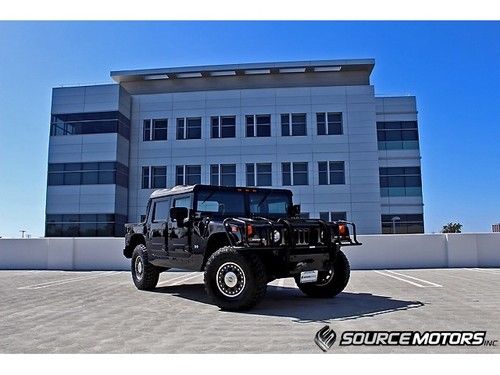

Custom H1low Milesdiesel Navitvlots Of Extrafinancing Approval Guaranteed(o.a.c) on 2040-cars

Los Angeles, California, United States

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Automatic

Make: Hummer

Warranty: Vehicle has an existing warranty

Model: H1

Mileage: 56,863

Options: Compact Disc

Sub Model: Base Trim

Power Options: Air Conditioning, Cruise Control, Power Windows

Exterior Color: Matte Black

Interior Color: Black

Number of Cylinders: 8

Doors: 5 or more

Engine Description: 6.5L V8 SFI 16V Turbo

Hummer H1 for Sale

1997 hummer h1 hard top 4wd - great conditon!(US $39,900.00)

1997 hummer h1 hard top 4wd - great conditon!(US $39,900.00) 1998 am general hummer base sport utility 4-door 6.5l(US $33,500.00)

1998 am general hummer base sport utility 4-door 6.5l(US $33,500.00) 1999 hummer h1 alpha sut hummvee diesel low miles h2 h3 am general

1999 hummer h1 alpha sut hummvee diesel low miles h2 h3 am general 1995 am general hummer hard-top gas v8, low miles, babied, city vehicle(US $32,500.00)

1995 am general hummer hard-top gas v8, low miles, babied, city vehicle(US $32,500.00) H1 alpha open top, navigation, brush guard, night vision, one owner, duramax

H1 alpha open top, navigation, brush guard, night vision, one owner, duramax 1995 hummer h1 wagon, one owner from new, just serviced, loaded

1995 hummer h1 wagon, one owner from new, just serviced, loaded

Auto Services in California

Z Best Body & Paint ★★★★★

Woodman & Oxnard 76 ★★★★★

Windshield Repair Pro ★★★★★

Wholesale Tube Bending ★★★★★

Whitney Auto Service ★★★★★

Wheel Enhancement ★★★★★

Auto blog

AM General's new CEO has strong military roots

Fri, Dec 11 2015AM General has a new president and chief executive officer. Current CEO Charlie Hall is retiring from the company. In his place, the defense and automotive manufacturer has named industry veteran Andy Hove. Though primarily a defense contractor, AM General has produced a number of civilian vehicles as well. The company is perhaps best known for the Hummer (or Humvee in military parlance) and continued producing both the original H1 and the subsequent H2 after selling the brand to General Motors. Even after GM shut down the brand, AM General continued producing Humvees for military use and as a civilian kit. The company is also behind Mobility Ventures, which produces purpose-built wheelchair-accessible vehicles, assembles the R-Class for Mercedes-Benz, and has been linked to potential commercial van and pickup truck assembly for GM as well. Based in South Bend, IN, AM General shares its roots with the Jeep brand. It was split off from American Motors Corporation after the latter was bought by Renault and then by Chrysler. Today it's owned by New York-based investment firms Renco Group and MacAndrews & Forbes. A former Army officer, Hove arrives at the company with considerable experience in the defense industry, particularly in vehicle manufacturing. He has previously served as president of HDT Global and before that of Oshkosh Defense. Prior to that he headed up the Bradley tank program for BAE Systems, where he increased sales from $250 million to $2 billion within five years. His departing predecessor Charlie Hall was named CEO in 2011, assuming day-to-day responsibility for the company's operations from the suitably named chairman James Armour. Related Video: AM General Announces Vehicle Manufacturing Industry Leader Andy Hove To Serve As Chief Executive Officer Hove Succeeds Retiring CEO Charlie Hall SOUTH BEND, Ind., Dec 8, 2015 – AM General, the global leader in light tactical vehicles, today announced that Andy Hove will serve as the company's new Chief Executive Officer and President, succeeding Charlie Hall who is retiring. Hove brings to AM General a track record of excellence at a diverse array of defense and commercial companies in the United States and around the world. Hove most recently served as the President and CEO of HDT Global where he rapidly proved the quality of his leadership in helping transform the company.

GMC Hummer EV coming to Extreme E with Chip Ganassi Racing

Tue, Jan 26 2021The electric off-road racing series Extreme E is getting another famous face. This time it's not a person, but rather a vehicle: the GMC Hummer EV. GMC announced that it will be the main sponsor for the Chip Ganassi Racing Extreme E team. With the sponsorship, GMC gets to tweak the Extreme E Odyssey 21 race SUV to look more like the Hummer EV pickup and SUV that starts production late this year. The changes are subtle but effective, with the nose getting a full-width light-bar motif. Of course the race SUV is vastly more rounded than the road-going truck. It also features a standardized chassis from Spark Racing and a battery pack from Williams. The team is able to provide its own electric motor, though, which the series limits to 550 horsepower. The GMC Hummer EV race SUV will make its competition debut alongside several other pedigree teams at the first Extreme E event in Saudi Arabia this April. Three teams are operated by Formula One drivers including Sir Lewis Hamilton, Nico Rosberg and Jenson Button, the latter of whom will be driving. Andretti United will also field a team, a familiar competitor to Chip Ganassi in other racing series such as IndyCar. As for drivers, two World Rally Championship champions will compete: Carlos Sainz and nine-time consecutive champion Sebastien Loeb. The series will feature five races and with the way the competition is shaping up, they should be very interesting to watch. Related video:

GMC Hummer EV hits Neiman Marcus Christmas catalog for twice the price

Fri, Oct 29 2021This winter season, Nieman Marcus is getting into the true meaning of Christmas by offering a bunch of seriously expensive stuff in its annual holiday catalog. There's usually at least one automotive offering, and this year it's a 2022 GMC Hummer EV Edition 1 for an eye-watering $285,000. That's $172,405 more than the regular Edition 1 crab-walker, which is priced by GMC at $112,595. And what does one get for more than 2.5 times the cost of the most expensive electric Hummer? Well, hold your 1,000 horses, because this isn't just any Hummer EV Edition 1. No, it's a one-off Barrett-Jackson Hummer EV Edition 1. The interior of this Barrett-Jackson edition Hummer has been "curated" by Craig Jackson himself. And by curated, they mean it has a bunch of red trim everywhere and is garnished with a Neiman Marcus logo. Aside from that, there is nothing appreciably different about it. No performance upgrades, no special paint job. You do get an electric charging station at home, though, which might be the most useful addition to this whole enterprise. If that's not worth the price of an entire 1.5 extra Hummers to you, there's more. You get two VIP passes for the opening gala of the Barrett-Jackson auctions in exotic Scottsdale, Ariz. During the auction, you'll get access for two to Carolyn and Craig Jackson's personal skybox from where you can watch 1,500 cars trade hands. But don't get too comfy, because at some point you'll be invited on stage to receive your Hummer EV in front of a gaggle of inebriated fishing boat dealership owners. Oh, and you'll also get to bang the little auction hammer. You can pair the Hummer with other gifts in Nieman Marcus' "fantasy" catalog, like a $6.1 million dollar diamond ring. However, if you go with the $395,000 Great Gatsby-style roaring '20s party, make sure it doesn't end with the 9,000-pound Hummer Daisy Buchanan-ing any bystanders. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.