2018 Fiat 500 Pop Hatchback 2d on 2040-cars

Houston, Texas, United States

Engine:4-Cyl, MultiAir, Turbo, 1.4 Liter

Fuel Type:Gasoline

Body Type:Hatchback

Transmission:Automatic

For Sale By:Dealer

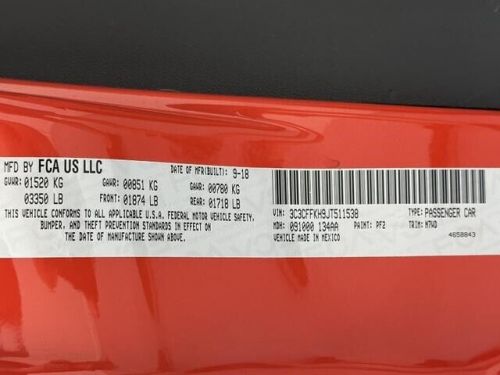

VIN (Vehicle Identification Number): 3C3CFFKH9JT511538

Mileage: 55508

Make: Fiat

Trim: Pop Hatchback 2D

Features: --

Power Options: --

Exterior Color: Orange

Interior Color: Tan

Warranty: Unspecified

Model: 500

Fiat 500 for Sale

2018 fiat 500 pop(US $13,992.00)

2018 fiat 500 pop(US $13,992.00) 2012 fiat 500 pop(US $7,000.00)

2012 fiat 500 pop(US $7,000.00) 2013 fiat 500 lounge(US $9,500.00)

2013 fiat 500 lounge(US $9,500.00) 2015 fiat 500 sport(US $7,442.00)

2015 fiat 500 sport(US $7,442.00) 2015 fiat 500 pop hatchback(US $3,950.00)

2015 fiat 500 pop hatchback(US $3,950.00) 2015 fiat 500(US $14,485.00)

2015 fiat 500(US $14,485.00)

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

North America profit helps Fiat Chrysler limit its losses from coronavirus

Fri, Jul 31 2020MILAN — Italian-American automaker Fiat Chrysler Automobiles (FCA) posted a smaller-than-expected operating loss in the second quarter, as a small profit in North America helped to limit the damage wrought by the COVID-19 pandemic. FCA said on Friday it had an adjusted loss before interest and tax of 928 million euros ($1.1 billion) in April-June, versus a forecast 1.87 billion euro ($2.2 billion) loss in an analyst poll compiled by Reuters. The group also said it made adjusted earnings before interest and tax of 39 million euros ($46.2 million) in North America, the home market of its Jeep and Ram brands, in the quarter. Milan-listed FCA shares were up 1.2% at 1125 GMT, after being little changed before the results. Chief Executive Mike Manley said the group's plants were up and running and car dealers were selling in showrooms and online, following disruptions caused by the pandemic. "We have the flexibility and financial strength to push ahead with our plans," he said in a statement. FCA, which is set to tie-up with Peugeot maker PSA to create Stellantis, the world's fourth largest carmaker, said on ongoing probe launched by European Commission competition authorities was not expected to delay the merger timetable. Despite the pandemic, PSA earlier this week delivered a profit in the first half of the year and stuck to its medium-term margin goal. FCA said its industrial free cash flow was minus 4.9 billion euros in the second quarter, with a slightly lower cash burn compared with January-March. Â

Major automakers urge Trump not to freeze fuel economy targets

Mon, May 7 2018WASHINGTON — Major automakers are telling the Trump administration they want to reach an agreement with California to avoid a legal battle over fuel efficiency standards, and they support continued increases in mileage standards through 2025. "We support standards that increase year over year that also are consistent with marketplace realities," Mitch Bainwol, chief executive of the Alliance of Automobile Manufacturers, a trade group representing major automakers, will tell a U.S. House of Representatives panel on Tuesday, according to written testimony released on Monday. The Trump administration is weighing how to revise fuel economy standards through at least the 2025 model year, and one option is to propose freezing the standards through 2026, effectively allowing automakers to delay investments in technology to cut greenhouse gas emissions from burning petroleum. The National Highway Traffic Safety Administration has not formally submitted its joint proposal with the Environmental Protection Agency to the White House Office of Management and Budget for review. Even so, last week, California and 16 other states sued to challenge the Trump administration's decision to revise U.S. vehicle rules. Auto industry executives have held meetings with the Trump administration for months and have urged the administration to try to reach a deal with California even as they support slowing the pace of reduction in carbon dioxide emissions that the Obama administration rules outlined. One automaker official said part of the message to President Donald Trump at a meeting on Friday will be to consider California like a foreign trade deal that needs to be renegotiated. Automakers want to urge him to get automakers a "better deal" — as opposed to potentially years of litigation between major states and federal regulators. On Friday, Trump is set to meet with the chief executives of General Motors, Ford, Fiat Chrysler and the top U.S. executives of at least five other major automakers, including Toyota, Volkswagen AG and Daimler AG, to talk about revisions to the vehicle rules. Senior EPA and Transportation Department officials will also attend. Environmental groups are eager to keep the rules in place, saying they will save consumers billions in fuel costs. A coalition of groups plans to stage a protest outside Ford's headquarters in Michigan.

Stellantis to introduce hybrid versions of Fiat 500e EV, Jeep Compass

Tue, May 28 2024 MILAN — Fiat owner Stellantis said on Monday it would build a hybrid version of its 500e small electric car at its Mirafiori plant in Turin, Italy, amid a slowdown in electric car sales. The announcement came after Stellantis CEO Carlos Tavares met in Turin with union representatives who had long been asking the company to boost production at Fiat's historic home with a new high-volume, cheaper model. The factory currently produces the 500e model, but a global slowdown in sales of fully electric vehicles has pushed Stellantis to significantly slow production rates, introducing protracted furlough periods for the plant's workers. "Carlos Tavares recalled the importance of offering affordable and high-quality cars for Italian customers," Stellantis said in a statement. It added that developing affordable cars also depended on external factors including lower energy costs, the development of a charging network for electric vehicles, and long-term subsidies for auto purchases. The move might help the automaker improve its relations with the Italian government, which has often criticized the group for its falling output in the country and for making some of its Fiat and Alfa Romeo models abroad. Stellantis — Italy's only major automaker — and the Rome government are in talks over a plan aimed at restoring the group's production in the country to 1 million vehicles by the end of this decade from around 750,000 last year. "The shared ambition with the Italian government to reach 1 million vehicles produced in Italy by 2030, will need a supportive business environment, currently impacted by electrification uncertainties and strong competition with new entrants to the market," the automaker said. FIM-Cisl union leader Ferdinando Uliano, who attended the meeting with Tavares, said Stellantis told him and others that production of the hybrid 500e would start in the first quarter of 2026 but did not give details about targeted output figures. Automotive News Europe, which first reported the hybrid 500 production earlier on Monday, said Stellantis was aiming for total annual output of 200,000 500s, including 125,000 hybrids, compared with fewer than 80,000 last year. The Franco-Italian carmaker also said it would build a hybrid version of the Jeep Compass SUV at the Melfi plant in southern Italy, and that production of the hybrid Fiat Panda city car made in Pomigliano near Naples could be extended.