2011 Fusion Sel, Excellent Condition, Loaded,leather,ms-sync,nav,silver/burgundy on 2040-cars

Fallbrook, California, United States

|

We need to get a truck for some rural land we just bought for retirement, and we cannot afford to keep both a truck and a car.

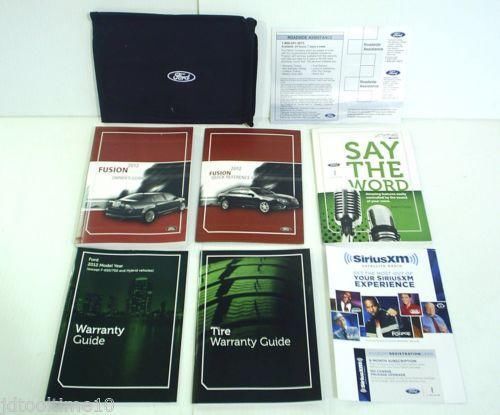

This 2011 Ford Fusion SEL has been a great car. Reliable, great mileage, non-smoker vehicle. Looks great, fully loaded with all the goodies. Leather interior, sunroof, MS-Sync (with voice control and GPS), Premium Sound, SiriusXM, bluetooth phone interface, remote start, heated power seats, power windows & mirrors, 4-cylinder, automatic, AC, cruise, premium wheels, new brakes, excellent condition. Only things to report are a very small scratch in the leather seat, and a smooth spot on the dashboard where I removed a sticky mount pad. Awards for the Ford Fusion:

|

Ford Fusion for Sale

2006 ford fusion se v6 (runs great!!!!!)

2006 ford fusion se v6 (runs great!!!!!) 2012 ford fusion sel htd leather sunroof rear cam 46k texas direct auto(US $15,980.00)

2012 ford fusion sel htd leather sunroof rear cam 46k texas direct auto(US $15,980.00) 2012 ford fusion se sedan sunroof sync 18'' wheels 15k texas direct auto(US $16,980.00)

2012 ford fusion se sedan sunroof sync 18'' wheels 15k texas direct auto(US $16,980.00) 2011 ford fusion se 3.0l v6 automatic alloy wheels 52k texas direct auto(US $12,980.00)

2011 ford fusion se 3.0l v6 automatic alloy wheels 52k texas direct auto(US $12,980.00) 13 fusion se, 2.5l 4 cyl, auto, cloth, pwr equip, cruise, clean 1 owner!

13 fusion se, 2.5l 4 cyl, auto, cloth, pwr equip, cruise, clean 1 owner! 2012 ford fusion se(US $14,900.00)

2012 ford fusion se(US $14,900.00)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Ford, Ram in heavy-duty towing spat

Mon, 28 Jul 2014Every pickup truck commercial has the brand trying to convince us that its model is the biggest, brawniest vehicle on the block. But Ford and Ram appear ready to really throw down the gauntlet and scrap over the towing figures for their heavy-duty models, and it could potentially end up in court.

The issue revolves around what it means to be best in class. Ford claims that its 2015 F-450 (pictured above) has a max tow rating of 31,200 pounds, compared to 30,000 pounds for the Ram 3500 (right). However, both companies market these heavy haulers as having the top towing in their class. According to Automotive News, Ford is threatening legal action if Ram doesn't back down.

The situation isn't as simple as just comparing the numbers, though. First, the two companies calculate their towing capacities differently. Ram adheres to the SAE J2807 rating, while Ford uses its own internal system. Although, as the company introduces new models, they are certified using the SAE standard. "When an all-new F-Series Super Duty is introduced, it also will use SAE J2807," said Ford to Autoblog in an emailed statement.

New UAW boss Williams talks tough, vows 'no more concessions'

Sun, 08 Jun 2014Dennis Williams, the newly elected president of the UAW, had some tough words for American automakers in his inauguration speech at the 2014 UAW Convention, striking down the possibility of any additional concessions from the 400,000-strong union.

"No more concessions. We are tired of it. Enough is enough," Williams said during his speech. UAW employees have not received a raise in nearly 10 years, according to Reuters.

Considering the recent strong results for Ford, Chrysler and General Motors, the union's demands are likely to carry a bit more weight in next year's negotiations. And considering Williams' tough stance, we could be in for some fireworks once negotiations commence.

2015 Ford F-150 spied in the rain

Mon, 10 Jun 2013Standing as quite a contrast from the spy shots of the 2015 Ford Mustang we saw earlier today, our spies also sent along these pictures of the next-generation F-150 pickup out testing in its (heavily camouflaged) full prototype body. Much of the new truck's design is hidden under the bulky coveralls, but we expect a lot of its new lines to be inspired by the Atlas concept that debuted at the 2013 Detroit Auto Show.

Perhaps the biggest unknown surrounding the new F-150 is what, exactly, its body will be made of. Earlier reports have suggested that lightweight aluminum materials may be used throughout, offering a serious reduction in weight versus previous models. But Ford engineers will need to be careful, though, as they need to keep a tight rein on costs while preserving class-competitive (if not class-leading) towing and payload capacity.

On the powertrain front, the new F-150 will undoubtedly carry on with EcoBoost engines, and we'd bet on a normally aspirated V8 as well. A diesel option hasn't been confirmed, but we wouldn't be surprised to see one some time in the truck's lifecycle. Mum's the word on when the production F-150 will be revealed, but our best guess is that we'll see it at the 2014 Detroit Auto Show.