Roadster, Hot Rod, Rat Rod, Classic, Straight Axel, Custom, 302, V8, Muscle on 2040-cars

Longs, South Carolina, United States

|

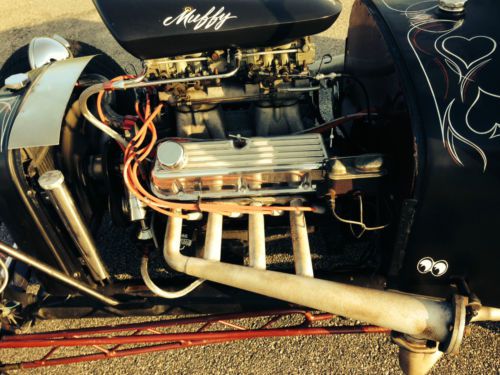

This is a 1930 Ford Model A running a 302 V8 with lake style headers that run into cherry bomb exhaust. It is no exaggeration to say that this hot rod is truly one of a kind custom vehicle, you won't ever see another of these on the road. It's an automatic and runs better than any other rat rod or hot rod you'll find. This rod is a smooth ride and turns everyones head. Why buy an $80,000 hot rod that you are afraid to drive; when you can have something that you take out cruising every night to car shows, the beach or up and down the strip? pinstriping Brand new tires (under 50 miles), new air filters, new valve covers, freshly changed full synthetic oil, and installed a killswitch. All Steel body on tubular frame. Automatic transmission is using a B&M shift kit with iconic "8 Ball" shift knob. One of a kind completely custom build. An added bonus of choosing to own a classic in states with strict emission laws is exemption from smog checks. Dual Carburetors. Plated, street legal, currently insured for $20,000. Seat belts installed. Caps at ends of the lake style headers can be removed quickly if you wish to run open headers (Warning: running open headers will draw all attention from the man in the Lamborghini and has a tendency to frighten small children).

|

Ford Model A for Sale

1980 ford shay model a roadster

1980 ford shay model a roadster 1931 ford model a 180a 2door deluxe phaeton restored rare 1 of 2229 show quality(US $52,900.00)

1931 ford model a 180a 2door deluxe phaeton restored rare 1 of 2229 show quality(US $52,900.00) 1928 ford model a tudor ratrod rat rod hotrod hot rod

1928 ford model a tudor ratrod rat rod hotrod hot rod 1929 ford model a 2 door all steel - classic street rod hot rod rat rod custom(US $18,500.00)

1929 ford model a 2 door all steel - classic street rod hot rod rat rod custom(US $18,500.00) 1980 shay model "a" deluxe roadster

1980 shay model "a" deluxe roadster Model a

Model a

Auto Services in South Carolina

X-Treme Audio Inc ★★★★★

Wingard Towing Service ★★★★★

Threlkeld Inc ★★★★★

TCB Automotive & Towing ★★★★★

Rothrock`s Garage ★★★★★

Reynolds Service Center ★★★★★

Auto blog

Translogic 177: Ford Research and Innovation Center

Tue, May 26 2015Translogic heads to Ford's Research and Innovation Center in Silicon Valley for a peek behind the scenes at the latest tech being produced by the Blue Oval. We hear why the automaker moved some of its R&D operations from Dearborn, MI to Palo Alto, CA, and get an early look at the all-new Ford GT supercar with Ford CEO Mark Fields. "Coming here to Silicon Valley, we really want to make a lot of progress on mobility, autonomous vehicles, [and] using analytics," said Fields. "So coming to Silicon Valley was ... to go to where the talent is, but also, importantly, to be a part of the community here." As for the GT, Ford's top boss is pleased with the tech driving the forthcoming supercar. "It's really a decades worth of innovation in areas of light-weighting, in areas of EcoBoost engines, and in areas of aerodynamics." Have an RSS feed? Click here to add Translogic. Follow Translogic on Twitter and Facebook. Click here to learn more about our host, Jonathon Buckley. Ford Technology Emerging Technologies Translogic Videos Original Video Mark Fields

Autoblog Podcast #326

Tue, 26 Mar 2013Easter Jeep Safari concepts, Shelby 1000, 2014 Cadillac CTS and Mercedes CLA45 AMG leaks

Episode #326 of the Autoblog Podcast is here, and this week, Dan Roth and Zach Bowman talk about this year's Easter Jeep Safari concepts, the 1,200-horsepower Shelby 1000 and leaked images of the 2014 Cadillac CTS and Mercedes-Benz CLA45 AMG. We wrap with your questions and emails, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Keep reading for our Q&A module for you to scroll through and follow along, too. Thanks for listening!

Autoblog Podcast #326:

Buy Ford and GM stock and make 5%

Tue, Feb 2 2016Want to make a five-percent return when 10-year treasuries are paying around two percent? Ford (F) and General Motors (GM) have solid balance sheets, strong cash flow, solid earnings, and growing markets. By all accounts, they are smart investments. But the market is down on these stocks. Why? Some of the stupid excuses include: They are cyclical companies The Detroit 3 have lost 3.5 million in sales since 2000 The world economy is shaky GM recently filed for bankruptcy Their markets have peaked They haven't changed their ways Let's take these criticisms one by one: They Are Cyclical Companies Yes, they are cyclical. Every company is cyclical. Every industry is cyclical. Some more than others, but not every company is immune from swings in the market. Banks used to be 'non-cyclical' leader, not anymore. Airline stocks are just as cyclical as auto stocks, yet they are trading at multiples greater than the auto industry. Why? And what accounts for the irrational stock price for Tesla (TSLA)? At least Ford (F) and General Motors (GM) make money and have positive cash flows. In fact, both companies have a net positive cash position. They have more cash on hand than liabilities. Auto sales in the United States hit a record 17.5 million vehicles in 2015. During the Great Recession, Ford (F) and General Motors (GM) cut their break even points to 10 million vehicles per year. Anything above an annual U.S. volume of 10 million vehicles is profit. And what a profit they make. Sales of Ford's F-150 continues to be the best-selling vehicle in the United States for over 30 years. Detroit 3 Have Lost 3.5 million in Sales Since 2000 Automotive News reports General Motors (GM), Ford (F) and Chrysler (FCA) have lost a combined 3.5 million vehicles sales since 2000. So how can they be making more money? Two big reasons – Fleet Sales and the UAW. Fleet Sales The Detroit 3 used to own car rental companies to keep their factories running. Ford owned Hertz (HTZ), General Motors owned all of National Car Rental and 29 percent of Avis, and Chrysler, the forerunner to Fiat Chrysler (FCA), used to own Thrifty Car Rental and Dollar Rent-A-Car. The Detroit 3 owned these rental companies to have a place to sell their bad product and keep their factories running. These were low margin sales, and in many cases, were money losers for the Detroit 3. They no longer own auto rental companies.