Salvage Title on 2040-cars

Washington, District Of Columbia, United States

|

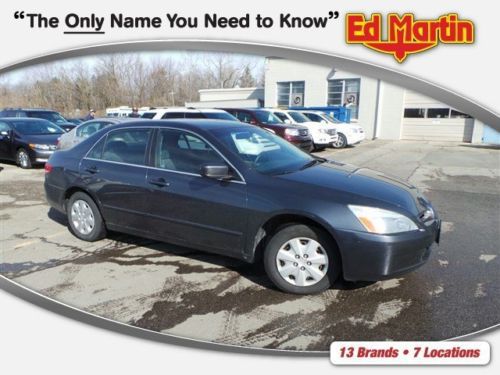

2005 HONDA ACCORD WITH NAVIGATOR SYSTM

RUN AND DRIVE GOOD |

Honda Accord for Sale

2004 honda accord ex coupe 3.0 v6 6-speed rare find!!!(US $9,700.00)

2004 honda accord ex coupe 3.0 v6 6-speed rare find!!!(US $9,700.00) 1998 honda accord lx sedan 4-door 3.0l

1998 honda accord lx sedan 4-door 3.0l 2009 honda accord ex-l auto sunroof htd leather nav 87k texas direct auto(US $14,980.00)

2009 honda accord ex-l auto sunroof htd leather nav 87k texas direct auto(US $14,980.00) 2009 honda lx-p(US $13,995.00)

2009 honda lx-p(US $13,995.00) 2.4 lx 2.4l 177 hp horsepower 2.4 liter inline 4 cylinder dohc engine 4 doors

2.4 lx 2.4l 177 hp horsepower 2.4 liter inline 4 cylinder dohc engine 4 doors Lx 2.4l cd front wheel drive power windows locks mirrors

Lx 2.4l cd front wheel drive power windows locks mirrors

Auto Services in District Of Columbia

Wrenchmasters ★★★★★

Ourisman Rockmont Chevrolet ★★★★★

New Concept Auto Repair ★★★★★

Certified Auto Repair & Towing ★★★★★

Carlord Inc ★★★★★

Big Chair Auto Repair ★★★★★

Auto blog

China's largest dealer body pushes back against foreign automakers over huge inventories

Mon, Jan 5 2015Do not think for a second that automakers forcing inventory on dealers in order to pad the numbers is a ruse known only in the US. Stories of individual brands have hinted at the trouble Chinese dealerships are having trying to move units as the country's economic growth remains hot but comes off the boil, like the one revealing that 95 percent of Toyota-FAW showrooms are losing money. Yet Toyota isn't the only culprit, and the issue has become so dire that the China Automobile Dealers Association (CADA), the largest dealer body in the country, has written to the government to complain. Chinese car sales are expected to close out the year with an annualized growth of six-percent, down from last year's 14 percent when targets were set, while in the background the pace of overall economic expansion is the slowest its been since the early nineties. Automakers, shipping cars on schedule to make their earlier targets, have blown up inventories such that they are an average of 1.8 times monthly sales, when the preferred multiplier is from 0.9 to 1.2. According to the CADA, the price wars and necessary incentives mean that only 30 percent of dealers are operating in the black. That number is down a whopping forty percent since 2010. In response, Toyota has already said it will not make its 2014 target of 1.1 million cars sold. We're a long way from 2012, when Toyota planned on selling 1.8 million cars in China in 2015, a target that's now as realistic as a manticore. BMW, Honda and Nissan have erased numbers on their spreadsheets, too; BMW growth dropped from 20 percent to 8 percent midyear after it began "reducing wholesale supplies," and Honda has been reworking its plans as sales have decreased each of the past six months. It's a big deal for Chinese dealers to begin protesting publicly, the CADA saying, "In the past, dealers were angry, but dared not speak out. But now, they have to shout because the situation is getting so unbearable." With six-percent growth forecast for next year and dealers unwilling to remain underwater, The Year of the Sheep coming in 2015 could portend meaning beyond the zodiac. News Source: ReutersImage Credit: AP Photo/Andy Wong BMW Honda Nissan Toyota Car Buying Car Dealers

2012 Honda NC700X

Fri, 28 Dec 2012Honda Builds The Crossover Of Bikes

Here in the land of Harleys and highways that stretch to infinity, Americans don't care much for sensible motorcycles. Unlike the majority of global bike buyers, North Americans tend to choose escape over utility, performance over practicality - that's simply how it's been done in the land of the free, at least until a funny thing happened on the way to the global recession.

As bank balances thinned and fuel prices crept skyward, sales of puffed up sportbikes and cartoonishly endowed cruisers plummeted. Americans rediscovered that motorcycles could be used for tasks like workaday commutes and trips to the grocery store, not just for riding into a Marlboro Man-approved sunset, fringe in tow. As consumers matured, manufacturers slowly responded with bikes better suited for purposeful priorities.

Honda sees sales up but profit sliding 16 percent in 2017-18

Fri, Apr 28 2017TOKYO - Honda forecasts a 16 percent fall in operating profit for the current financial year as the Japanese automaker sees higher auto sales being offset by a stronger yen and research-and-development costs. Japan's No. 3 automaker said it expects an operating profit of 705 billion yen ($6.34 billion) in the current FY2018, down from 840.7 billion yen posted in the fiscal year just ended, and lower than an average estimate of 850.8 billion yen from 23 analysts polled by Thomson Reuters I/B/E/S. It sees a 14 percent slide in net profit to 530.0 billion yen this year, down from 616.5. Honda's projections are based on a forecast that the yen will average 105 yen to the U.S. dollar through next March, stronger than the 108 yen rate in the year just ended.BUT CAR SALES ARE UP At the same time, there's good news as Honda expects its global vehicle sales to edge up 1 percent to 5.08 million this year, bolstered by growth in Asian sales to 2.06 million units, beating out North America to become Honda's top market as more Chinese drivers flock to its cars. The company expects to sell 1.92 million vehicles in North America, 2.5 percent less than the year just ended as it struggles to sell sedans including the Accord, which have fallen out of fashion in the past few years. Honda has been ramping up production of SUVs to keep up with strong demand for larger models in the United States, although overall vehicle sales show signs of slowing following a boom cycle after the global financial crisis. Mazda is taking a similar strategy, announcing on Friday it would expand production of SUV crossover models at home, while equipping overseas plants to enable more flexible production of models according to market needs. Japan's No. 5 automaker forecast a 19 percent jump in operating profit for the current financial year as it expects higher sales volumes, particularly in North America, to help it recover from last year's profit slump.A CONSERVATIVE OUTLOOK Executive Vice President Seiji Kuraishi acknowledged that Honda's expected currency hit of 95 billion yen was based on a "conservative" yen forecast, adding that growing costs to create next-generation cars would also impact earnings. "Our costs are rising to develop new technologies which will be needed in the future, like automated driving functions and electric cars," he told reporters at a results briefing.