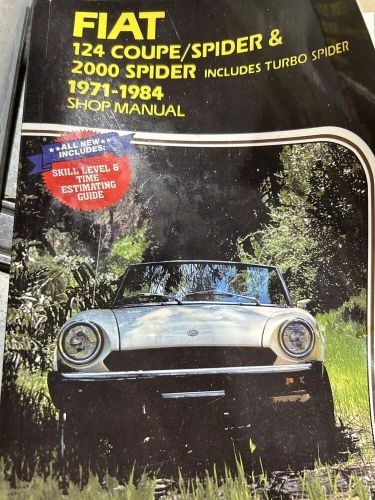

1983 Fiat 124 Spider on 2040-cars

Grants Pass, Oregon, United States

Body Type:Convertible

Transmission:Manual

Vehicle Title:Clean

Fuel Type:Gasoline

VIN (Vehicle Identification Number): ZFRAS00B8D5503157

Mileage: 30000

Number of Seats: 2

Model: 124 Spider

Exterior Color: Blue

Make: Fiat

Fiat 124 Spider for Sale

1981 fiat 124 spider(US $12,500.00)

1981 fiat 124 spider(US $12,500.00) 1976 fiat 124 spider spider(US $10,995.00)

1976 fiat 124 spider spider(US $10,995.00) 1979 fiat 124 spider(US $12,750.00)

1979 fiat 124 spider(US $12,750.00) 1978 fiat 124 spider(US $14,900.00)

1978 fiat 124 spider(US $14,900.00) 2017 fiat 124 spider abarth 2dr convertible(US $20,995.00)

2017 fiat 124 spider abarth 2dr convertible(US $20,995.00) 1978 fiat 124 spider(US $7,950.00)

1978 fiat 124 spider(US $7,950.00)

Auto Services in Oregon

Woodall`s Auto Repair & Towing ★★★★★

USA Auto Glass Repair ★★★★★

Truce Auto ★★★★★

Tom`s Import Service ★★★★★

Tigard Tire & Auto Service ★★★★★

The Auto Man ★★★★★

Auto blog

Automakers are getting nervous about Europe's economy

Sun, Nov 6 2022Carmakers BMW and Stellantis on Thursday expressed concerns about Europe's economic outlook, joining a chorus of retailers and others in warning of waning consumer confidence on the continent and hitting their shares. "Obviously the macro(-economic situation) in Europe is more challenging, which gives me pause, personally," Stellantis chief financial officer Richard Palmer said on a conference call with analysts. "If there was anywhere where I was more concerned, it would be Europe than anywhere else really based on the macro." This follows a dire assessment of consumer sentiment in Europe from the likes of consumer goods company Unilever and news of lower spending by Europeans from Amazon. Like other major auto companies, Stellantis and BMW have been hit by supply chain disruptions stemming from the global coronavirus pandemic that have curtailed car production. They have also benefited from strong consumer demand amid low vehicle supply, allowing them to raise prices and keep them high even as the semiconductor shortage shows signs of easing. BMW posted a 35.3% jump in third-quarter revenue despite a small drop in vehicle sales. Stellantis said its revenue rose 29% on the back of a 13% increase in vehicle sales as more semiconductors became available. The concern among analysts has been that demand may falter, just as carmakers get their hands on the supplies they need, undermining pricing and hurting profits. But this week Ferrari said it was confident about its prospects for this year and 2023 as demand for its luxury cars, as well its pricing power, remained strong. Both BMW and Stellantis said on Thursday they had vehicle order books that stretched into the second quarter of 2023. But BMW's chief financial officer Nicolas Peter said high inflation and rising interest rates could hit buyers' wallets. "This is causing conditions for consumers to deteriorate, which will affect their behaviour in the coming months," he said. "We therefore continue to expect our higher-than-average order books to normalise, especially in Europe." He added customers had been unhappy about the wait for new cars, so "a slight reduction (in orders) would not be negative." Palmer said Stellantis was "ready for any softness in demand" but in the short term had been affected by a shortage of drivers to deliver its cars to dealers. "At the moment, we can't build enough cars," he said.

Fiat celebrates 30 years of Panda 4x4 with Antartica edition [w/poll]

Wed, 04 Sep 2013Typically, 4x4s are rather large affairs, but the Fiat Panda stands resolutely against the trend. And what's more, it's done just that for 30 years now, over the course of which Fiat has rolled out three successive generations and sold over 400,000 examples of the little off-roader that could. So to celebrate three decades of the Panda 4x4, Fiat is rolling out this special edition.

Called the Fiat Panda 4x4 Antartica, it's set to debut next week at the Frankfurt Motor Show alongside a new Black Code trim for the Freemont (known to us as the Dodge Journey) and an anniversary edition Abarth 595. Fiat has based this special edition on the Panda 4x4 Rock and upgraded it with two-tone paint, 15-inch diamond-finish alloys, orange trim, fog lights, tinted glass and special badging. Inside, it's got gray and orange upholstery, and European buyers can order it up with either the 85-horsepower 900cc TwinAir engine or the 75hp 1.3-liter diesel.

A limited run will reach European showrooms by the end of the year. But we wonder... should Fiat consider bringing the Panda Stateside to share floor space with the diminutive 500? Have your say in our informal poll below, and feel free to read through the press release, too.

FCA worker in Indiana tests for coronavirus, but the plant will stay open

Thu, Mar 12 2020Fiat Chrysler Automobiles NV said Thursday that an employee has tested positive for COVID-19 at its Kokomo, Indiana, transmission plant, but the location will remain open. The Italian-American automaker said the company placed the employee and his immediate co-workers and others he may have come into direct contact with in home quarantine. The automaker said it is “deploying additional sanitization measures across the entire facility, re-timing break times to avoid crowding and deploying social spacing.” Fiat Chrysler is canceling all in-person meetings unless “business critical” and conducted meetings through video conferencing technologies. Automakers also have canceled non-essential travel. Ford, meanwhile, said its plants in North America remain unaffected. General Motors spokesman Jim Cain said the Detroit automaker has not had any cases of the coronavirus in its North American plants yet, citing such measures as reduced travel and restricted entry to plants as helping. How the No. 1 U.S. automaker would respond to a positive test would depend on the situation, he added. “You do plan to operate with a certain amount of absenteeism, but every facility has a different operating plan,” he said. The Fiat side of the FCA operation, meanwhile, is temporarily halting operations at some plants in Italy and will reduce production rates in response to coronavirus in the country, the largest outbreak in Europe, a spokesman for the automaker said on Wednesday. FCA said in a statement it had stepped up measures across its facilities, including intensive sanitation of all work and rest areas, to support the government's directives to curb the spread of the infectious disease. "As a result of taking these actions the company will, where necessary, make temporary closures of its plants across Italy," it said. The spokesman said affected plants were Pomigliano, Melfi, Atessa and Cassino, each of them halted for two or three days between Wednesday and Saturday. FCA said that to allow greater spacing of employees at their workstations, "daily production rates will be lowered to accommodate the adapted manufacturing processes." However, a source close to the matter said FCA did not expect an impact on overall production rates. The source added that temporary closures were in no way linked to disruptions of auto parts supplies following anti-virus measures imposed by Rome all over Italy.