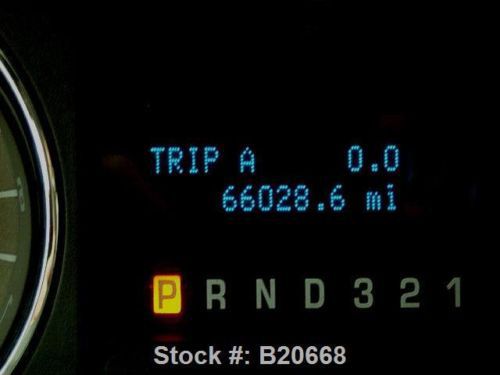

2010 Ford F-150 Supercrew V8 6-passenger Bedliner 66k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Ford F-150 for Sale

1996 ford f150xl pickup truck

1996 ford f150xl pickup truck 2002 ford sport super cab 4x4(US $8,990.00)

2002 ford sport super cab 4x4(US $8,990.00) 12 ford f150 4x4 fx4 ecoboost v6, leather seats, nav, sunroof, certified

12 ford f150 4x4 fx4 ecoboost v6, leather seats, nav, sunroof, certified 2010 ford f-150 lariat crew cab pickup 4-door 5.4l(US $25,000.00)

2010 ford f-150 lariat crew cab pickup 4-door 5.4l(US $25,000.00) No reserve 2008 ford f-150 xlt supercab, 1 corp. owner

No reserve 2008 ford f-150 xlt supercab, 1 corp. owner 2012 ford f-150 fx4 crew 4x4 5.0l sunroof nav 20's 36k texas direct auto(US $34,980.00)

2012 ford f-150 fx4 crew 4x4 5.0l sunroof nav 20's 36k texas direct auto(US $34,980.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Ford recalls nearly 200,000 Expeditions and Navigators for fire risk

Thu, Sep 1 2022Ford is recalling 2015-2017 Expeditions and 2015-2017 Lincoln Navigators because the front blower motor could fail and cause a fire. In total, 198,482 Expeditions and Navigators will be recalled. In the official recall documents posted by NHTSA, Ford says that it “has not identified the cause of this condition.” However, Ford also says it is currently aware of 25 fire allegations related to the blower motors on these vehicles. Despite not strictly identifying the cause of blower motor fires, Ford put forth a theory in its fieldwork analysis of the issue. “In June 2022, based on component analysis, Ford Engineering theorized that a mispositioned blower motor brush holder spring could cause an internal short or localized heating of the brush spring or holder. It is believed that when a fire initiates on the blower motor, it does so at the positive brush holder location. The variable blower controller would remain operational and there would be no signs of an overheated relay. Field data indicates that this concern typically occurs at a higher time in service, and on vehicles with higher mileage.” Since the blower motor is located on the passenger side interior behind the glovebox, the fires that start are interior fires. Ford isnÂ’t aware of any accidents related to this issue, but there is one claim of burnt hands and fingers as a result of a fire. According to Ford, warning signs of an impending fire or failed blower motor include an inoperative fan, burning smell and/or smoke from the instrument panel vents while the vehicle is on. To remedy this situation, Ford is recalling the affected SUVs and replacing the blower motor assembly with a revised part. The new part uses a blower motor assembly design utilized on other applications. If folks with these SUVs experience any symptoms of blower motor failure before the new part becomes available, Ford says they can take their vehicle to the dealer to have it replaced with a part of the same design. Once the redesigned part becomes available, the dealer will then swap it in. Owner notification letters are expected to begin on September 12 this year. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2015 Ford Mustang EcoBoost loses big power on 87 octane

Mon, Jan 5 2015The 2015 Ford Mustang with the 2.3-liter EcoBoost four-cylinder is a pretty potent package on paper. With 310 horsepower and 320 pound-feet of torque, it boasts better performance numbers than the 3.7-liter V6, but with better fuel economy as an added benefit. However, if you're in the market for one of these boosted 'Stangs, you should probably keep in mind that it really prefers to gulp premium, 93-octane fuel. It can drink 87-octane swill in a pinch, but you're going to find significantly less power underfoot when pulling away. While it's not shocking that the ponies are dialed back with a lower grade of gasoline, an alleged page from a Ford training manual obtained by Mustang 6G purports to show just how much power is lost, though. According to this document, the 2.3-liter EcoBoost makes 275 horsepower and 300 pound-feet of torque when running on lower octane fuel. That's a substantial reduction of about 11.3 percent compared to when the engine drinks 93 octane. Interestingly, according to Mustang 6G, that finding was a bit better than expected, because a Ford engineer reportedly said power would be down about 13 percent without altering peak torque. In speaking with Autoblog, Paul Seredynski of Ford powertrain communications, objected to part of this document. While he couldn't confirm the specific losses listed for the Mustang EcoBoost, "torque remains unchanged" with lower octane gasoline, Seredynski said. He speculated this training manual page was "possibly from before the engine was certified" and therefore showed incorrect figures. Serendynski did confirm that the automaker recommends using 93 octane, and like all modern engines, the software adapts if it's lower. "Peak power would be reduced" by using a lesser grade, he confirmed. Featured Gallery 2015 Ford Mustang EcoBoost: First Ride View 20 Photos News Source: Mustang 6GImage Credit: Copyright 2015 AOL, Ford, Mustang 6G Ford Technology Convertible Coupe Performance ecoboost ford mustang ecoboost

More evidence GT500-replacement will be named GT350

Tue, 17 Dec 2013During the recent unveiling of the 2015 Ford Mustang, we saw the car in both V6 and GT form, but we'll have to wait a little bit longer to see the successor to the Shelby GT500. In the meantime, though, it looks like SVTPerformance.com has confirmed reports that this high-performance model will bring the Shelby GT350 name back to Ford.

According to the forum post, a user found the Shelby GT350 name on a Ford promo website listing its 2015 lineup. The Shelby GT350 name was first used on a Mustang back in 1965, and most recently it has been a model created for customers as a post-title purchase by Shelby American. As for that car, Shelby confirmed earlier in the year that its GT350 would be phased out at the end of this month.

The million-dollar question for Mustang and Shelby enthusiasts is when we'll see next factory Shelby GT350. Last we heard it was planned for a debut at the New York Auto Show. We've included our previous spy shots of this hi-po, sixth-gen Mustang, and we've also captured it on spy video showing off its exhaust note.