2006 Ford F350 Heavy Duty,towing Package,utility Body,ready To Drive,low Reserve on 2040-cars

Exton, Pennsylvania, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Engine:V8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Ford

Model: F-350

Trim: super duty XL

Options: Leather Seats

Safety Features: Driver Airbag, Passenger Airbag

Drive Type: 4X2

Power Options: Air Conditioning

Mileage: 140,070

Sub Model: XL

Exterior Color: White

Disability Equipped: No

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Ford F-350 for Sale

2006 ford f-350sd lariat,powerstroke diesel, 4wd, leather, clean, clean carfax

2006 ford f-350sd lariat,powerstroke diesel, 4wd, leather, clean, clean carfax White ford f350 turbocharged diesel 7.3(US $6,900.00)

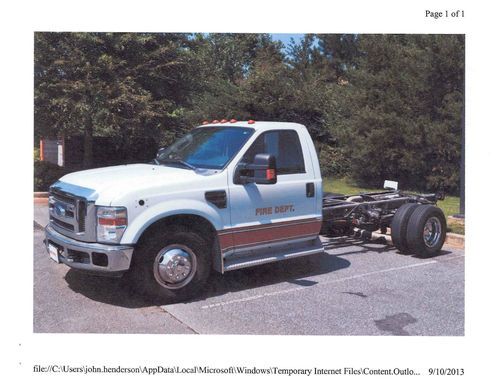

White ford f350 turbocharged diesel 7.3(US $6,900.00) 2008 ford f-350 cab/chassis

2008 ford f-350 cab/chassis 2004 ford f350 super duty 6.0 diesel 4x4(US $7,000.00)

2004 ford f350 super duty 6.0 diesel 4x4(US $7,000.00) Ford f-350 7.3 diesel 4x4 utylity box extra cab dual rear wheel(US $5,000.00)

Ford f-350 7.3 diesel 4x4 utylity box extra cab dual rear wheel(US $5,000.00) Power stroke diesel ranch hand sunroof b&w trailer hitch heated htd dvd leather(US $22,981.00)

Power stroke diesel ranch hand sunroof b&w trailer hitch heated htd dvd leather(US $22,981.00)

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

GM, Ford, Honda winners in 'Car Wars' study as industry growth continues

Wed, May 11 2016General Motors' plans to aggressively refresh its product lineup will pay off in the next four years with strong market share and sales, according to an influential report released Tuesday. Ford, Honda, and FCA are all poised to show similar gains as the auto industry is expected to remain healthy through the rest of the decade. The Bank of America Merrill Lynch study, called Car Wars, analyzes automakers' future product plans for the next four model years. By 2020, 88 percent of GM's sales will come from newly launched products, which puts it slightly ahead of Ford's 86-percent estimate. Honda (85 percent) and FCA (84 percent) follow. The industry average is 81 percent. Toyota checks in just below the industry average at 79 percent, with Nissan trailing at 76 percent. Car Wars' premise is: automakers that continually launch new products are in a better position to grow sales and market share, while companies that roll out lightly updated models are vulnerable to shifting consumer tastes. Though Detroit and Honda grade out well in the study, many major automakers are clumped together, which means large market-share swings are less likely in the coming years. Bank of America Merrill Lynch predicts the industry will top out with 20 million sales in 2018 and then taper off, perhaps as much as 30 percent by 2026. Not surprisingly, trucks, sport utility vehicles and crossovers will be the key battlefield in the next few years, Car Wars says. FCA will launch a critical salvo in 2018 with a new Ram 1500, followed by new generations of the Chevy Silverado and GMC Sierra in 2019, and then Ford's F-150 for 2020, according to the study. Bank of America Merrill Lynch analyst John Murphy said the GM trucks could be pulled ahead even earlier to 2018, prompting Ford to respond. "This focus on crossovers and trucks is a great thing for the industry," Murphy said. Cars Wars looks at Korean (76 percent replacement rate) and European companies more vaguely (70 percent), but argues their slower product cadence and lineups with fewer trucks puts them in weaker positions than their competitors through 2020. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery 2016 Chevrolet Silverado View 11 Photos Image Credit: Chevrolet Earnings/Financials Chrysler Fiat Ford GM Honda Nissan Toyota study FCA

2018 Honda Accord charges into slumping sedan market

Sat, Jul 15 2017DETROIT - Honda on Friday revealed its newest-generation Accord, one of four re-engineered midsize sedans that Asian automakers are betting on to win market share as Detroit automakers shift focus to SUVs, crossovers, and pickup trucks. The new Accord, like rival Toyota's all-new Camry arriving this month, offers major improvements in fuel economy, technology, styling and safety. Honda declined to discuss details ahead of Friday's event in Detroit. The Accord and Camry are pillars of their manufacturers' US businesses, each selling well over 300,000 vehicles a year. In the coming months, Nissan is expected to launch a new Altima midsize sedan, and Hyundai will launch a new Sonata. Both are popular marques that will be promoted heavily. "There has been no new news on the midsize sedan side for three years, and we think this is a great opportunity to bring attention back to the segment," said Jack Hollis, Toyota's head of marketing for North America. Year to date, US passenger car sales are down 11.4 percent, and sales of midsize sedans are down 14.2 percent. Still, Americans bought 7.1 million sedans in 2016. With General Motors and Ford cutting sedan production, and Fiat Chrysler Automobiles abandoning the segment, Honda and its Asian rivals could boost sales with updated models, dealers said. "They could take share from other brands, which is traditionally what happens when a new product is launched," said Pete DeLongchamps, vice president for manufacturer relations at Group 1 Automotive Inc, the third-largest US auto dealer group. "NOT FINDING A PLACE WITH CONSUMERS" The Accord for years was Honda's top-selling model in the United States. Within the past year, US sales of the Honda CR-V have eclipsed the aging Accord, and Honda has expanded production capacity for the compact crossover. Passenger-car sales have steadily declined since 2012, when they made up 51.2 percent of the US market. Sedans have sagged to a 38.1 percent share in the first half of this year. IHS Markit said US consumer loyalty to SUVs and pickup trucks has risen since 2012, but declined for sedans. The new Accord and Camry "may stem the decline," said IHS Markit's Tom Libby. "I don't think they will cause a marked reverse." Improvements to the Accord should boost sales at Galpin Honda in San Fernando, California, general manager Ed Hartoonian said.

Aluminum lightweighting does, in fact, save fuel

Mon, Apr 14 2014When the best-selling US truck sheds the equivalent weight of three football fullbacks by shifting to aluminum, folks start paying attention. Oak Ridge National Laboratory took a closer look at whether the reduced fuel consumption from a lighter aluminum body makes up for the fact that producing aluminum is far more energy intensive than steel. And the results of the study are pretty encouraging. In a nutshell, the energy needed to produce a vehicle's raw materials accounts for about 10 percent of a typical vehicle's carbon footprint during its total lifecycle, and that number is up from six percent because of advancements in fuel economy (fuel use is down to about 68 percent of total emissions from about 75 percent). Still, even with that higher material-extraction share, the fuel-efficiency gains from aluminum compared to steel will offset the additional vehicle-extraction energy in just 12,000 miles of driving, according to the study. That means that, from an environmental standpoint, aluminum vehicles are playing with the house's money after just one year on the road. Aluminum-sheet construction got topical real quickly earlier this year when Ford said the 2015 F-150 pickup truck would go to a 93-percent aluminum body construction. In addition to aluminum being less corrosive than steel, that change caused the F-150 to shed 700 pounds from its curb weight. And it looks like the Explorer and Expedition SUVs may go on an aluminum diet next. Take a look at SAE International's synopsis of the Oak Ridge Lab's study below. Life Cycle Energy and Environmental Assessment of Aluminum-Intensive Vehicle Design Advanced lightweight materials are increasingly being incorporated into new vehicle designs by automakers to enhance performance and assist in complying with increasing requirements of corporate average fuel economy standards. To assess the primary energy and carbon dioxide equivalent (CO2e) implications of vehicle designs utilizing these materials, this study examines the potential life cycle impacts of two lightweight material alternative vehicle designs, i.e., steel and aluminum of a typical passenger vehicle operated today in North America. LCA for three common alternative lightweight vehicle designs are evaluated: current production ("Baseline"), an advanced high strength steel and aluminum design ("LWSV"), and an aluminum-intensive design (AIV).