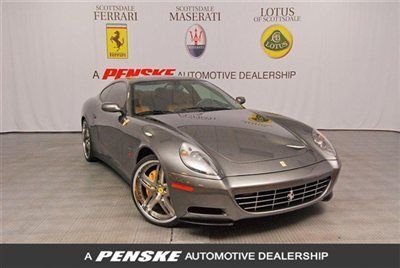

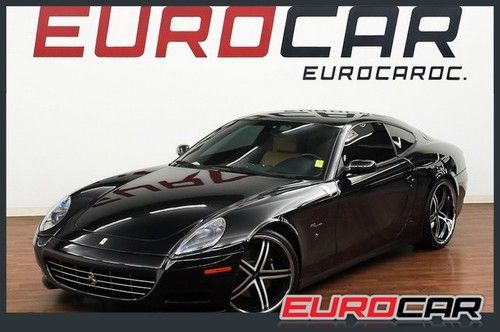

2008 Ferrari 612 Scaglietti Oto, Glass Roof, Hgt2 Package, Black/black, 1-owner! on 2040-cars

San Diego, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:5.7L 5750CC V12 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Make: Ferrari

Model: 612 Scaglietti

Trim: Base Coupe 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 18,783

Number of Doors: 2 Generic Unit (Plural)

Sub Model: OTO Glass Roof

Exterior Color: Black

Number of Cylinders: 12

Interior Color: Black

Ferrari 612 for Sale

2008 ferrari 612 scag~hgt2 pack~fresh major ser~carbon interior~like 2009 & 2007(US $142,500.00)

2008 ferrari 612 scag~hgt2 pack~fresh major ser~carbon interior~like 2009 & 2007(US $142,500.00) 2006 ferrari 612 scag~fresh clutch & major service~daytona's~htd seats~shields(US $114,500.00)

2006 ferrari 612 scag~fresh clutch & major service~daytona's~htd seats~shields(US $114,500.00) 2005 ferrari 612 scaglietti base coupe 2-door 5.7l(US $144,000.00)

2005 ferrari 612 scaglietti base coupe 2-door 5.7l(US $144,000.00) 2007 ferrari scaglietti 612 coupe 33k miles egear navi,bose,rear cam we finance(US $107,777.00)

2007 ferrari scaglietti 612 coupe 33k miles egear navi,bose,rear cam we finance(US $107,777.00) F1 gfg forged wheels scuderia shields daytona seats kenwood navi custom audio(US $99,888.00)

F1 gfg forged wheels scuderia shields daytona seats kenwood navi custom audio(US $99,888.00) Consignment sale service records spare key f1 yellow calipers(US $109,000.00)

Consignment sale service records spare key f1 yellow calipers(US $109,000.00)

Auto Services in California

Zenith Wire Wheel Co ★★★★★

Yucca Auto Body ★★★★★

World Famous 4x4 ★★★★★

Woody`s & Auto Body ★★★★★

Williams Auto Care Center ★★★★★

Wheels N Motion ★★★★★

Auto blog

Electro super star Deadmau5 selling kitty-themed Ferrari 458

Thu, 19 Jun 2014Are you a huge fan a electronic dance music, Internet memes, and in the market for a customized Ferrari? Then today is your lucky day. EDM star Deadmau5, real name Joel Zimmerman, is selling his Ferrari 458 Spider on Craigslist. He calls it the Purrari, and it features a full-body wrap of the eight-bit Nyan Cat, pink brake calipers, prancing cat logos, a Purrari emblem 6,500 miles on the odometer. It's currently located in Toronto, Canada, with an asking price of $380,000. Any amount offered over that is being donated to the Toronto Humane Society.

In addition to the car, the buyer gets an iPod full of "nyancat songs" and a meeting with Zimmerman to say goodbye to his Purrari over a cup of coffee. If you're not in the Toronto area, he is willing to ship the feline automobile anywhere in North America. Obviously, a blue, cat-themed Ferrari isn't to everyone's taste, so Zimmerman can remove the wrap at the buyer's request... though he won't be happy about it.

If you're curious why Zimmerman would sell such a personalized item, it appears a new supercar has his eye now. On May 28, he tweeted about driving a McLaren 650S and announced the Purrari would go up for sale soon. We can only imagine what theme his next ride gets.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

Ferrari posts record profits on restricted volume

Wed, 19 Feb 2014Most automakers are after one thing and one thing only: selling more cars. Because, after all, selling more cars means making more money. Right? Well that's usually the case, but Ferrari has taken a different approach. Rather than try and sell more cars, Ferrari intentionally sold fewer models in 2013, yet it made more money.

The move was implemented after 2012 emerged as the strongest year in the company's history. Instead of pushing to sell even more cars, it opted to maintain a level of exclusivity by selling fewer - 5.4 percent fewer than the year before, to be specific - thereby ensuring that those it did sell were worth more. As a result, in 2013, Ferrari logged record turnover, profits and finances: on 2.3-billion euros of revenue (up 5 percent from the previous year), Ferrari recorded 363.5 million euros in profit last year - that's roughly $500M USD.

Before you go jumping to conclusions, though, bear a few factors in mind. For one, Ferrari's stakeholders aren't pocketing all that cash - they're reinvesting it into the company: over the course of the same year, Ferrari invested some 337 million euros - 464 million dollars - in research and development. And while the company's extensive merchandizing efforts continue to bring in more cash, at 54 million euros ($74M) raised last year, the branding operation still doesn't account for a sixth of overall revenues. Still, it's little wonder that the experts at Brand Finance have named Ferrari the world's most powerful brand for the second year running.