2013 Fiat 500t Sport Hatchback Turbo on 2040-cars

Tomball, Texas, United States

|

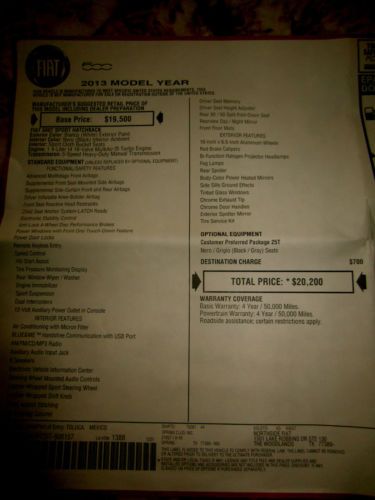

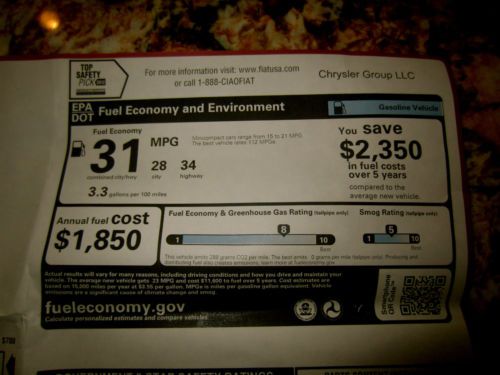

I am the original owner of this 2013 Fiat 500T Sport, very exciting car to drive. lots of airbags and tech features. Clean Carfax and under 2000 Miles. Manual transmission with sport button to give you that extra zip. I am in Texas and shipping must be paid by the buyer but I will help arrange the pickup. Thank you for your time and good luck.

|

Fiat 500 for Sale

2012 - fiat 500c pop cabrio - 6600 miles - blue convertible great condition 500(US $15,750.00)

2012 - fiat 500c pop cabrio - 6600 miles - blue convertible great condition 500(US $15,750.00) 2012 fiat 500 lounge w/ leather 27k 1 owner, moonroof, lifetime warranty

2012 fiat 500 lounge w/ leather 27k 1 owner, moonroof, lifetime warranty Pop 1.4l cd front wheel drive power steering abs 4-wheel disc brakes mp3 player

Pop 1.4l cd front wheel drive power steering abs 4-wheel disc brakes mp3 player 1952 fiat 500 c topolino, convertible(US $24,950.00)

1952 fiat 500 c topolino, convertible(US $24,950.00) Over 30 new 2013 abarth hatchbacks & cabrios in stock - all at $4,000 off msrp!!(US $22,700.00)

Over 30 new 2013 abarth hatchbacks & cabrios in stock - all at $4,000 off msrp!!(US $22,700.00) Over 30 new 2013 abarth hatchbacks & cabrios in stock - all at $4,000 off msrp!!(US $18,700.00)

Over 30 new 2013 abarth hatchbacks & cabrios in stock - all at $4,000 off msrp!!(US $18,700.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Weekly Recap: Marchionne's Manifesto again calls for industry consolidation

Sat, May 2 2015Sergio Marchionne isn't taking no for an answer. Despite public rebuffs from General Motors and Ford, the leader of Fiat Chrysler Automobiles continues to push for consolidation within the auto industry. His latest assertion came Wednesday when he said a combination of FCA with another automaker could net savings of $5 billion or more annually. No, this isn't about selling his company, he claimed, it's about cutting costs. Put simply, the auto industry wastes money, Marchionne said during FCA's earnings conference call. Companies invest billions to develop basic components that all cars use, but many consumers don't care how they work or recognize the differences. "About half of this is really relevant in terms of positioning the car in the marketplace," he said. "The other half, in our view, is stuff which is neither visible to the consumer nor is it relevant to the consumer." In 2014, top automakers spent more than $100 million on product development, FCA estimated. Marchionne said consolidation could save up to $1 billion on powertrains alone, noting that almost every automaker offers four- and six-cylinder engines. Not everyone has to make their own, he contended. "The consumer could not give a flying leap whose engines we are using because they are irrelevant to the buying decision." That's pretty provocative for enthusiasts, but less so for average consumers. Still, there are major differences in power and efficiency ratings, even among similar engines. Skeptics could argue consolidation would also weaken competition and reduce choices for car buyers. Marchionne stressed his presentation, curiously entitled Confessions of a Capital Junkie, wouldn't require closing factories or dealerships. It's not his final "big deal" as CEO, intent to sell FCA, or a way to elevate his company up the automotive food chain. He claims he wants to fundamentally change the industry and its habit for burning cash. "The horrible part about this, and the thing that I find most offensive, is that the capital consumption rate is duplicative," he said. "It doesn't deliver real value to the consumer and it is in its purest form, economic waste." Other News & Notes Ford Profits dip in first quarter Ford profits fell $65 million to $924 million in the first quarter, hampered by slight dips in revenue and sales.

New Fiat Chrysler CEO picks management team to tackle industry in flux

Mon, Oct 1 2018MILAN/DETROIT — Fiat Chrysler's new boss unveiled his management team on Monday, seeking to revive the automaker in Europe, forge ahead in North America and keep the group in contention in the industry's race to develop self-driving and electric cars. Mike Manley took over in July after long-time chief Sergio Marchionne fell ill and later died after succumbing to complications from surgery. British-born Manley has since pledged to carry through a strategy Marchionne outlined in June to keep FCA "strong and independent." "The next five years will continue to be extremely challenging for our industry, with tougher regulations, intense competition and probably slower industry growth around the world," Manley said in a letter to employees on Monday. "Nevertheless, with a laser focus on execution and a continued flexibility that allows us to adjust as circumstances change ... we have a clear line of sight to achieving our five-year ambitions." Manley appointed Pietro Gorlier, thus far chief operating officer of FCA's components business, as FCA's next European chief to tackle a region where profitability is below that of peers, many workers are stuck in furloughs and various plants run at below capacity. The carmaker's previous European chief Alfredo Altavilla left after FCA appointed Manley as Marchionne's successor. As head of the components unit, Gorlier has also led Magneti Marelli, the parts unit that FCA may either spin off or sell. He will be succeeded at Magneti Marelli by the parts maker's lighting division head Ermanno Ferrari. Japan's Calsonic Kansei has been in talks with FCA about buying the unit, sources familiar with the matter have said, but no binding agreement has been reached and the deal could still fall apart. Choosing an Italian as head of Europe might soothe some fears in Italy that FCA could weaken its link to Fiat's roots. In his last strategy unveiled in June, Marchionne vowed to convert Italian plants to churn out Alfa Romeos, Jeeps and Maseratis instead of less profitable mass market vehicles to preserve jobs and boost margins. Europe will also become a big part of the company's electrification drive. FCA will copy in Europe what worked in the United States, where it retooled plants to build pricier SUVs and trucks in a move since emulated by bigger rivals Ford and GM. Manley also named new managers to succeed him at Jeep and RAM, the two brands which have been driving profits in recent years and remain at the core of growth plans.

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.