Big Florida Cat Needs Good Home..spoiled But With Impeccable Manners..no Reserve on 2040-cars

Saint Petersburg, Florida, United States

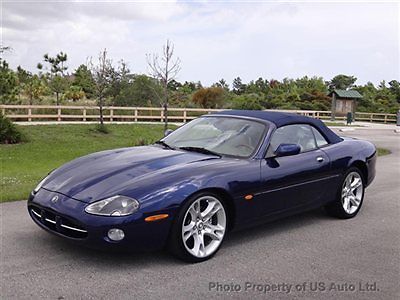

Jaguar XK for Sale

Certified 510hp upgrade wheels adaptive cruise control(US $51,900.00)

Certified 510hp upgrade wheels adaptive cruise control(US $51,900.00) 2003 jaguar xk8 convertible one owner clean carfax navigation florida car v8 4.2(US $12,995.00)

2003 jaguar xk8 convertible one owner clean carfax navigation florida car v8 4.2(US $12,995.00) Certified 510hp red calipers 20 inch wheels bowers & wilkins stereo(US $54,900.00)

Certified 510hp red calipers 20 inch wheels bowers & wilkins stereo(US $54,900.00) 10 xk convertible, low miles, super clean, priced less than 1/2 original sticker(US $43,888.00)

10 xk convertible, low miles, super clean, priced less than 1/2 original sticker(US $43,888.00) Xkr-s 550hp very rare french racing blue carbon fiber spoiler(US $99,900.00)

Xkr-s 550hp very rare french racing blue carbon fiber spoiler(US $99,900.00) 2001 jaguar xk8 base convertible 2-door 4.0l

2001 jaguar xk8 base convertible 2-door 4.0l

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Jaguar Land Rover might buy another luxury brand that it doesn't need

Mon, Sep 25 2017It seems that Jaguar Land Rover may be getting bigger in the near future. According to Bloomberg, the company is looking at acquiring some tech companies, and possibly yet another luxury car brand, provided that it fits with the current lineup of cars. On the surface, this makes some sense since Bloomberg reports that a whopping 78 percent of Tata Motors' revenue comes from luxury brands. And of course, any kind of tech acquisition could be useful considering the rapid development of electric and autonomous vehicles. But dig a little deeper, and a possible luxury brand acquisition just doesn't make sense for Jaguar Land Rover. The main reason for this is that the Jaguar and Land Rover brands have the luxury market thoroughly covered. Both brands offer full luxury lines from entry-level to high-end ( Discovery Sport to Range Rover on the Land Rover side, and XE to XJ on the Jaguar side). They also cater to every kind of luxury, from sporty vehicles such as the F-Type and SVR Land Rovers, to cushy luxury machines such as the XJ and Range Rover. So whether the company is competing with BMW or Mercedes, Jaguar and Land Rover have the bases covered. There aren't any other typical luxury brands that would actually add anything to the current lineup. In fact, adding another conventional luxury brand could actually result in the new brand poaching existing Jaguar and Land Rover buyers, rather than picking up new ones. What would make more sense for Jaguar Land Rover would be to pick up either a more mainstream brand, or an ultra-luxury marque. Neither Jaguar nor Land Rover has something that competes directly with the likes of Ford or Toyota in the mainstream game, or Rolls-Royce or Bentley at the top of the luxury heap. Picking up a brand in one of these segments would allow JLR and Tata Motors to actually expand offerings and pick up more sales, rather than having an internal competitor. What path would be ideal? Probably going even farther upmarket. Supercar makers and ultra-luxury brands continue to sell well, and there's the potential for significant profit by layering on features and content to existing platforms. Perhaps the best possibility for a high-end complement to Jaguar Land Rover would be Aston Martin. Not only does it have a strong reputation and line-up, it also could handle both supercars and luxury sedans, thanks to its Lagonda sub brand. Of course it would require Aston Martin to be receptive to a purchase.

Hot Rod Garage series premieres with 700-hp big-block Jaguar XJ

Fri, 23 May 2014Roadkill hosts Mike Finnegan and David Freiburger have broken up - kinda - to spin off a new show, Hot Rod Garage, that mostly gives up the driveway and parking lot wrench work for the confines of a garage. We say kinda because while Finnegan is the primary host for Hot Rod Garage, Freiburger plays guest host and the new show starts off by wrenching on the Roadkill Draguar project car.

What's the Draguar? It's a 1974 Jaguar XJ12 that's about to be force-fed a 383-cubic-inch Chevrolet long-block engine with tidbits like Holley carbs, a Weiand 6-71 roots blower and a "custom WillBlow transmission," all good for about 700 horsepower. After that Finnegan gets into swapping parts on his wife's El Camino and some TIG welding lessons.

You can check out the first episode below. And in case you're worried, no, Roadkill isn't going away.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.