1992 Gmc Sonoma Gt #359 on 2040-cars

Peru, Indiana, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Engine:4.3L 262Cu. In. V6 GAS OHV Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: GMC

Model: Sonoma

Cab Type (For Trucks Only): Regular Cab

Trim: GT Standard Cab Pickup 2-Door

Options: CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes

Mileage: 87,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

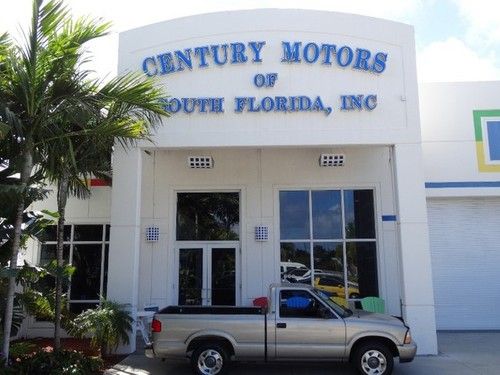

This is truck #359 of 806. This is the "little brother" to the Syclone. All of the GT's came with the "W" code 4.3L backed with the 4L60 (700R4) and a Govlock rear diff. The interior is the same as the Syclone except for the boost gauge and the inflatable lumbar seats with embroidery. The cladding is specific to the GT aside from the front and rear bumpers.

GMC Sonoma for Sale

No reserve auction,automatinv-6 4x4,extended cab 3 door,cap,68,000 actual miles

No reserve auction,automatinv-6 4x4,extended cab 3 door,cap,68,000 actual miles 2000 gmc sonoma 4wd extended cab private sale no reserve

2000 gmc sonoma 4wd extended cab private sale no reserve 2003 gmc sonoma sls extended cab pickup 3-door 4.3l

2003 gmc sonoma sls extended cab pickup 3-door 4.3l 1995 gmc sonoma 2.2 5 speed ext cab

1995 gmc sonoma 2.2 5 speed ext cab 1991 gmc sonoma syclone pickup all wheel drive new engine warranty call gordon(US $13,900.00)

1991 gmc sonoma syclone pickup all wheel drive new engine warranty call gordon(US $13,900.00) 2000 gmc sonoma 76,949 miles clean carfax manual transmission runs great!!(US $5,900.00)

2000 gmc sonoma 76,949 miles clean carfax manual transmission runs great!!(US $5,900.00)

Auto Services in Indiana

Webbs Auto Center ★★★★★

Webb Ford ★★★★★

Tire Grading Co ★★★★★

Sun Tech Auto Glass ★★★★★

S & S Automotive ★★★★★

Prestige Auto Sales Inc ★★★★★

Auto blog

Do you guys like trucks?

Wed, Jan 17 2018Do you guys like trucks? If the answer is yes, boy do we have the show for you! The 2018 North American International Auto Show is lousy with 'em. Yeah, we saw the new Ram 1500, Chevy Silverado and Ford Ranger, but that's just scratching the surface. There are big trucks, little trucks, clean trucks, dirty trucks, old trucks, new trucks, red trucks, blue trucks. It's like a Dr. Seuss book. Anyway, we made a little video for you truck nuts (see what I did there?). Check it out above, and if you're looking for more serious coverage of the Detroit Auto Show, we've got it, along with a ton of images and other videos from the show floor. Enjoy! Related Video: Humor Detroit Auto Show Chevrolet Ford GMC Honda Lincoln Nissan RAM Toyota Truck Videos Original Video 2018 detroit auto show

GMC and AEV reveal Sierra Grande upfit SEMA concept

Fri, Oct 27 2023If there was any question as to whether GMC was dedicating resources to its off-road models, it was dismissed the instant American Expedition Vehicles entered the conversation. The two have already partnered to produce a GMC-branded alternative to the Chevrolet Colorado ZR2 Bison. The 2024 GMC Canyon AT4X AEV Edition is midsize pickup perfection, but the collaboration is far from over. With GMC now pushing the AT4X package on its heavy-duty pickups, AEV is looking for ways to explore the space.¬† "The Sierra Grande Concept represents AEVís creative vision of how the company would further elevate the adventure-ready foundation of the GMC Sierra HD AT4X into a legendary overlanding rig," AEV said in its announcement The Sierra Grande is all Sierra HD AT4X underneath. The steering knuckles, control arms, rear suspension and butter-smooth DSSV dampers are all lifted directly from the production truck.¬†This SEMA-bound concept is the quintessential upfit smorgasbord, boasting everything from add-on lighting to upgraded underbody protection. There are even two winches ¬ó one for the front and one for the back. If you ask us, they should have gone ahead and put one on each side too.¬† The snorkel pairs nicely with the 40-inch BF Goodrich tires, and the onboard air system guarantees you're never in a pickle when you hit pavement to head home. The bed is aluminum, but the skid plates are stamped steel (as is the brush guard). The front winch is rated for 12,500 pounds; the rear for "just" 9,500.¬† Unlike the Canyon AT4X AEV Edition, the Sierra Grande is merely an exercise ¬ó for now, anyway. We suspect that GMC has plenty more in store for its off-road trucks.¬† Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Electric pickups compared: 2025 Ram 1500 REV specs vs. Silverado EV, F-150 Lightning

Wed, Apr 5 2023Now that the 2025 Ram 1500 REV has been revealed, along with its most important specifications, we now have information on all of the mainline Big 3 electric full-size pickup trucks. So it's time to see how the numbers stack up, because trucks are all about numbers. We'll see how the Ram compares to the power, battery capacity, payload, towing and other features of the 2024 Chevy Silverado EV and the 2024 Ford F-150 Lightning. Power and torque The Ram has just one powertrain option. It features two electric motors making 654 horsepower and 620 pound-feet. That gives it the most powerful standard powertrain, if not the most torque, as the Chevy Silverado EV has 510 horsepower and 615 pound-feet of torque, while the F-150 Lighting has 452 horsepower and 775 pound-feet. But the Chevy and Ford each have upgraded motor combinations. The Silverado is the most potent with 754 horsepower and 785 pound-feet, and the F-150 has 580 horsepower and 775 pound-feet. The GMC Sierra EV will also be available with this more powerful pair of motors, and most of its specifications will be the same as the Silverado. There are a couple of exceptions which we'll note when they come up. All three trucks come standard with dual motors and all-wheel drive, regardless of output, battery or trim level. They're all available with locking rear differentials, too. Ford F-150 Lightning front low View 48 Photos Battery, range and charging The Ram is packing some serious packs of batteries. The standard model gets 168 kWh and an estimated range of 350 miles. And the optional 229-kWh pack is estimated to deliver 500 miles of range. That's more capacity and range than the others. It also boasts an 800-volt battery system that allows for close to 350-kW charging. The Ford F-150 Lightning has a base battery of 98 kWh with a range around 230 miles. Optional is a 131-kWh pack with between 300 and 330 miles of range, depending on other vehicle specifications. It's the slowest charger, only allowing 150-kW charging maximum. The Silverado EV's battery specs are a bit nebulous. At launch, it will only be available with one battery pack option that GM claims will provide around 400 miles of range. The company didn't give an exact capacity, though. We would guess its size falls between the Ram's 168 and 229 kWh packs. A smaller battery pack will be offered later, with a shorter but unknown range. The Silverado can use 350-kW fast charging like the Ram.