2014 Fiat 500 Pop on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

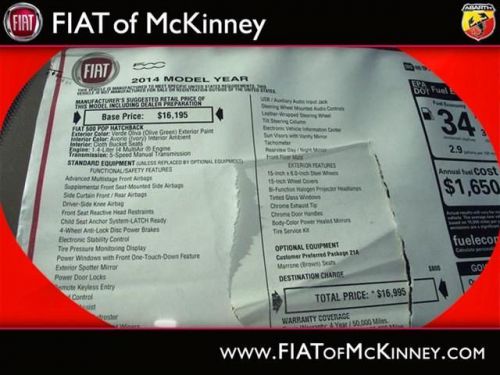

Engine:1.4L I4 16V MPFI SOHC

VIN (Vehicle Identification Number): 3C3CFFAR3ET172226

Stock Num: 14F119

Make: Fiat

Model: 500 Pop

Year: 2014

Exterior Color: Green

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 12

A real head turner!!! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $1,500!! Priced below MSRP!!! The price is the only thing that's been discounted on this impressive Vehicle.. A real head turner!!! Yes, I am as good as I look** Safety equipment includes: ABS, Traction control, Curtain airbags, Passenger Airbag, Daytime running lights...Comes equipped with all the standard amenities for your driving pleasure: wireless phone connectivity - BLUE&ME, Power locks, Power windows, Air conditioning, Cruise control...

Fiat 500 for Sale

2014 fiat 500 pop(US $18,795.00)

2014 fiat 500 pop(US $18,795.00) 2014 fiat 500 pop(US $18,895.00)

2014 fiat 500 pop(US $18,895.00) 2013 fiat 500 abarth(US $18,999.00)

2013 fiat 500 abarth(US $18,999.00) 2014 fiat 500 pop(US $19,202.00)

2014 fiat 500 pop(US $19,202.00) 2014 fiat 500c lounge(US $22,567.00)

2014 fiat 500c lounge(US $22,567.00) 2014 fiat 500l trekking(US $23,545.00)

2014 fiat 500l trekking(US $23,545.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

U.S. automakers unite in opposition to possible Trump vehicle tariffs

Mon, Feb 18 2019WASHINGTON — The U.S. auto industry urged President Donald Trump's administration on Monday not to saddle imported cars and auto parts with steep tariffs, after the U.S. Commerce Department sent a confidential report to the White House late on Sunday with its recommendations for how to proceed. Some trade organizations also blasted the Commerce Department for keeping the details of its "Section 232" national security report shrouded in secrecy, which will make it much harder for the industry to react during the next 90 days Trump will have to review it. "Secrecy around the report only increases the uncertainty and concern across the industry created by the threat of tariffs," the Motor and Equipment Manufacturers Association said in a statement, adding that it was "alarmed and dismayed." "It is critical that our industry have the opportunity to review the recommendations and advise the White House on how proposed tariffs, if they are recommended, will put jobs at risk, impact consumers, and trigger a reduction in U.S. investments that could set us back decades." Representatives from the White House and the Commerce Department could not immediately be reached. The industry has warned that possible tariffs of up to 25 percent on millions of imported cars and parts would add thousands of dollars to vehicle costs and potentially devastate the U.S economy by slashing jobs. Administration officials have said tariff threats on autos are a way to win concessions from Japan and the EU. Last year, Trump agreed not to impose tariffs as long as talks with the two trading partners were proceeding in a productive manner. "We believe the imposition of higher import tariffs on automotive products under Section 232 and the likely retaliatory tariffs against U.S. auto exports would undermine - and not help - the economic and employment contributions that FCA, US, Ford Motor Company and General Motors make to the U.S. economy," said former Missouri Governor Matt Blunt, the president of the American Automotive Policy Council. Some Republican lawmakers have also said they share the industry's concerns. In a statement issued on Monday, Republican Congresswoman Jackie Walorski said she fears the Commerce Department's report could "set the stage for costly tariffs on cars and auto parts." "President Trump is right to seek a level playing field for American businesses and workers, but the best way to do that is with a scalpel, not an axe," she added.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Fiat Chrysler Automobiles targets mid-October IPO

Thu, 04 Sep 2014The merged Fiat Chrysler Automobiles is targeting October 13 to launch its initial public offering on the New York Stock Exchange, CEO Sergio Marchionne told reporters assembled for a meeting in Rimini, Italy.

"The most likely date for the listing in the US is October 13," Marchionne said, according to Reuters.

Marchionne is trusting that the money made in the IPO will be contribute heavily his ambitious, $64-billion five-year growth plan, which will see FCA reboot Alfa Romeo and Maserati and expand Jeep's global presence. Should the IPO fall short, though, Marchionne has confirmed that "all decision [sic] on any capital increase will be taken by the board of FCA at the end of October."