1965 Ford Fairlane "rare" 1 Owner All Original!!! on 2040-cars

Belpre, Ohio, United States

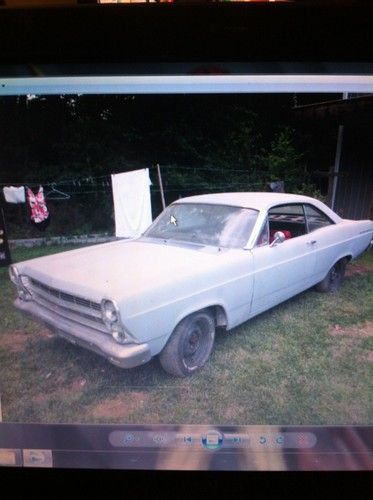

Body Type:Coupe

Vehicle Title:Clear

Engine:200 6 CYLINDER

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Ford

Model: Fairlane

Trim: 2 DR

Drive Type: COUPE

Mileage: 57,600

Disability Equipped: No

Exterior Color: AQUA

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Tan

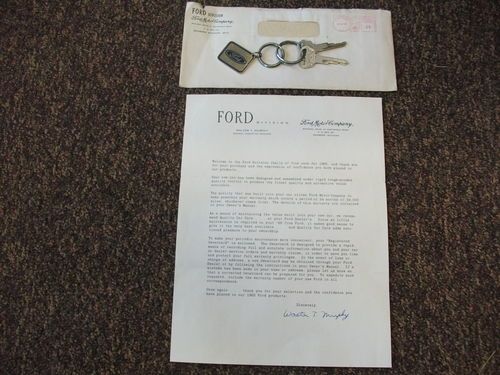

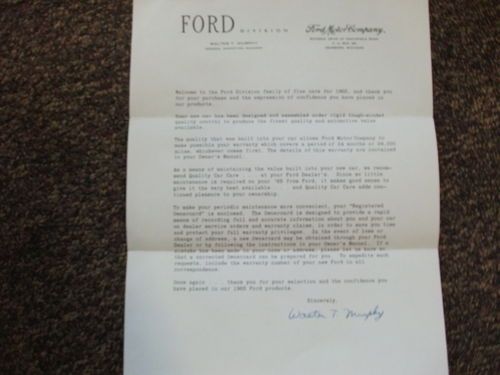

Up for sale is a 1965 Ford Fairlane that we purchased at an estate sale, it was a one owner local family... The miles are actual and runs unbelievably well... It has brand new tires, exhaust, manifold, and gas tank... This body style was only made one year... The car just needs restored!!! Call 304-488-7299 with any more questions and I can also take more pictures thanks Matt...

Ford Fairlane for Sale

Auto Services in Ohio

Yocham Auto Repair ★★★★★

Williams Auto Parts Inc ★★★★★

West Chester Autobody ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Sweeting Auto & Tire ★★★★★

Auto blog

Here's more of the Ford GT soundtrack

Mon, Aug 3 2015You probably won't be surprised to find out that that while we outsiders were speculating on the racing plans for the new Ford GT, the automaker was already testing the American exotic on track. Ford Performance has just posted some footage from one of those tests and it's worth a watch. In spite of that early exhaust promo and Xcar's two in-depth videos on the racer and the road-going coupe, this is the first time we've been treated to sustained looks at the track version just laying in laps and roaring by. Now that we know Ford's plans include running four cars throughout the 2016 season, the early testing makes sense. Ford will have two cars running in the GTE-Pro class in the Tudor United Sports Car Championship and another two in the same class in the FIA World Endurance Championship, all of them campaigned by Chip Ganassi Racing with the Felix Sabates team. Then the company plans to have all four cars at Le Mans, which will be Chip Ganassi's first ever tilt at the French event. If you want some practice picking out exhaust notes come 2016, check out the video above. Related Video: Featured Gallery Ford GT LM GTE Pro View 18 Photos News Source: Ford Performance via YouTube Motorsports Ford Coupe Racing Vehicles Performance Videos ford performance

Chinese market Ford Taurus will be unveiled at Shanghai Motor Show

Fri, Apr 10 2015A new Ford Taurus is on the way, at least for some markets. As part of a huge unveiling of seven models for the Asia Pacific market at the Shanghai Motor Show, Ford is announcing the debut of the company's next-gen large sedan on April 18 just before the event in China begins. Unfortunately, the Taurus that we see in Shanghai might not signal too much about the future version in the US. Ford spokesperson Monique Brentley tells Autoblog that this debut is specifically for the Chinese market, and the Blue Oval isn't saying whether any of this updated look will come across the Pacific. We got a tiny preview of the new Taurus earlier this year when one was spotted wearing heavy camouflage while testing in China. That one retained the sedan's hexagonal grille but added more horizontal chrome slats. It also featured reshaped headlights and a broad, lower air dam. Previous reports have indicated the next-gen model might be built around a stretched and widened version of the Fusion platform, and a major goal during development was shedding as many pounds as possible. With little time before the official unveiling, it won't be long until we'll know much of this for sure. Related Video: NEW FORD TAURUS, FORD GT TO LEAD FORD LINEUP AT AUTO CHINA 2015 Ford to unveil seven new vehicles for Asia Pacific at Auto Shanghai 2015, underscoring its commitment to expanding world-class showrooms across the region New Ford Taurus will bring the historic nameplate to China for the first time with sophisticated design, roomy space and advanced technology Ford GT supercar will lead Ford Performance lineup in Asia Pacific debut; Focus RS, Focus ST and Fiesta ST highlight Ford's passion for performance innovation in all forms Full range of Ford vehicles for China and exciting interactive displays will greet visitors to Ford's display SHANGHAI, China, April 2, 2015 – Taking another bold step to fulfill its promise of introducing 15 new vehicles to China by 2015, Ford will unveil the new Ford Taurus at Auto Shanghai 2015, with a special pre-show event on April 18. Ford's new flagship sedan for China will take the stage at the auto show, along with six other new vehicles making their debuts in Asia Pacific. "We are looking forward to taking the wraps off seven new vehicles for our customers in China and continuing our delivery of great products and innovative technologies," said John Lawler, chairman and CEO, Ford China.

Ford recalls 2020-21 Explorer and Lincoln Aviator, 2021 E-Series

Mon, Dec 21 2020Ford announced safety recalls for the 2020-2021 Explorer and Lincoln Aviator along with the 2021 E-Series early Monday. The recalls address entirely different issues. In the case of the 2020-2021 Ford Explorer and Lincoln Aviator, that issue is motor mount hardware. Specifically, the fasteners that secure the passenger-side motor mount may back out. In Ford's words, this can result in a "loss of power," which is the entirely predictable result of an engine parting ways with the vehicle it powers. As alarming as that may sound, owners should not have to worry about anything extreme, as the passenger side mount is only one of multiple, and Ford says it is not aware of any incidents that have occurred with vehicles in customer hands. Ford says it impacts only about 1400 examples of the Explorer and Aviator in the States (plus two in Mexico and 65 in Canada) that were built at Chicago Assembly Plant between July 28 and 30, 2020. Ford is in the process of alerting its owners to the recall, and those with affected models will have their mount hardware replaced by their local Ford dealerships free of charge. The 2021 E-Series is being recalled for a potential heat management issue resulting from improperly aligned thermal insulation on the underside of its engine cover. In vehicles where this insulation was not properly installed so that it reaches all the way to the edges of the cover, the resulting heat bleed can cause high in-cabin surface temperatures, and direct contact them could result in burns. This is the larger of the two recalls, as Ford says it covers nearly 33,000 examples sold in the United States and Canada. Fortunately, as with the above issue, Ford says it has not been made aware of any customer incidents. Ford says the remedy is a set of insulation patches for the exposed areas. Related Video:

1967 ford fairlane 500 xl hardtop, z code, 390, 4 sp, 406 tri heads

1967 ford fairlane 500 xl hardtop, z code, 390, 4 sp, 406 tri heads 1966 ford fairlane 500 4.7l

1966 ford fairlane 500 4.7l 1957 ford skyliner retractable fairline convertible hardtop

1957 ford skyliner retractable fairline convertible hardtop 1965 ford fairlane 500 4.7l

1965 ford fairlane 500 4.7l 1957 ford fairlane base 5.1l

1957 ford fairlane base 5.1l 1956 ford fairlane club coupe

1956 ford fairlane club coupe