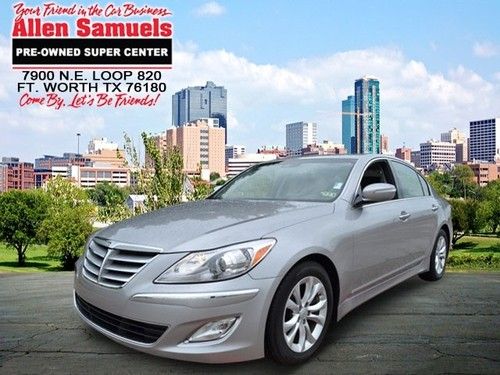

We Finance!!! 2011 Hyundai Genesis 4.6 Roof Nav Heated Leather 1 Own Texas Auto on 2040-cars

Webster, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.6L 4627CC V8 GAS DOHC Naturally Aspirated

Body Type:Sedan

Fuel Type:GAS

Make: Hyundai

Model: Genesis

Trim: 4.6 Sedan 4-Door

Disability Equipped: No

Doors: 4

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 44,107

Number of Doors: 4

Sub Model: GENESIS 4.6

Exterior Color: White

Number of Cylinders: 8

Interior Color: Tan

Hyundai Genesis for Sale

We finance!!! 2010 hyundai genesis coupe 3.8 track heated leather texas auto(US $19,998.00)

We finance!!! 2010 hyundai genesis coupe 3.8 track heated leather texas auto(US $19,998.00) 2009 hyundai genesis tech pkg one owner we finance lifetime warranty

2009 hyundai genesis tech pkg one owner we finance lifetime warranty We finance! 2009 hyundai genesis rwd power sunroof 6 disc cd changer(US $17,300.00)

We finance! 2009 hyundai genesis rwd power sunroof 6 disc cd changer(US $17,300.00) 9k low miles navigation leather sunroof one 1 owner autoamerica

9k low miles navigation leather sunroof one 1 owner autoamerica Luxury(US $23,686.00)

Luxury(US $23,686.00) 2010 hyundai genesis 4.6 sedan 4-door 4.6l

2010 hyundai genesis 4.6 sedan 4-door 4.6l

Auto Services in Texas

Yale Auto ★★★★★

World Car Mazda Service ★★★★★

Wilson`s Automotive ★★★★★

Whitakers Auto Body & Paint ★★★★★

Wetzel`s Automotive ★★★★★

Wetmore Master Lube Exp Inc ★★★★★

Auto blog

Hyundai recalling 15,500 Entourage minivans over rust in cold-weather states

Mon, 25 Nov 2013Hyundai has increased its quality by leaps and bounds in recent years, but we're not sure the Entourage minivan is the best representation of the brand. Essentially a rebadged version of the Kia Sedona, the Entourage has been out of production for about five years now, and it's evidently run into some trouble.

The problem apparently revolves around the suspension - specifically the front lower control arm - which could rust and fracture, particularly in snow-belt states. As a result, Hyundai and the National Highway Traffic Safety Administration have issued a recall for the Entourage from the 2007 and 2008 model years, the only two years it was sold in the United States.

The recall applies to some 15,500 units sold or registered in Massachusetts, Maryland, Michigan, New Hampshire, New York, Pennsylvania, Vermont, Wisconsin, Connecticut, Delaware, Iowa, Illinois, Indiana, Maine, Minnesota, Missouri, New Jersey, Ohio, Rhode Island, West Virginia and the District of Columbia. Hyundai will notify owners as to when they should bring their vehicles in for inspection before either rustproofing or replacing the components in question. What's interesting, however, is that the nearly identical Kia Sedona has not been subject to the same recall.

Hyundai details its five Super Bowl ads, Santa Fe is MVP [w/video]

Thu, 24 Jan 2013If the Super Bowl were Las Vegas, Hyundai would be considered one of its whales. The South Korean automaker will be advertising for the sixth straight year during The Big Game, and this time it's rolling up with five spots, four of them new. The new 2013 Santa Fe gets the star treatment, featuring in three of the spots, but the theme throughout is using "a Hyundai vehicle as the ultimate sidekick and partner-in-fun."

The four brand new commercials are:

Epic PlayDate - the headliner, uses the Santa Fe for "an unforgettable and epic play date" and features a brand new song from "a legendary alternative rock band."

Weekly Recap: Hyundai spins off Genesis as new luxury division

Sat, Nov 7 2015Hyundai is creating a standalone luxury division that will use the Genesis name in an ambitious move that could bring the Korean automaker more profits, sales, and prestige. The Genesis division launches in December in Korea, followed by a rollout in other markets, including the United States in 2016. The brand will have six models by 2020. They will all start with a "G" for Genesis, then have a number, like 70, 80, or 90 to represent their segment, Hyundai said. The vehicles will also get more upscale design to differentiate them from other Hyundais. Luc Donckerwolke, a veteran Volkswagen Group designer who joined Hyundai earlier this year, will oversee a new Prestige Design unit at the company. The current winged Genesis emblem will be restyled and worn by all of the brand's luxury vehicles. Hyundai says its new division will focus on technology, customer service, and will have "refined performance character." The current Genesis sedan offers a 5.0-liter V8 that makes 420 horsepower. Naturally, Hyundai is optimistic for its new Genesis brand, but it will face immediate challenges as it enters a crowded and competitive market with a long list of entrenched competitors. Brands with storied histories like Cadillac and Lincoln have struggled recently, and even top-selling brands Mercedes-Benz, BMW, and Lexus aren't immune to potential troubles. Rumors have persisted that Hyundai harbored luxury ambitions since it first launched the Genesis sedan in 2008. OTHER NEWS & NOTES SEMA shows aftermarket's strength Further evidence of the auto industry's momentum was on display at the SEMA show this week as carmakers and tuners again turned out in full force. The Ford Cobra Jet Mustang, a Chevy Silverado customized by Kid Rock, and a Kia Forte Koup Mud Bogger were among the prominent displays. The show attracts more than 140,000 people per year, including 2,400 exhibitors, who come to buy and sell products. SEMA is a barometer for customization trends in the aftermarket, a key reason automakers attend. "They represent things we are thinking about and want to get some exposure," Mopar boss Pietro Gorlier said. Honda previews next-gen Ridgeline In other SEMA news, Honda previewed the next generation of its Ridgeline pickup at the show with a race-prepped vehicle that will compete in the Score Baja 1000 this year. The hood, side profile, roof, and front fascia offer hints of what the new truck will look like in production trim. Art St.