2003 Ford Crown Victoria Ex Police Car Interceptor Package Govt. Surplus-va. on 2040-cars

Manassas, Virginia, United States

Body Type:Sedan

Vehicle Title:Clear

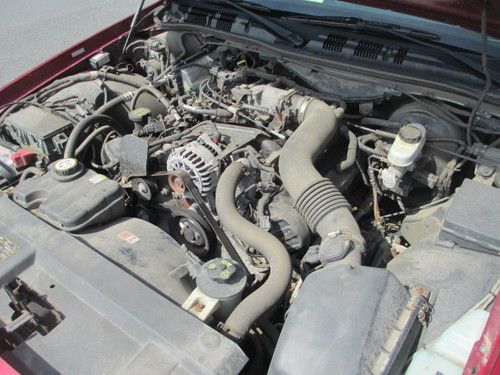

Engine:4.6L 281Cu. In. V8 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Ford

Model: Crown Victoria

Trim: Police Interceptor

Drive Type: RWD

Mileage: 122,274

Disability Equipped: No

Exterior Color: Red

Warranty: Vehicle does NOT have an existing warranty

Ford Crown Victoria for Sale

2003 ford crown victoria ex police car interceptor package govt. surplus-va.

2003 ford crown victoria ex police car interceptor package govt. surplus-va. 1999 ford crown victoria ex police car interceptor package govt. surplus-va.

1999 ford crown victoria ex police car interceptor package govt. surplus-va. 2008 ford crown victoria ex police car interceptor package govt. surplus-va.

2008 ford crown victoria ex police car interceptor package govt. surplus-va. 2008 ford crown victoria ex police car interceptor package govt. surplus-va.

2008 ford crown victoria ex police car interceptor package govt. surplus-va. 2005 ford crown victoria ex police car interceptor package govt. surplus-va.

2005 ford crown victoria ex police car interceptor package govt. surplus-va. 2006 ford crown victoria police interceptor

2006 ford crown victoria police interceptor

Auto Services in Virginia

Unique Auto Sales ★★★★★

Tony`s Auto Body Shop ★★★★★

The Tire Shop ★★★★★

TC Mobile Detailing ★★★★★

Snow`s Auto Repair ★★★★★

Sherwood Hills Automotive ★★★★★

Auto blog

Petersen Museum celebrates 50 years of Ford Mustang with special exhibit

Mon, May 5 2014If you're a pony-car enthusiast, this is your year. Not only has Ford introduced an all-new Mustang, but it's also the 50th anniversary of the original. Celebrations and commemorations have been scheduled throughout the year, and not the least of them is the latest exhibit at the Petersen Automotive Museum in Los Angeles. Called "Mustangs Forever: 50 Years of a Legend", the exhibit includes Mustangs from every generation of the iconic pony car, including the 1965 convertible Ronald Reagan drove during his California gubernatorial campaign, a 1971 Mach 1 Cobra Jet, a 1974 Mustang II, 1993 SVT Cobra, 2000 Cobra R and a 2006 Shelby GT-H. Special sections focus on motorsports, aftermarket modifiers and limited-edition models. The display opened on Sunday with the Mustang Madness spectacular and will run for the next six months, but if you're not heading to Southern California within the coming half-year then you can scope out all the action in our live gallery of photos above.

2022 Ford Maverick and GMC Hummer EV driven | Autoblog Podcast #699

Fri, Oct 8 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Autoblog Green, John Beltz Snyder. John is fresh off the 2022 Ford Maverick first drive, and Greg got behind the wheel of the GMC Hummer EV at GM's Milford Proving Grounds. John also just spent a week living the fast life in the Audi RS E-Tron GT. They muse about thee Lamborghini Countach, both old and new, particularly a reboot of the 1971 Lamborghini Countach LP prototype 500. Finally, they reach into the mailbag to help a listener decide whether or not to replace a 2002 Mercedes-Benz E 320 wagon with an all-wheel drive electric crossover. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #699 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving:2022 Ford Maverick 2022 GMC Hummer EV 2022 Audi RS E-Tron GT 1971 Lamborghini Countach LP prototype 500 lives again Spend My Money: Keep a 2002 E 320 Wagon or buy a new AWD EV? Full Transcript Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video: 2022 GMC Hummer EV Edition 1 first drive

Ford, Stellantis workers join those at GM in ratifying contract that ended UAW strikes

Mon, Nov 20 2023DETROIT — The United Auto Workers union overwhelmingly ratified new contracts with Ford and Stellantis, that along with a similar deal with General Motors will raise pay across the industry, force automakers to absorb higher costs and help reshape the auto business as it shifts away from gasoline-fueled vehicles. Workers at Stellantis, the maker of Jeep, Dodge and Ram vehicles, voted 68.8% in favor of the deal. Their approval brought to a close a contentious labor dispute that included name-calling and a series of punishing strikes that imposed high costs on the companies and led to significant gains in pay and benefits for UAW workers. The deal at Stellantis passed by a roughly 10,000 vote margin, with ballot counts ending Saturday afternoon. Workers at Ford voted 69.3% in favor of the pact, which passed with nearly a 15,000-vote margin in balloting that ended early Saturday. Earlier this week, GM workers narrowly approved a similar contract. The agreements, which run through April 2028, will end contentious talks that began last summer and led to six-week-long strikes at all three automakers. Shawn Fain, the pugnacious new UAW leader, had branded the companies enemies of the UAW who were led by overpaid CEOs, declaring the days of union cooperation with the automakers were over. After summerlong negotiations failed to produce a deal, Fain kicked off strikes on Sept. 15 at one assembly plant at each company. The union later extended the strike to parts warehouses and other factories to try to intensify pressure on the automakers until tentative agreements were reached late in October. The new contract agreements were widely seen as a victory for the UAW. The companies agreed to dramatically raise pay for top-scale assembly plant workers, with increases and cost-of-living adjustments that would translate into 33% wage gains. Top assembly plant workers are to receive immediate 11% raises and will earn roughly $42 an hour when the contracts expire in April of 2028. Under the agreements, the automakers also ended many of the multiple tiers of wages they had used to pay different workers. They also agreed in principle to bring new electric-vehicle battery plants into the national union contract. This provision will give the UAW an opportunity to unionize the EV battery plants plants, which will represent a rising share of industry jobs in the years ahead.