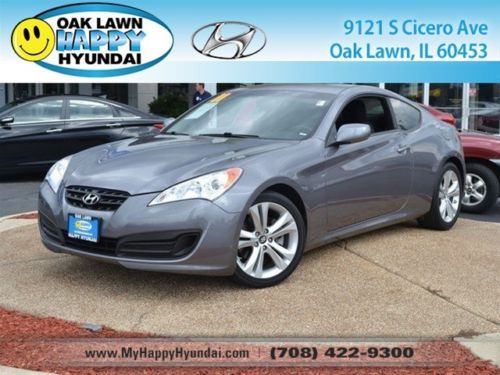

2011 Coupe Used 2.0l 4 Cyls Rwd Gray on 2040-cars

Oak Lawn, Illinois, United States

Hyundai Genesis for Sale

Hyundai genesis coupe 3.8 track 6-spd nav/fac 19's 16k miles brembo we finance(US $21,990.00)

Hyundai genesis coupe 3.8 track 6-spd nav/fac 19's 16k miles brembo we finance(US $21,990.00) 2013 hyundai genesis premium coupe 2.0t

2013 hyundai genesis premium coupe 2.0t 4dr sdn v6 3.8l low miles sedan automatic gasoline 3.8l v6 cyl white satin pearl(US $20,944.00)

4dr sdn v6 3.8l low miles sedan automatic gasoline 3.8l v6 cyl white satin pearl(US $20,944.00) 2011 hyundai genesis 2.0t coupe auto paddle shift 46k texas direct auto(US $15,980.00)

2011 hyundai genesis 2.0t coupe auto paddle shift 46k texas direct auto(US $15,980.00) Hyundai genesis 4dr sedan v8 low miles automatic gasoline 4.6l dohc mpi 32-valve

Hyundai genesis 4dr sedan v8 low miles automatic gasoline 4.6l dohc mpi 32-valve 2012 sedan used 3.8l v6 automatic 8-speed rwd red

2012 sedan used 3.8l v6 automatic 8-speed rwd red

Auto Services in Illinois

West Side Motors ★★★★★

Turi`s Auto Collision Center ★★★★★

Transmissions R US ★★★★★

The Autobarn Nissan ★★★★★

Tech Auto Svc ★★★★★

T Boe Inc ★★★★★

Auto blog

2024 CES Mega Photo Gallery: Honda concepts, a VinFast truck and flying cars galore

Thu, Jan 11 2024The 2024 rendition of CES is coming to a close, and per usual, it was full of all the funky, futuristic tech the show is long known for. Itís also full of cars and legitimately forward-thinking tech related to cars, and we were on the ground to see it all and bring photos to you in this Mega Gallery.¬† A boatload of manufacturers attended and made big reveals, from the Star Wars-like Honda concept cars to a pickup truck from VinFast, the sort of debuts we got to see ran the gamut. Of course, there were plenty of reveals and vehicles on the floor that were even more outlandish than concepts from traditional OEMs like Honda and Mercedes. Check out this flying Xpeng car as an example. Or perhaps the flying Mansory car. Apparently, flying cars were a theme. Anyway, make sure you scroll down to check out the various reveals and photos of the cars and technologies revealed at the 2024 CES in our barrage of galleries. Honda 0 Series Honda 0 Series saloon 1 View 26 Photos VinFast Wild pickup VinFast Wild 10 View 10 Photos VinFast VF3 VinFast VF3 1 View 4 Photos VW GTI Prototype with AI-enhanced infotainment CES 2024: New Volkswagen GTI with AI-Enhanced Infotainment View 17 Photos Kia PBV Concept Kia PBV Concept platform View 28 Photos Sony Honda Mobility Afeela concept Afeela by Sony Honda Mobility View 5 Photos Hyundai Mobion Concept Hyundai Mobion Concept CES 2024 View 6 Photos Mullen Five RS Mullen 2 View 14 Photos Mansory Empower concept Mansory Empower concept View 14 Photos Hyundai Supernal S-A2 eVTOL Hyundai Supernal S-A2 View 13 Photos XPeng Aeroht eVTOL Flying Car XPeng Aeroht eVTOL?Flying Car View 6 Photos Verge TS Ultra verge-ts-ultra-ces-2024-electric-motorcycle-01 View 17 Photos Horwin Senmenti Maxi Scooter Range Horwin Senmenti 0 View 12 Photos BMW Teleoperated Valet BMW iX controlled with Remote Valet View 15 Photos Mercedes-Benz MB.OS infotainment Mercedes-Benz MB.OS infotainment system View 9 Photos Lamborghini Telemetry X Lamborghini Telemetry X View 5 Photos Related video: Green Motorsports CES BMW Ford Honda Hyundai Kia Lamborghini Mercedes-Benz Volkswagen Volvo Green Automakers Green Culture Technology Infotainment Smartphone Autonomous Vehicles Commercial Vehicles Concept Cars Polestar Infrastructure

2014 Hyundai i40 Tourer / Sonata wagon

Tue, 08 Jul 2014Recently, we took a vacation to Australia, because sometimes we have to get away from all of that other travel and good living that we withstand in order to bring you the latest car news. While there, we grabbed the keys to a Hyundai i40 Tourer, essentially the Sonata wagon we never got a chance to love here.

Even though it didn't have a manual transmission, it did have a diesel and, for reasons beyond that oil-burner, our enduring affections. No, this story will not include another plea for Hyundai to bring it to the US - it likely wouldn't stand a chance against our crossover- and size-crazed mania, but it's a brilliant fit for markets that appreciate tidy haulers.

Hyundai Azera fate in question for US

Thu, 17 Jul 2014

The Azera has been consistently outsold by its rivals. Through June, Hyundai has shifted just 4,191 units.

Hyundai's dealers call the Azera the "nicest car nobody knows about." That's according to Mike O'Brien, Hyundai Motor America's vice president of corporate and product planning. Indeed, the fullsize sedan is a handsome, well-rounded machine, loaded with creature comforts. Yet it's not selling well, and its space in Hyundai showrooms is about to get a whole lot more crowded thanks to the newly spruced-up 2015 Sonata. No surprise, then, that company officials admit that the model's future in the US is uncertain.