2017 Fiat 124 Spider Abarth on 2040-cars

Simsbury, Connecticut, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:1.4L Gas I4

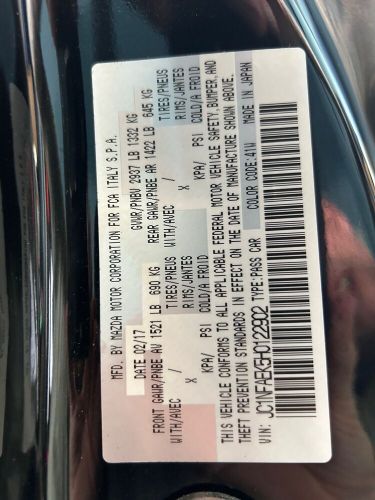

Year: 2017

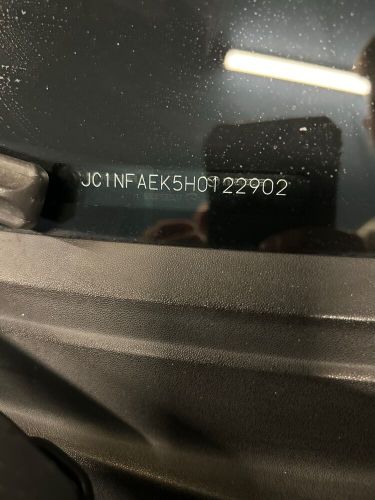

VIN (Vehicle Identification Number): JC1NFAEK5H0122902

Mileage: 38000

Trim: Abarth

Number of Cylinders: 4

Make: Fiat

Drive Type: RWD

Model: 124 Spider

Exterior Color: Black

Fiat 124 Spider for Sale

1979 fiat 124 spider(US $2,700.00)

1979 fiat 124 spider(US $2,700.00) 1978 fiat 124 spider(US $6,950.00)

1978 fiat 124 spider(US $6,950.00) 1982 fiat 124 spyder(US $17,995.00)

1982 fiat 124 spyder(US $17,995.00) 2017 fiat 124 spider lusso(US $18,899.00)

2017 fiat 124 spider lusso(US $18,899.00) 2017 fiat 124 spider lusso(US $18,000.00)

2017 fiat 124 spider lusso(US $18,000.00) 1979 fiat 124 spider(US $8,100.00)

1979 fiat 124 spider(US $8,100.00)

Auto Services in Connecticut

West Springfield Auto Parts ★★★★★

Monro Muffler Brake & Service ★★★★★

M K Auto Body Inc ★★★★★

Lia Volkswagen of Enfield ★★★★★

Jensen Tire & Automotive ★★★★★

Goodyear Tire & Service Network ★★★★★

Auto blog

Fiat Chrysler Automobiles targets mid-October IPO

Thu, 04 Sep 2014The merged Fiat Chrysler Automobiles is targeting October 13 to launch its initial public offering on the New York Stock Exchange, CEO Sergio Marchionne told reporters assembled for a meeting in Rimini, Italy.

"The most likely date for the listing in the US is October 13," Marchionne said, according to Reuters.

Marchionne is trusting that the money made in the IPO will be contribute heavily his ambitious, $64-billion five-year growth plan, which will see FCA reboot Alfa Romeo and Maserati and expand Jeep's global presence. Should the IPO fall short, though, Marchionne has confirmed that "all decision [sic] on any capital increase will be taken by the board of FCA at the end of October."

Fiat Chrysler to get $105M fine from NHTSA for recall woes

Sun, Jul 26 2015The National Highway Traffic Safety Administration is about to send a powerful message to automakers doing business in the United States, assuming reports of an upcoming $105 million fine against Fiat Chrysler Automobiles comes to fruition. In addition to the record-setting monetary fine, according to The Wall Street Journal, FCA will have to accept an independent auditor that will monitor the company's recall and safety processes and will be forced to buy back certain recalled vehicles. In other cases, such as with Jeep Grand Cherokee and Liberty models with gas tanks that could potentially catch fire in certain types of accidents, FCA will offer financial encouragement for owners to get their recall work done or to trade those older vehicles in on new cars, according to the report. FCA could reportedly reduce its fines if it meets certain conditions, though those remain unclear at this time. These actions against FCA are being taken after NHTSA began a probe into the automaker over almost two dozen separate instances where the government claims FCA failed to follow proper procedures for recalls and safety defects. Included in those safety lapses are more than 11 million vehicles currently in customer hands. These penalties and fines are separate from the investigation over security problems with Chrysler's Uconnect system that allowed hackers to obtain remote access into key vehicle systems in 1.4 million vehicles. Related Video: Image Credit: Marco Bertorello/AFP/Getty Earnings/Financials Government/Legal Recalls Chrysler Dodge Fiat Jeep RAM Safety fiat chrysler automobiles fine

Fiat contemplating sub-brand to compete with Dacia, Datsun

Tue, 05 Feb 2013You can add Fiat to the admittedly short list of automakers considering a low-cost brand to rival Dacia. The inexpensive Eastern European brand from Renault-Nissan has performed on the balance sheet like a premium model line, and the money the alliance is taking off the table is encouraging other players to deal themselves in. Pretty soon Nissan's Datsun sub-brand will join the Dacia party, going on sale in Russia, Indonesia and India and will claim even more rubles, rupiahs and rupees for the parent company. Volkswagen recently said it will make a decision this year on a budget line for the Chinese market. With the euthanasia of Lancia and plans to move the Fiat brand upmarket, company CEO Sergio Marchionne wonders aloud to Automotive News Europe whether there could be room for a new budget brand underneath Fiat.

We're told that the initiative has been in the idea box for five years and even moved to the stage of name considerations, like Innocenti, but worries about profit kept it from realization. If such a range were to be developed, Marchionne says it couldn't be built in Italy and stay within budget, and the company is "analyzing its manufacturing capacity outside of Europe to see if a low-cost brand is viable."