2014 Ford Fusion Se on 2040-cars

10715 Us Highway 19, Port Richey, Florida, United States

Engine:1.5L I4 16V GDI DOHC Turbo

Transmission:6-Speed Automatic

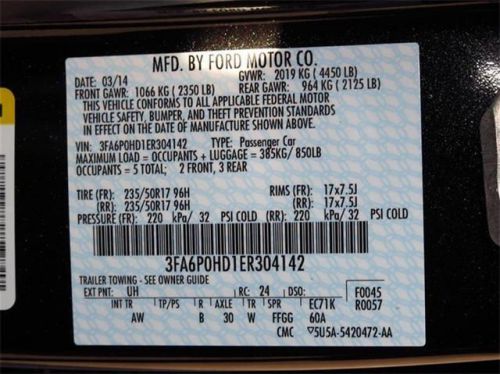

VIN (Vehicle Identification Number): 3FA6P0HD1ER304142

Stock Num: R304142

Make: Ford

Model: Fusion SE

Year: 2014

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 1

Thank you for your interest in our dealership! team is here to provide you the best pricing, the most information, and the best service. GOOD CREDIT - BAD CREDIT- NO CREDIT WE CAN HELP ! Please print this coupon and present it to Jason to receive $200 OFF of your vehicle purchase and a full year of maintenance FREE!

Ford Fusion for Sale

2014 ford fusion se(US $26,995.00)

2014 ford fusion se(US $26,995.00) 2014 ford fusion se(US $27,405.00)

2014 ford fusion se(US $27,405.00) 2014 ford fusion se(US $27,935.00)

2014 ford fusion se(US $27,935.00) 2014 ford fusion hybrid se(US $27,990.00)

2014 ford fusion hybrid se(US $27,990.00) 2014 ford fusion se(US $30,615.00)

2014 ford fusion se(US $30,615.00) 2014 ford fusion hybrid se(US $32,140.00)

2014 ford fusion hybrid se(US $32,140.00)

Auto Services in Florida

Y & F Auto Repair Specialists ★★★★★

X-quisite Auto Refinishing ★★★★★

Wilt Engine Services ★★★★★

White Ford Company Inc ★★★★★

Wheels R US ★★★★★

Volkswagen Service By Full Throttle ★★★★★

Auto blog

Watch Piquet and Mansell bend some sheetmetal in Ford Fusion GP

Tue, 12 Feb 2013As we told you about before, there were four episodes planned for the Ford Fusion GP campaign in Brazil, and the whole series has now run its course. The Ford ads pit Brazilian Formula One driver Nelson Piquet against English F1 pilot Nigel Mansell driving the new Fusion, the two coming together again after their partnership at the Williams F1 team ended in a miserable state more than 20 years ago.

They're lined up for you below, in reverse chronological order. You should watch number three first, though, as it adds a bit more spice to the NASCAR action in the fourth.

2019 Chicago Auto Show Truck Roundup: Toyota, Ford, Chevy and Ram bring it

Thu, Feb 7 2019The 2019 Chicago Auto Show features an array of heavy-duty trucks, smaller trucks, other kinds of trucks, and well, more trucks. That means new versions of the 2020 Chevy Silverado Heavy Duty and 2020 Ford F-150 Super Duty, a refreshed 2020 Toyota Tacoma and a trick tailgate on the 2019 Ram 1500. Sound a little crazy? Morgan Stanley research says 68 percent of passenger vehicles sold in the United States last year were classified as light trucks. So actually, bring on the trucks! Here's some impressions on the Chicago reveals, plus our take on the 2020 Subaru Legacy sedan. — Toyota updated the 2020 Tacoma with some light but useful enhancements. An improved infotainment has new audio features and larger screens. The grilles and wheels are different, but nothing drastic. Toyota still offers nice differentiation across the Tacoma lineup, and the design tweaks are subtle but thoughtful. Toyota tends to stretch out the Tacoma's generations, so it's wise to keep modifying and iterating to keep pace in this competitive segment. — Staying with Toyota, the Land Cruiser Heritage Edition is a legit special model that fans of this historic nameplate will appreciate. An anchor of the Toyota line in the United States since 1958, the Land Cruiser's roots date to Toyota's 1951 BJ Series military vehicle. Two colors, Midnight Black and Blizzard Pearl, are exclusive to this model and look slick against the blacked-trimmed grille and lightly bronzed wheels. Inside, bronze stitching is used on the steering wheel, seats, center console and other parts. The best part? Land Cruiser spelled out in script on the rear pillar. It's a limited model (1,200 units) and pricing isn't out yet, but that badge is probably why you buy this SUV. — The 2020 Chevy Silverado HD gets imposing looks that differentiate it from the light-duty range, an eye-popping max towing capability of 35,500 pounds and some updated powertrain elements. A new gas-fed V8 that serves as the entry point is one of the highlights, and the 6.6-liter mill makes 401 hp and 464 lb-ft, up significantly over the old 6.0-liter. There's also a new Allison 10-speed transmission teaming with the Duramax diesel to achieve that lofty max towing figure. With an updated trailering system and a larger cabin, the Silverado HD range is comprehensively remade to fight Ram and Ford. — The 2020 Ford Super Duty is also redone, and like the Chevy line, it gets a new gas V8 checking in at 7.3 liters.

Will the Ford GT make 630 hp?

Fri, Sep 11 2015Ford intends to build just 250 examples of the next-generation GT annually when production begins next year. That's low even by supercar standards, but anyone with an Xbox One can drive the highly anticipated model right now in the demo for Forza Motorsport 6. The car is even on the cover of the retail version, but the game might be giving a glimpse at one of the upcoming vehicle's biggest secrets. According to the specs page, the GT makes 630 horsepower and 539 pound-feet of torque, according to Motor Authority. Weight is shown at 2,890 pounds with a front/rear distribution of 43/57. Until now, Ford's only comment on the GT's output from its 3.5-liter twin-turbo V6 is "more than 600 horsepower," and that's certainly the case here. If accurate, the figures make the new model 130-hp more powerful than than the last GT, while also being hundreds of pounds lighter. Compared to modern competitors, the GT would be less powerful than a Ferrari 488 GTB and heavier than a McLaren 675LT. Unfortunately, Ford isn't commenting on the numbers in the game. "As we stated back at NAIAS, the Ford GT will produce more than 600 horsepower, and we can't speak to what Forza includes as specifications in their video game," company spokesperson Matt Leaver said to Autoblog via email. Don't think this is all doom and gloom, just yet. For one thing, more than numbers make a great car. Plus, the GT is still quite some way out from production, and spy shots still show it under development. Even if these figures are accurate at the time of Forza's development, that doesn't mean that they can't change in the meantime. Related Video: