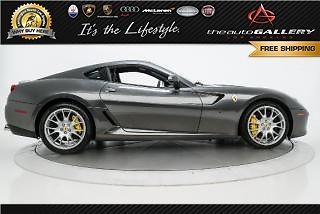

2008 Ferrari 599 Gtb. White Over Black. 8500 Miles. 350k Msrp. Carbon Fiber. on 2040-cars

La Jolla, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.0L 5999CC V12 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Year: 2008

Make: Ferrari

Warranty: Vehicle does NOT have an existing warranty

Model: 599 GTB

Trim: Fiorano Coupe 2-Door

Doors: 2

Drive Type: RWD

Engine Description: 6.0L V1 2 FI DOHC 48V

Mileage: 8,556

Number of Doors: 2

Sub Model: Fiorano

Exterior Color: White

Number of Cylinders: 12

Interior Color: Black

Ferrari 599 for Sale

2011 ferrari 599 gtb 60 f1 alonso final edition! rare!!(US $349,900.00)

2011 ferrari 599 gtb 60 f1 alonso final edition! rare!!(US $349,900.00) 2008 ferrari 599 gtb fiorano nero / loaded / recent service / amazing condition(US $169,999.00)

2008 ferrari 599 gtb fiorano nero / loaded / recent service / amazing condition(US $169,999.00) 2007 ferrari 599 gtb low mile (10k+) excellent inside & out showstopper tdf blue(US $169,500.00)

2007 ferrari 599 gtb low mile (10k+) excellent inside & out showstopper tdf blue(US $169,500.00) 2008 ferrari 599gtb "novitec upgrades" a must see....

2008 ferrari 599gtb "novitec upgrades" a must see.... Carbon fiber lower cabin zone- carbon fiber driving zone- carbon ceramic brakes(US $189,998.00)

Carbon fiber lower cabin zone- carbon fiber driving zone- carbon ceramic brakes(US $189,998.00) 2007 ferrari 599 gtb fiorano f1, sport buckets, carbon fiber stering wheel w/led(US $179,995.00)

2007 ferrari 599 gtb fiorano f1, sport buckets, carbon fiber stering wheel w/led(US $179,995.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

Ferrari, not Tesla, might be the stock to buy

Mon, May 8 2017Last week Tesla's earnings – or lack thereof – were one of the big stories in the auto industry. As usual, the electric carmaker didn't make money, but the news sent the market, analysts, and Tesla's devoted fans into a lather. But another company, this plucky upstart called Ferrari, also attracted a positive reaction from the market and actually had the financials to back it up. Ferrari posted net revenues of $898 million (at today's exchange rates) EBITDA of $265 million (a slightly complicated way to snapshot financial performance) and an adjusted net profit of $136 million in the first quarter. The company delivered 2,003 cars, and sales of its V12 models increased 50 percent. It quietly made progress nearly a year and a half into its life as an independent automaker. For 2017, Ferrari expects to deliver 8,400 cars and rake in net revenue of $3.6 billion. No one thought Ferrari would flounder when Fiat Chrysler Automobiles spun it off in fall 2015. With a rich history, expensive products, and its own loyal fan base that's arguably even larger than Tesla's, the company seemed poised for success, though skeptics wondered how it might fare after longtime chief Luca di Montezemolo stepped down before the spinoff. Plus, the company remains within the FCA sphere, as its key stakeholders are largely connected to its former parent in some way, and Chairman Sergio Marchionne also steers FCA. Last week's results showed Ferrari is gaining footing in the evolving automotive world, and analysts responded. UBS analyst Michael Binetti reiterated Ferrari stock (RACE on the NYSE) as buy status and raised his target price from $85 to $92. Morgan Stanley's Adam Jonas was even more bullish, raising projections to $100 in the next 12 months. Shares were trading around $82 Monday morning. Both analysts viewed Ferrari as something different than a conventional automaker stock, with Binetti comparing it to luxury house Hermes, which produces high margins even for a specialty goods maker. Jonas suggested Ferrari's singular reputation and history (16 Formula One Constructors titles, the most ever) could insulate its products when autonomous and electric cars become even more commonplace. "In our view, a Ferrari is not transportation," he wrote in a note to clients. "Ownership is viewed as an exclusive club, and membership requires more than just money.

Stellantis says its 2021 performance has been better than expected

Thu, Jul 8 2021MILAN — Stellantis softened up investors ahead of its electrification strategy event on Thursday by flagging that 2021 got off to a better-than-expected start despite a chip shortage that has hit automakers worldwide. Stellantis, which was formed in January from the merger of Italian-American automaker Fiat Chrysler and France's PSA, faces an investor community keen to hear how it plans to come up with a range of electrified vehicles (EVs) to rival Tesla. At its "EV Day 2021" kicking off at 1230 GMT, Stellantis will disclose significant investments in electrification technology and connected software as it aims to be an industry frontrunner, it said in a statement. In April, Chief Executive Carlos Tavares said it would offer low-emission versions — either battery or hybrid electric — of almost all of its European models by 2025, and they should make up 70% of European sales and 35% of U.S. sales by 2030. Stellantis, the world's fourth-biggest automaker, has 14 brands in its stable, including Jeep, Ram, Opel, Fiat, Peugeot and Maserati.  Stellantis EV Day coverage: Dodge will launch the 'world's first electric muscle car' in 2024 Fully electric Ram 1500 will begin production in 2024 Jeep will have 4xe plug-in hybrid models across the lineup by 2025 Stellantis teases mystery electric Chrysler concept Stellantis previews 4 electric platforms: Here's how they'll be used Fiat says all Abarth models to be electric from 2024 Opel Manta E will be the electric revival of the classic German coupe Stellantis says its 2021 performance has been better than expected  At a similar EV strategy event last week, French rival Renault announced that 90% of its main brand models would be all-electric by 2030, whereas previously it had included hybrids in its target. Germany's Volkswagen, the world's second-biggest automaker after Toyota, expects all-electric vehicles to make up 55% of its total sales in Europe by 2030, and more than 70% of sales at its Volkswagen brand. Stellantis said its margins on adjusted operating profits in the first half of 2021 were expected to exceed an annual target of between 5.5% and 7.5%, despite production losses due to a global shortage of semiconductor supplies. Stellantis shares listed in Milan were down 2.6% at 0920 GMT, underperforming the broader European car index. Bestinver analyst Marco Opipari said Thursday's news was positive but that the stock was suffering from profit taking as it had moved up about 20% since the end of April.

Ferrari rated world's most powerful brand ahead of Apple

Fri, 22 Feb 2013Ferrari has nabbed the honor of becoming the world's most powerful brand from Apple. According to Brand Finance, the Italian automaker earned the highest rating among all brands on the Global 500 list despite being worth considerably less than its competition. But the ranking takes into account more than just a company's bottom line. Brand Finance also looks at margins, average revenue per customer and less tangible notions like brand affection and loyalty.

There's no disputing those latter two categories, and this year saw Ferrari enjoy the best financial results in the automaker's history. In 2012, the company's revenue jumped by eight percent to 2.43 billion euro thanks in part to a 4.5 percent increase in deliveries worldwide.

Meanwhile, Apple squeaked out ahead of Samsung to earn the top spot as the most valuable brand at $400 billion. You can check out the Brand Finance press release below for more information.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.041 s, 7949 u