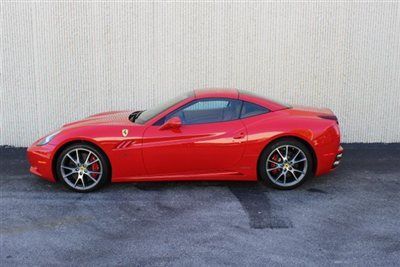

2010 Ferrari California Black Tan 5408 Miles Magneride 20 Camera Yellow Rev on 2040-cars

Rancho Mirage, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Make: Ferrari

Model: California

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 5,408

Number of Doors: 2

Sub Model: 2+2

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Tan

Ferrari California for Sale

2013 ferrari california spider - 2k miles - daytona scuderia navigation carbon(US $219,995.00)

2013 ferrari california spider - 2k miles - daytona scuderia navigation carbon(US $219,995.00) Ferrari california carbon fiber loaded call today.(US $158,888.00)

Ferrari california carbon fiber loaded call today.(US $158,888.00) 2011 ferrari california 7,800 miles novitec rosso wheels & options(US $180,000.00)

2011 ferrari california 7,800 miles novitec rosso wheels & options(US $180,000.00) 2013 ferrari california 500 miles ,salvage !!!!(US $129,500.00)

2013 ferrari california 500 miles ,salvage !!!!(US $129,500.00) 2010 ferrari(US $179,900.00)

2010 ferrari(US $179,900.00) 2010 ferrari california for $1399 a month with $34,000 down(US $169,000.00)

2010 ferrari california for $1399 a month with $34,000 down(US $169,000.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

Haas F1 secures engine deal with Ferrari

Fri, 05 Sep 2014Plans are coming together for Gene Haas to launch his US-based Formula One team in 2016. The tooling magnate and NASCAR team owner has renamed his grand prix racing outfit from Haas Formula to Haas F1, he's setting up shop in North Carolina with a satellite location to be announced somewhere in Europe, and now he's penned an engine supply deal with Ferrari.

The deal doesn't come as such a surprise after Haas signed on as a sponsor with the Maranello squad a couple of months ago, but confirms the reinforcement of the partnership between the two teams. "The multi-year agreement," according to Ferrari in the statement below, "is for the supply of the entire power unit starting from 2016," including the engine, hybrid assist and presumably the gearbox as well. But that's not the extent of the deal.

Billed as a "technical collaboration agreement," the deal opens the door for Haas and Ferrari to cooperate even more closely than the latter does with existing powertrain customers Sauber and Marussia. "We believe this new partnership has the potential to evolve beyond the technical role of supplying our power unit and all related technical services," said Scuderia Ferrari team principal Marco Mattiacci.

Ferrari vs. Ferrari: Cut convertibles unloved by collectors?

Mon, 05 Aug 2013The New York Times' Wheels blog has a really interesting story on a pair of Ferraris that are set to be auctioned off in Monterey during the Pebble Beach Concours d'Elegance. While the two cars are similar on the surface, their differing histories and Ferrari's attitude towards one of them has led to a sort of experimental auction process.

On the one hand, we have one of ten 1967 275 GTB/4 NART Spiders, in the classic Rosso Corsa and appearing at RM Auctions and seen above. On the other, we have a Fly Yellow version that started life as a 1965 275 GTB Coupe, and was converted into a NART Spider. Called a "cut" car, this particular replica is one of about 100 GTB Coupes that were converted into convertibles to satiate the climbing demand for ultra-rare Spiders.

This will mark one of the first times that an original NART Spider will go toe to toe with a replica of itself at auction, and will answer a number of questions about just how important provenance is in the collector car world. Head on over to The Times blog for the full story.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.