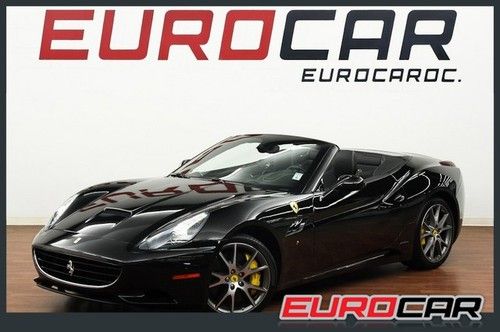

2012 Ferrari California 2dr Conv Low Mileage Convertible on 2040-cars

Plano, Texas, United States

Vehicle Title:Clear

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle has an existing warranty

Model: California

Trim: Base Convertible 2-Door

Options: Convertible

Power Options: Power Windows

Drive Type: RWD

Mileage: 1,143

Number of Doors: 2

Sub Model: 2dr Conv

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Ferrari California for Sale

2012 ferrari california 2dr conv low mileage convertible(US $234,900.00)

2012 ferrari california 2dr conv low mileage convertible(US $234,900.00) 2010 ferrari california 2dr conv low mileage convertible(US $195,000.00)

2010 ferrari california 2dr conv low mileage convertible(US $195,000.00) 2011 ferrari approved cpo california, blue pozzi/cuoio(US $169,700.00)

2011 ferrari approved cpo california, blue pozzi/cuoio(US $169,700.00) 2010 ferrari california(US $180,000.00)

2010 ferrari california(US $180,000.00) 2011 ferrari california best color combo!! like new!!

2011 ferrari california best color combo!! like new!! One owner california car low miles options navi ipod daytona scuderia shields(US $198,888.00)

One owner california car low miles options navi ipod daytona scuderia shields(US $198,888.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

Ferrari FXX-K Evo sprouts wings and looks ready to fly

Sun, Oct 29 2017The winged devil you see above is the Ferrari FXX-K Evo. All those protuberances are there for a reason – from the reshaped front fascia with its carbon fiber splitters to the twin-profile rear wing and fixed fins – and that's to produce downforce. Some of the most important aero bits are hidden where you can't see. Vortex generators affixed to the belly of the beast and a massive rear diffuser help suck the FXX-K Evo to the track. A path of air travels from the hood, over the canopy, and ultimately to the rear wing, all in an effort to optimize flow and increase high-speed stability. At 124 miles per hour, says Ferrari, the bits and baubles push toward the earth with 1,411 pounds of downforce. In addition to the aero tweaks, Ferrari made adjustments to the FXX-K's suspension, fitted it with a redesigned steering wheel, and installed a larger interior display. Owners of previous FXX-K models can opt to have these upgrades added to their cars, and a limited number of new Evos will be produced. These 1,050-horsepower hybrid gasoline-electric machines aren't meant for the street. Instead, Ferrari arranges a nine-race schedule for owners who wish to stretch the FXX-K's legs out on the track. And if you're lucky enough to own one, we certainly hope you find enough time to take part in the high-speed festivities. Related Video:

Kimi out, Bottas in at Ferrari?

Fri, Jun 26 2015Things have not gone well for Scuderia Ferrari driver Kimi Raikkonen since he returned to the team in 2014. After a pair of strong seasons for Lotus that saw him finish third and fifth, the Finn ended last season in 12th, 106 points behind his teammate, Spaniard Fernando Alonso. His 2015 fortunes have improved – he currently sits in fourth, only a spot behind teammate Sebastian Vettel – but he's been remarkably inconsistent, struggling with the SF15-T, a car that was specifically designed to work with his driving style. He only has a single podium this season, was forced to retire in Australia after a bad pitstop, and he crashed out of the most recent round in Austria. Clearly, Kimi should just stay away from races starting in "Austr." That advice may have come too late, though, as rumors are bubbling up that Ferrari may be swapping its Finns, dropping Raikkonen for his young countryman, Valtteri Bottas. Fox News, citing a report from Germany's Bild, claims Ferrari has made an offer to Bottas' current team, Williams, to secure his services. It doesn't sound like the British team will give him up all that easily, though. According to Fox, Williams enjoys a contractual "option" on the 25-year-old Finn's contract for next season, and that Ferrari would need to buy that contract out to steal him away. Bild claims the Italians have offered $4.4 million, but Williams' second-in-command, Claire Williams, wants nearly four times that. Ferrari has, rejected that figure, allegedly and unsurprisingly. Should the two sides come to a compromise, German and Sahara Force India driver Nico Hulkenberg seems to be the popular choice to take the open Williams seat, Fox is reporting. It's unclear where Raikkonen would end up next. And with that, we consider the 2015 Formula 1 silly season officially open.

Chief justice invokes 'Ferris Bueller' Ferrari in Supreme Court car case

Wed, Jan 10 2018WASHINGTON — U.S. Supreme Court justices on Tuesday wrestled with the scope of police authority to search vehicles without warrants, with Chief Justice John Roberts referencing the shiny red Ferrari taken for a joyride in the 1986 comedy film "Ferris Bueller's Day Off" to make a serious legal point. The justices heard arguments in two cases in which convicted defendants are seeking to have key evidence against them thrown out because it was obtained by police officers through vehicle searches conducted without a court-issued warrant. One case involved a stolen motorcycle that was covered by a tarpaulin and parked on private property next to a house in Charlottesville, Virginia. The other involved a rental car stopped by police in Pennsylvania — driven by a man who was not named on the agreement with the rental agency — in which heroin was found. At issue is whether police in the two cases violated the U.S. Constitution's Fourth Amendment, which protects against unreasonable searches and seizures. In the motorcycle case, Roberts and other justices seemed concerned about issuing a broad ruling in favor of law enforcement that would let police officers not just inspect the immediate area outside a property without a warrant but also potentially inside a house if a vehicle is located there. Under the Fourth Amendment, police need a warrant to search a house unless there is an emergency situation. In the case of convicted defendant Ryan Collins, the motorcycle was a few feet from the house. In "Ferris Bueller's Day Off" starring Matthew Broderick, three teenagers skip school and take a ride in a red 1963 Ferrari Modena Spyder California that was parked inside a showroom-type garage apparently attached to a house. After mentioning the film's car, Roberts asked Trevor Cox, the state of Virginia's lawyer who was defending the police search, whether he was arguing that police "can just go in" to a house without a warrant because a car is "mobile and they got it in there somehow (so) they can get it out." Roberts also mentioned comedian Jay Leno, known for storing a large collection of cars. Other justices voiced similar concerns, including Neil Gorsuch, who seemed troubled about police officers being able to search garages and other outbuildings without a warrant. "Not many people live in their garage. Some people do, some people do, and in barns, but usually they're reserved for cars and for animals.