1990 Ford Thunderbird Sc Anniversary Addition on 2040-cars

Allentown, Pennsylvania, United States

Vehicle Title:Clear

Engine:3.8L 232Cu. In. V6 GAS OHV Supercharged

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Ford

Warranty: Vehicle does NOT have an existing warranty

Model: Thunderbird

Trim: Super Coupe Coupe 2-Door

Options: Sunroof, Leather Seats, CD Player

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: RWD

Mileage: 134,621

Exterior Color: Black

Number of Doors: 2

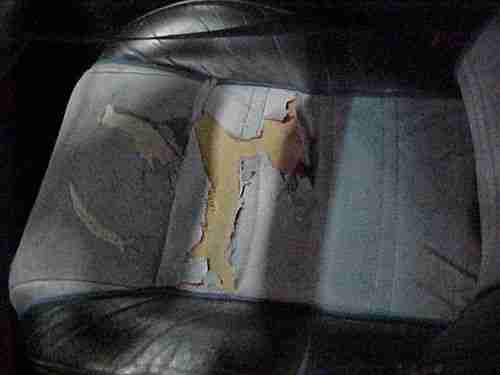

Hello. You are bidding on a 1990 35th anniversary edition ford thunderbird super coupe. Not sure exactly how many were built but I think it was under five thousand. The car is titled in my name and have owned it around nine years. The mileage is 134,621 miles. The car is currently out of inspection and was last registered in 2008. The car still runs and drives. The car is fully loaded with some nice options and is fun to drive. Posi rear,tilt wheel, ac, traction control, sun roof, lower lumbar, power windows, factory jbl sound system with subwoofer, leather interior, super charger, and power mirrors. I`m sure there are some more items that I forgot. The car does have some issues. Traction control light stays on, subwoofer is dry rotted from the heat(common problem) but still works, ac needs charged(found a pinhole in a hose) drivers bottom seat cushion is worn out, some stains in back seat area, top of the back seat cushions is cracked from the heat of the sun(in picture) brake light is on in the dash, small dent in the front of the hood,back bumper cover is cracked( have another correct bumper cover) and the right side quarter panel has a rust spot developing. No smoke coming out of the exhaust pipe. Engine runs strong and trans shifts smoothly. Lights, horn and turn signals etc. work correctly. Wheels have paint peeling and thread on tires is fair. This was the nicest car I have ever driven. Handles wonderfully and has quick power. Hopefully these cars will become collectible. Selling the car because I need the space and don`t have the time to fix.Good luck bidding and if there are any questions please e-mail me. Can also provide more picture if necessary. Thank you. FRED 484-895-8577

Ford Thunderbird for Sale

1955 ford t bird convertible restored ca no rust cold ac 292 v8 auto disc brakes(US $34,900.00)

1955 ford t bird convertible restored ca no rust cold ac 292 v8 auto disc brakes(US $34,900.00) 2003 ford thunderbird hardtop convertible htd seats 65k texas direct auto(US $17,980.00)

2003 ford thunderbird hardtop convertible htd seats 65k texas direct auto(US $17,980.00) 1963 ford thunderbird

1963 ford thunderbird Great 'squarebird' ready for summer

Great 'squarebird' ready for summer 65 t-bird special landau 10th anniversary rare 1965 thunderbird all original

65 t-bird special landau 10th anniversary rare 1965 thunderbird all original 2002 ford thunderbird hard top pwr soft top all options low reserve exc cond(US $12,975.00)

2002 ford thunderbird hard top pwr soft top all options low reserve exc cond(US $12,975.00)

Auto Services in Pennsylvania

Wayne Carl Garage ★★★★★

Union Fuel Co ★★★★★

Tint It Is Incorporated ★★★★★

Terry`s Auto Glass ★★★★★

Terry`s Auto Glass ★★★★★

Syrena International Ltd ★★★★★

Auto blog

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.

Ford 2Q profit drops 86% as it restructures overseas

Thu, Jul 25 2019DEARBORN, Mich. (AP) — Ford's net profit tumbled 86% in the second quarter due largely to restructuring costs in Europe and South America. Net income for the April-through-June period dropped to $148 million, or 4 cents per share. Without the charges the company made 28 cents per share. Revenue was flat at $38.9 billion. On average, analysts surveyed by FactSet expected earnings 31 cents per share on revenue of $38.49 billion. Chief Financial Officer Tim Stone says the company had charges of $1.2 billion as it moved to close factories in Europe and South America. He says Ford already is seeing an impact from its global fitness measures that included a reduction of 7,000 white-collar workers. Ford, which released numbers after the markets closed Wednesday, says its results include a $181 million valuation loss on an investment in a software company, trimming 4 cents off adjusted earnings per share. Its stock fell 6.3% in after-hours trading to $9.68. Stone said Ford is in the early stages of its restructuring, but already is seeing improvement in some regions. Free cash flow also improved by 80% to $2.1 billion in the first half of the year, he said. "We're already starting to see some early benefits," he said. "A lot of work to do." The company expects improvement in the second half of the year as more new big SUVs hit dealerships and more of the restructuring takes hold. Ford on Wednesday forecast pretax adjusted earnings of $7 billion to $7.5 billion for all of 2019, compared with $7 billion last year. The company previously had only said that pretax earnings would improve. Full-year adjusted earnings per share are forecast to be $1.20 to $1.35, up from $1.30 in 2018. Previously it did not give per-share guidance. Ford's U.S. sales fell nearly 5% in the second quarter, according to the Edmunds.com auto pricing site, as the company exited most of its passenger car business. But Stone said sales of the new Ford Ranger small pickup offset much of that as its share of the small truck segment rose 14%. Edmunds, which provides content for The Associated Press, said Ford's average vehicle sale price rose 2.8% to $41,328 during the quarter. In North America, Ford's biggest profit center, pretax earnings fell 3% to just under $1.7 billion, which the company blamed on switching its Chicago factory to build new versions of midsize SUVs.

Toyota fears supplier pressure in Australia with GM pull out

Wed, 11 Dec 2013With Ford and General Motors both announcing an end to production in Australia, the country's auto industry is in a bad way. With the exit of two big players, there's increased concern that a third Australian manufacturer, Toyota, will be forced out, as well.

"We are saddened to learn of GM Holden's decision. This will place unprecedented pressure on the local supplier network and our ability to build cars in Australia," Toyota Australia said in a statement. The GM closure of Holden production will be the direct end to 2,900 jobs, but will also force a dramatic reduction in the size of the country's supplier network, as there will simply be fewer cars to build.

In the same statement, Toyota Australia said it would work with suppliers and local government to figure out whether continuing production Down Under was even feasible. According to Automotive News, a representative for the Australian Manufacturing Workers' Union told reporters it was "highly likely" that Toyota would also close up shop within the next few years.