sport(US $31,822.00)

2020 jeep gladiator sport(US $31,822.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Off-roader plows through a deep bog like it was nothing

Wed, May 18 2016The Facebook page Jeeps With Attitude runs a weekly series called Too Deep Tuesday wherein they post videos of off-roaders running their rigs through bogs and mud holes of surprising depth and coming out the other side soggy but relatively unscathed. This week's video, in which a driver extracts a buried vehicle from the muddiest bog in the land, is the perfect mix of nutso bravery and off-road know-how. The video starts with the vehicle already sunk to its hood and listing to starboard in a deep, sticky bog. Slowly but surely, the vehicle creeps forward through the mud, pushing a heavy bow wave of muck and debris in front of it. Unlike other recent videos where jeep drivers lost their rides in the water and destroyed their expensive toys, this driver keeps his cool and with a steady foot on the accelerator and the help of a winch and a convenient tree, eventually emerges triumphant. What did he do right? Well, using the vehicle's winch to help pull the rig out of the mud was the big thing. Also, he kept his cool and, once committed, never hesitated or deviated from his chosen path. Gunning it blindly or backing up in that mess would have meant almost certain death for that vehicle, a lesson that the aforementioned Jeep drivers learned the hard way. Related Video: News Source: Facebook Weird Car News Jeep Driving Off-Road Vehicles Videos

EPA posts 2018 Jeep Wrangler Unlimited fuel economy

Sun, Nov 5 2017When Jeep loosed a trio of 2018 Wrangler photos in October, Jeep cognoscenti parried over details like radio antenna placement and painted tailgate hinges, while every other viewer merely noted, "It's still a Wrangler." Now that the Environmental Protection Agency's listed fuel economy ratings for the 2018 Wrangler Unlimited with the 3.6-liter V6, Jeep savants will again parry over details. Every other viewer will merely note, "It's still got Wrangler gas mileage." According to the EPA, the current Wrangler Unlimited with the 3.6-liter V6 and six-speed manual clocks 16 miles per gallon in the city, 21 on the highway, and 18 combined. The 2018 version with the same six-speed manual comes in at 17/23/19. Switching transmissions, the current model with the five-speed automatic hooks up 16/20/18, the 2018 model with an eight-speed automatic does 18/23/20. Those numbers might not jump off the page, yet according to the EPA's cost calculator, you'll save $250 per year on gas with the eight-speed auto 2018 Wrangler Unlimited, $150 per year with the coming six-speed manual. The eight-speed auto option also exceeds Chrysler's prediction from 2014 of a nine-percent improvement in fuel economy over the five-speed auto. Now we wait for numbers on the dark horse four-cylinder, which we'd expect to best the sixer's numbers, unless the rumors are true and the four-pot really is packing every wild horse it can handle. In that case, we'll turn to the EcoDiesel for frugal kicks. If we don't find out beforehand, we can expect those goodies and more at the LA Auto Show in December. Related Video: News Source: FuelEconomy.gov via Motor Trend Auto News Government/Legal Jeep SUV Off-Road Vehicles

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.