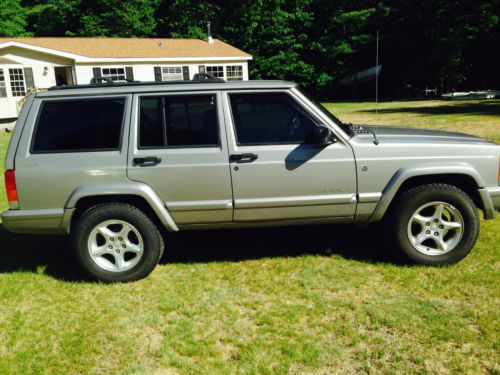

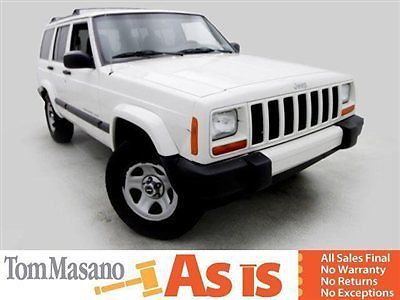

1998 Jeep Cherokee Classic Sport Utility 4-door 4.0l on 2040-cars

Excelsior Springs, Missouri, United States

|

Please see condition statement above

|

Jeep Cherokee for Sale

2001 jeep cherokee sport utility 4-door 4.0l(US $18,500.00)

2001 jeep cherokee sport utility 4-door 4.0l(US $18,500.00) 2001 jeep cherokee limited sport utility 4-door 4.0l(US $5,250.00)

2001 jeep cherokee limited sport utility 4-door 4.0l(US $5,250.00) 1999 jeep cherokee (f9675a) ~ absolute sale ~ no reserve ~

1999 jeep cherokee (f9675a) ~ absolute sale ~ no reserve ~ 2003 jeep grand cherokee laredo(US $3,200.00)

2003 jeep grand cherokee laredo(US $3,200.00) 2000 jeep cherokee 4x4 xj needs a few little things headliner,ac, radio(US $2,600.00)

2000 jeep cherokee 4x4 xj needs a few little things headliner,ac, radio(US $2,600.00) 2001 jeep cherokee sport 4x4 "rare solar yellow" "only 80k" near mint condition(US $9,450.00)

2001 jeep cherokee sport 4x4 "rare solar yellow" "only 80k" near mint condition(US $9,450.00)

Auto Services in Missouri

Value Auto Clinic ★★★★★

The Car ★★★★★

Ted`s Automotive ★★★★★

Swafford`s Auto Service ★★★★★

Strosnider Enterprises ★★★★★

St. Louis Window Tinting ★★★★★

Auto blog

Stellantis mega-merger gets approval from FCA, PSA shareholders

Mon, Jan 4 2021MILAN — Shareholders of Fiat Chrysler and PSA Peugeot decisively voted Monday to merge the U.S.-Italian and French carmakers to create worldÂ’s 4th-largest auto company. Addressing separate meetings, both PSA Peugeot CEO Carlos Tavares and Fiat Chrysler Chairman John Elkann spoke of the “historic” importance of the vote, which combines legacy car companies that helped write the industrial histories of the United States, France and Italy. Before the merger is finalized, shares in the new company, to be called Stellantis, must the launched. It will be traded in Milan, New York and Paris. The marriage of PSA Peugeot and Fiat Chrysler Automobiles is built on the promise of cost-savings in the capital-hungry industry, but what remains to be seen is if it will be able to preserve jobs and heritage brands in a global market still suffering from the pandemic. The deal will create the worldÂ’s fourth-largest carmaker, with the capacity to produce 8.7 million cars a year, behind Volkswagen, Toyota and Renault-Nissan, and create 5 billion euros in annual synergies. “We are fully aware of the fact that together we will be stronger than individually,'' PSA CEO Carlos Tavares told a virtual gathering of eligible shareholders. “The two companies are in good health. These two companies have strong positions in their markets.” The new company will put together under one roof French mass-market carmakers Peugeot and Citroen, top-selling Jeep and Italian luxury and sports brands Maserati and Alfa Romeo - pooling companies that have helped define the industry in the United States, France and Italy. While the tie-up is billed as a merger of equals, the power advantage goes to PSA, with Tavares running Stellantis and holding the tie-breaking vote on the 11-seat board. Tavares is set to take full control of the company early this year, possibly by the end of January. Fiat Chrysler chairman John Elkann, heir to the Fiat-founding Agnelli family and Fiat ChryslerÂ’s biggest shareholder, will be the Stellantis chairman. Fiat Chrysler CEO Mike Manley will head North American operations, which is key to Tavares' long-time goal of getting a U.S. foothold for the French carmaker he has run since 2014, and the clear money-maker for Fiat Chrysler. Such a deal was long wanted by Fiat ChryslerÂ’s long-time CEO Sergio Marchionne, who had predicted the necessity of consolidation in the industry. He was unable to find a deal before his sudden death in July 2018.

Off-roader plows through a deep bog like it was nothing

Wed, May 18 2016The Facebook page Jeeps With Attitude runs a weekly series called Too Deep Tuesday wherein they post videos of off-roaders running their rigs through bogs and mud holes of surprising depth and coming out the other side soggy but relatively unscathed. This week's video, in which a driver extracts a buried vehicle from the muddiest bog in the land, is the perfect mix of nutso bravery and off-road know-how. The video starts with the vehicle already sunk to its hood and listing to starboard in a deep, sticky bog. Slowly but surely, the vehicle creeps forward through the mud, pushing a heavy bow wave of muck and debris in front of it. Unlike other recent videos where jeep drivers lost their rides in the water and destroyed their expensive toys, this driver keeps his cool and with a steady foot on the accelerator and the help of a winch and a convenient tree, eventually emerges triumphant. What did he do right? Well, using the vehicle's winch to help pull the rig out of the mud was the big thing. Also, he kept his cool and, once committed, never hesitated or deviated from his chosen path. Gunning it blindly or backing up in that mess would have meant almost certain death for that vehicle, a lesson that the aforementioned Jeep drivers learned the hard way. Related Video: News Source: Facebook Weird Car News Jeep Driving Off-Road Vehicles Videos

Fiat/PSA's dominance in small vans hangs up EU's merger approval

Mon, Jun 8 2020BRUSSELS — EU antitrust regulators are concerned about Fiat Chrysler and Peugeot / PSA's combined high market share in small vans and may require concessions to clear their $50 billion merger, people familiar with the matter said. The companies, which are seeking to create the world's fourth biggest carmaker, were told of the European Commission's concerns last week. If Fiat and PSA fail to dispel the European Commission's doubts in the next two days and subsequently decline to offer concessions by Wednesday, the deadline for doing so, the deal would face a four-month-long investigation. The EU competition enforcer, which has set a June 17 deadline for its preliminary review, declined to comment. Fiat was not immediately available for comment while PSA had no immediate comment. Hiving off overlapping businesses, usually a regulatory demand to ensure more competition, could prove tricky for the carmakers because of the technicalities. Fiat and PSA are looking to merge to help offset slowing demand and shoulder the cost of making cleaner vehicles to meet tougher emissions regulations. The deal puts under one roof the Italian carmaker's brands such as Fiat, Jeep, Dodge, Ram, Maserati and the French company's Peugeot, Opel and DS. Related Video: Government/Legal Chrysler Dodge Fiat Jeep Maserati RAM Citroen Opel Peugeot