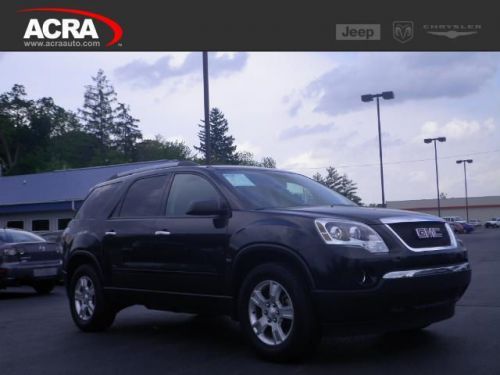

2011 Gmc Acadia Slt on 2040-cars

2600 S 3rd St, Terre Haute, Indiana, United States

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GKKRRED4BJ185606

Stock Num: 14-06229

Make: GMC

Model: Acadia SLT

Year: 2011

Exterior Color: Quicksilver

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 42888

Climb inside the 2011 GMC Acadia! This vehicle continues to deliver segment-leading versatility and all-terrain dominating performance! The following features are included: leather upholstery, automatic temperature control, and remote keyless entry. A 3.6 liter V-6 engine pairs with a sophisticated 6 speed automatic transmission, and for added security, dynamic Stability Control supplements the drivetrain. We pride ourselves in consistently exceeding our customer's expectations. Please don't hesitate to give us a call.

GMC Acadia for Sale

2010 gmc acadia(US $16,995.00)

2010 gmc acadia(US $16,995.00) 2012 gmc acadia denali(US $39,000.00)

2012 gmc acadia denali(US $39,000.00) 2008 gmc acadia slt-2(US $12,988.00)

2008 gmc acadia slt-2(US $12,988.00) 2011 gmc acadia denali(US $35,988.00)

2011 gmc acadia denali(US $35,988.00) 2011 gmc acadia sl(US $23,495.00)

2011 gmc acadia sl(US $23,495.00) 2011 gmc acadia sle

2011 gmc acadia sle

Auto Services in Indiana

Wolski`s Auto Repair ★★★★★

Wheels Auto Sales ★★★★★

Tony Kinser Body Shop ★★★★★

Tilley`s Hilltop ★★★★★

Standard Auto Sales ★★★★★

Schepper`s Tires & Batteries ★★★★★

Auto blog

The biggest gas-guzzlers of 2024: 'The Meanest List' is the opposite of greenest cars

Thu, Mar 14 2024In some circles — especially some automotive circles — bigger is better. This explains the Hummer, for example. In its so-called “Meanest List” of a dozen models, the American Council for an Energy-Efficient Economy (ACEEE) makes no apologies for berating “the worst-performing mass market automobiles” sold in 2024 in the U.S. The most diminutive car on the list is a Chevy Corvette Z06. At the top of this particular heap is the Mercedes-Benz AMG G63, a gas-powered SUV that the environmental agency says was “the worst-performing vehicle of the more than 1,200 models assessed by Greener Cars and has an annual fuel cost over $4,000.” Not to mention its MSRP of around $184,000. Rank Make & Model Powertrain Green Score MSRP Estimated Annual Fuel Cost* 1 Mercedes-Benz AMG G63 Gas 20 $184,000 $4,242 2 Ram 1500 TRX 4x4 Gas 22 $98,335 $3,819 3 Ford F150 Raptor R Gas 24 $79,975 $3,777 4 Cadillac Escalade V Gas 26 $152,295 $3,388 5 Dodge Durango SRT Gas 26 $74,995 $3,332 6 Jeep Wrangler 4dr 4X4 Gas 27 $35,895 $3,260 7 Jeep Grand Wagoneer 4x4 Gas 28 $91,945 $3,058 8 Mercedes-Benz G550 Gas 28 $143,000 $3,186 9 GMC Hummer EV SUV EV 29 $98,845 $1,746 10 GMC Sierra Gas 29 $37,700 $3,069 11 Chevrolet Corvette Z06 Gas 30 $114,395 $3,169 12 Mercedes-Benz Maybach S680 Gas 30 $234,300 $3,031 *ACEEE analysis using EIA data of the annual cost of driving 15,000 miles In terms of numbers, the dirty dozen of the meanest includes seven SUVs and three trucks. Lonely at the middle of the list is the sole electric, the GMC Hummer EV, which weighs in at 9,000 pounds. The council notes that “though EVs have lower emissions than similarly sized gasoline models, the Hummer demonstrates that size and efficiency, not just fuel source, are important factors in a carÂ’s environmental impact.” ItÂ’s also worth reminding prospective buyers that the average fuel cost of a vehicle on the “Greenest List” eats up only a fifth of the fuel cost of a vehicle on the Meanest List, “showing that greener options can also be more affordable.” The ACEEE also put out a "Greener List" of efficient gasoline and hybrid cars that don't require plugging in. By the Numbers Green Cadillac Chevrolet Dodge Ford GMC Hummer Jeep Maybach Mercedes-Benz RAM Emissions Fuel Efficiency Green Automakers Truck SUV Electric Hybrid

GM extends production cuts, affects Cadillacs, Camaro and Acadia

Thu, Apr 8 2021General Motors is extending production cuts at some of its North America factories due to a chip shortage that has roiled the global automotive industry, the U.S. carmaker said on Thursday. The move's impact has been baked into GM's prior forecast that the shortage could shave up to $2 billion off this year's profit. GM's Lansing Grand River assembly in Michigan will extend its downtime through the week of April 26. The plant makes Chevrolet Camaros and Cadillac CT4 and CT5 sedans. It has been out of action since March 15. GM's Spring Hill assembly in Tennessee will shut down for two weeks starting the week of April 12. The plant makes the Cadillac XT5, XT6 and GMC Acadia. The company said it has not taken downtime or reduced shifts at any of its more profitable full-size truck or full-size SUV plants due to the shortage. The news was first reported by CNBC. Reporting by Ankit Ajmera in Bengaluru; Editing by Maju Samuel and Sriraj Kalluvila

GM, Pilot will build EVgo fast chargers at 500 truck stops across U.S.

Thu, Jul 14 2022All of our maps showing electric vehicle charging stations across the U.S. are going to need an update. Today, General Motors, Pilot and EVgo announced plans to work together on a nationwide DC fast charging network. The plan calls for 2,000 charging stalls that can deliver up to 350 kW to be installed at up to 500 Pilot and Flying J travel centers in the U.S. The goal is to have DC fast chargers available in 50-mile intervals across the country. The new charging stations will feature GM's "Ultium Charge 360" branding and "Pilot Flying J" logos but will not be limited to drivers of GM EVs. The plugs will use CCS connectors and be available to anyone. GM EV owners can take advantage of benefits, including the ability to make exclusive reservations, get discounts on charging costs and streamline the charging process with Plug and Charge and in-vehicle apps that can provide real-time charger availability. The first installation phase will take place in 2023, and "the bulk of the installations" should be completed by 2025, EVgo CEO Kathy Zoi said during a conference call with reporters announcing the plan. "We're gonna get going immediately and commence all of that engineering and planning stuff," she said. "We've got a pretty orderly plan." Pilot CEO Shameek Konar said the company expects the new EV charging stations to coexist with the current fuel infrastructure. "An average Pilot Flying J location is about 10 acres," Konar said. "This will be in addition to all of our gas pumps. The way I think about it is, this is a new source of energy that is going to coexist with gas for quite some time. We can debate how long, but we need to serve both groups of customers." Installing DC fast chargers at hundreds of Pilot's travel centers — aka truck stops — means there should be food, drinks, restrooms, WiFi and even showers available while you wait for an EV to charge. Pilot recently announced its “New Horizons” plan that will invest $1 billion in upgrading Pilot travel centers with more premium amenities, including expanded seating and lounge areas. While the exact amount of time it will take to charge an EV using these new stations will vary on the EV and its current state of charge, most EVs can refill from a low state of charge to around 80 percent in 20-30 minutes on a fast charger. The new stations are future-proofed to deliver up to 350 kW, a charge rate that few EVs today can handle.