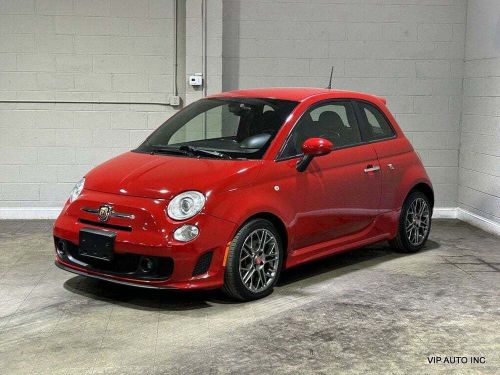

2016 Fiat 500 2dr Hatchback Abarth on 2040-cars

Fredericksburg, Virginia, United States

Engine:1.4L 4 CYLINDER

Fuel Type:Gasoline

Body Type:Coupe

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 3C3CFFFH1GT165455

Mileage: 36769

Make: Fiat

Trim: 2dr Hatchback Abarth

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Model: 500

Fiat 500 for Sale

2017 fiat 500 abarth(US $15,999.00)

2017 fiat 500 abarth(US $15,999.00) 2012 fiat 500 pop(US $9,859.00)

2012 fiat 500 pop(US $9,859.00) 2012 fiat 500 pop(US $6,000.00)

2012 fiat 500 pop(US $6,000.00) 2016 fiat 500 pop(US $500.00)

2016 fiat 500 pop(US $500.00) 2014 fiat 500 pop hatchback(US $6,950.00)

2014 fiat 500 pop hatchback(US $6,950.00) 2015 fiat 500 coupe 1957-edition(retro package)(US $8,750.00)

2015 fiat 500 coupe 1957-edition(retro package)(US $8,750.00)

Auto Services in Virginia

Z Auto Body ★★★★★

Wooddale Automotive Specialist ★★★★★

White Tire Distributors ★★★★★

Vega MotorSport Window Tinting & Detailing ★★★★★

Tysinger Motor Co., Inc. ★★★★★

The Body Works of VA INC ★★★★★

Auto blog

Ferrari stock sale pegged for October, or later

Sat, Jun 6 2015The Ferrari IPO is still coming, but it won't be before Columbus Day (Monday, October 12, that is), according to Fiat Chrysler Automobiles CEO Sergio Marchionne. The outspoken exec is blaming tax reasons for the fourth-quarter date, according to a report from Reuters. Marchionne said a full year needed to pass between FCA's October 13, 2014 Wall Street debut and any additional listing. This isn't the first delay in the Ferrari IPO. FCA was originally supposed to make a 10-percent offering of Ferrari during second or third quarter of 2015, before officially pushing things back to the third quarter of this year. Now, it's unclear if Ferrari will even go public before the dawn of 2016. Related Video: News Source: ReutersImage Credit: Marco Vasini / AP Earnings/Financials Government/Legal Chrysler Ferrari Fiat Sergio Marchionne FCA fiat chrysler automobiles

Fiat Chrysler's dealers and mechanics to reopen on Monday in Italy

Thu, Apr 30 2020MILAN — Fiat Chrysler said on Thursday its Italian network of approved dealers and mechanic workshops would reopen on May 4, when the country is set to start lifting a national lockdown put in place to limit the spread of the coronavirus. A package of health and safety measures for workers and clients will be put in place across the entire network to comply with the rules set by Rome to prepare for a staged restart of economic activities after weeks of national lockdown triggered by the virus outbreak. A vast majority of FCA's dealers and workshops in Italy are run by private operators, while the automaker directly operates some large ones in big cities. FCA this week resumed van production at its Atessa plant in central Italy and some operations in other Italian plants, including preparatory works at its Melfi facility for the final development of Jeep's new hybrid cars, and at Turin's Mirafiori plant for its new electric 500 small car. Related Video:

FCA withdraws its offer to merge with Renault

Thu, Jun 6 2019UPDATE: Fiat Chrysler Automobiles released a statement confirming that it has withdrawn its merger offer, saying "it has become clear that the political conditions in France do not currently exist for such a combination to proceed successfully." The full statement can be read below our original story, which continues below. Fiat Chrysler has withdrawn its $35 billion merger offer for Renault, the Wall Street Journal and Bloomberg News reported on Wednesday. A source said that FCA had informed Renault it had withdrawn the offer after Renault's board of directors failed to reach a decision on the merger during a meeting that ran late into the night Wednesday. Instead, the board granted the French government's request to postpone its vote. The government wanted time to persuade Renault's reticent alliance partner Nissan. Renault's board issued a press release that said simply that it was "unable to take a decision due to the request expressed by the representatives of the French State to postpone the vote to a later Council." WSJ reported that Nissan's two members on Renault's board were balking, while the rest of the board favored the merger. The French government wouldn't it back the deal unless Nissan agreed to maintain its role in the Renault-Nissan alliance, sources said. Nissan had received little advance warning of the merger proposal and was balking. Apparently the French government thought Nissan could be brought around if given more time. "We should take our time to make sure that things are done well," French Finance Minister Bruno Le Maire told French television on Wednesday. When the French requested a delay and Renault's board granted it, FCA withdrew. The French state, which owns 15% of Renault, had also been seeking more influence over the merged company, firmer job guarantees and improved terms for Renault shareholders in return for blessing the $35 billion tie-up. The merger would have created the world's third-biggest automaker with combined sales of 8.7 million vehicles per year, and was intended to cut costs as the parties develop electric and autonomous vehicles. Read Fiat Chrysler Automobile's full statement below: FCA withdraws merger proposal to Groupe Renault June 5, 2019 , London - IMPORTANT NOTICE The Board of Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA), meeting this evening under the Chairmanship of John Elkann, has resolved to withdraw with immediate effect its merger proposal made to Groupe Renault.