2012 Gmc Acadia Sl on 2040-cars

8315 E Us Highway 36, Avon, Indiana, United States

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

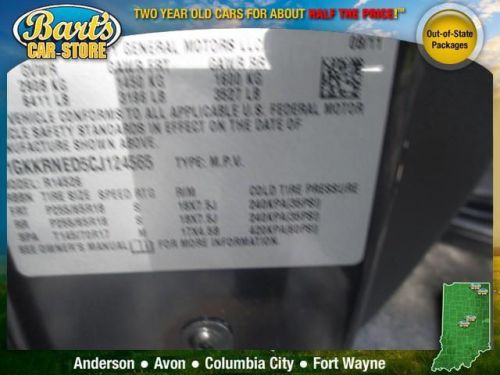

VIN (Vehicle Identification Number): 1GKKRNED5CJ124565

Stock Num: B800153

Make: GMC

Model: Acadia SL

Year: 2012

Exterior Color: Carbon Black Metallic

Interior Color: Ebony

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 70645

Thank you for visiting another one of Bart's Car Store - Avon's exclusive listings! 100% CARFAX guaranteed! 100% AutoCheck guaranteed! At Bart's Car Store - Avon, we strive to provide you with the best quality vehicles for the lowest possible price, and this Acadia is no exception. "Use your SMARTS and buy at BART'S"

GMC Acadia for Sale

2014 gmc acadia slt-1(US $34,988.00)

2014 gmc acadia slt-1(US $34,988.00) 2014 gmc acadia slt-1(US $43,245.00)

2014 gmc acadia slt-1(US $43,245.00) 2014 gmc acadia slt-1(US $34,988.00)

2014 gmc acadia slt-1(US $34,988.00) 2014 gmc acadia slt-2(US $44,340.00)

2014 gmc acadia slt-2(US $44,340.00) 2014 gmc acadia slt-2(US $44,990.00)

2014 gmc acadia slt-2(US $44,990.00) 2014 gmc acadia denali(US $49,655.00)

2014 gmc acadia denali(US $49,655.00)

Auto Services in Indiana

Xtreme Precision ★★★★★

Whetsel`s Automotive ★★★★★

USA Auto Mart ★★★★★

Tony Kinser Body Shop ★★★★★

Tire Barn Warehouse ★★★★★

The Tire Store ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2015 GMC Yukon erupts into flames during Anaheim test drive [w/video]

Mon, 24 Mar 2014A 2015 GMC Yukon burst into flames while on a test drive in Anaheim, CA on Sunday after smoke filled the cabin. Residents of the neighborhood where the driver abandoned the redesigned Yukon reported hearing a series of small explosions (likely the tires, based on the video), according to a report from KTLA and The Los Angeles Times.

No one was injured in the incident, which The Times reports occurred after a possible oil or fluid leak. As you can see in the image above, the Yukon was engulfed in flames, although the Anaheim Fire Department was able to put out the blaze in about 15 minutes.

"We're very lucky that no one got hurt, and it was in an area that... was safe," Lt. Tim Schmidt of the Anaheim Police Department told KTLA reporters. "If there was any place that was going to be safe, it would be this area. It's very open. It worked out for us."

Average transaction prices climb to a record $36,270 in January

Sat, Feb 3 2018The automotive sector made a hash of the numbers last month, a mess of pluses and minuses clogging the transaction-price charts according to Kelley Blue Book. The overall industry rose one percent, even though buyers bought fewer cars and light vehicles in January 2018 vs 2017 using the selling-day adjusted rate. Due to January transaction prices rising to $36,270, a record for January, the value of new vehicles sold climbed more than $1 billion compared to January 2017. KBB's transaction prices don't include customer incentives, which changes the complexion slightly; average incentive spending rose to just over ten percent. The average transaction price in December 2017 was $36,756, so January dropped a bit - nothing unexpected, with the month annually blamed for "January doldrums." More revealing is the fact that the average transaction price in January 2017 was $34,910. This year's plumped-up figure came courtesy of the continued shift to crossovers, SUVs, and light trucks, which shouldn't surprise anyone who's read an automotive blog in the past 20 years. That category comprised nearly 70 percent of new vehicle sales for the month. Some manufacturers profited more than others, though. Fiat Chrysler managed 12.8 percent fewer sales in January compared year-on-year, but the company's vehicles sold for $1,300 more. The Ford brand suffered a 6.3-percent dip in sales, but brand transaction prices increased $2,000, while a Lincoln sold for $8,700 more on average. General Motors sold more cars and sold them for more money; overall GM transaction prices rose four percent, or $1,270, while a GMC traded hands for seven-percent more than in January 2017 and a Cadillac got $2,300 more on average. Of KBB's listed automakers, the Volkswagen Group got the most of out its customers, transaction prices rising at the German automaker by 5.6 percent to $42,243 in January 2018 compared to a year earlier. American Honda followed with a 4.3-percent increase to $28,991, GM in third at 4.1 percent to $40,313. Find your next car at Autoblog using our new and used car listings or the Car Finder tool. Broken out by segment, minivans rocked the table, transaction prices leaping by 7.9 percent to $35,380 compared to January a year earlier. Luxury cars boasted the next-highest rise, at 3.6 percent to $58,533.