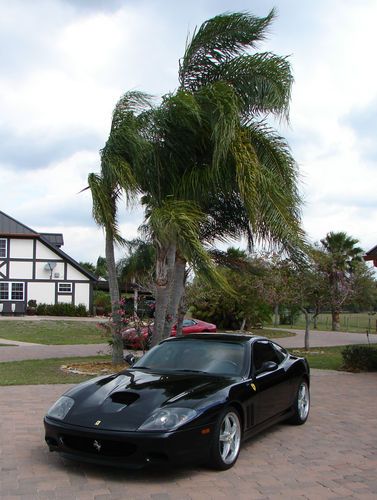

2002 Ferarri 575 / 575m / Maranello / Red Tan / 7,995 Miles Clean Inside And Out on 2040-cars

Ontario, California, United States

Engine:5.7L 5750CC V12 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Ferrari

Options: Compact Disc

Model: 575 M Maranello

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Trim: Base Coupe 2-Door

Power Options: Air Conditioning, Power Windows

Drive Type: RWD

Doors: 2

Mileage: 7,994

Engine Description: 5.8L V12 FI

Sub Model: Maranello

Number of Doors: 2

Exterior Color: Red

Interior Color: Tan

Number of Cylinders: 12

Warranty: Vehicle does NOT have an existing warranty

Ferrari 575 for Sale

Superamerica, one owner, 1 of 559 in the world, just serviced, only 2,551 miles.(US $198,888.00)

Superamerica, one owner, 1 of 559 in the world, just serviced, only 2,551 miles.(US $198,888.00) Black superamerica with fiorano handling package!(US $189,900.00)

Black superamerica with fiorano handling package!(US $189,900.00) 2003 ferrari 575 m maranello *nero daytona* *daytona seats* *full carbon fiber*(US $119,900.00)

2003 ferrari 575 m maranello *nero daytona* *daytona seats* *full carbon fiber*(US $119,900.00) Major service blu scuro shields contrast stitching 19 modular aluminum calipers(US $109,900.00)

Major service blu scuro shields contrast stitching 19 modular aluminum calipers(US $109,900.00) 2002 ferrari 575 m maranello f1

2002 ferrari 575 m maranello f1 Superamerica, one owner, 1 of 559 in the world, just serviced, only 2,551 miles.(US $207,888.00)

Superamerica, one owner, 1 of 559 in the world, just serviced, only 2,551 miles.(US $207,888.00)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Incredible $12 million Ferrari collection up for auction

Tue, Dec 8 2015Ferraris come up for auction all the time, but in Scottsdale next month Gooding & Company will be auctioning off an entire collection of Maranello's finest projected to fetch around $12 million. The collection belongs to one Tony Shooshani, described as "a widely published and renowned Ferrari collector." He's the proprietor of a 599XX Evo, a LaFerrari, and one of only six Pininfarina Sergio roadsters made. They'll remain in his collection, along with his prized 288 GTO and his thoroughbred Arabian stallion named Enzo. But he's liquidating some other notables from his garage, giving other collectors a chance to bring them home instead. This includes a trio of supercars. There's an Enzo tipped to fetch between $2.4 and 2.8 million, an F50 ($2.5-2.9m), and an F40 ($1.3-1.6m). The more classically inclined may be more enticed by the 1960s-era 250 GT Lusso ($2.2-2.5m), 250 GT Series II Cabriolet ($2-2.3m), and Dino 206 GT ($700-800k), and there's a pair of 80s models as well in a 512 BBi ($400-475k) and 328 GTS ($125-150k). The Berlinetta Boxer was Ferrari's first mid-engined twelve-cylinder supercar, and the 512 BBi was the ultimate incarnation thereof. It was never officially sold in the United States, but some still made it over here. This particular example was once owned by racing legend AJ Foyt. Those pre-sale estimates place the value of the collection altogether at $10.3 million on the low side, and as high as $13.5 million. That's a whole lot of cash, but there's a whole lot of machinery here – in both quantity and quality. So if you've had a good six or seven figures burning a hole in your proverbial pocket and have been looking for the right place to invest it, this could be your chance. Related Video: Gooding & Company is Thrilled to Announce The Tony Shooshani Collection to be Auctioned at the Scottsdale Auctions Headlining the historic collection, a trio of rare Ferrari supercars from an astute collector – the 1990 Ferrari F40, the 1995 Ferrari F50 and the 2003 Ferrari Enzo SANTA MONICA, Calif. (November 30, 2015) – Gooding & Company, the auction house acclaimed for selling the world's most significant and valuable collector cars, is pleased to announce an outstanding array of Ferraris at its annual two-day Scottsdale Auctions on January 29 and 30, 2016.

Fiat gives outgoing Ferrari chairman $35M severance package

Thu, 11 Sep 2014Luca di Montezemolo may not have wanted to leave Ferrari this way, but don't feel too bad for the departing chairman, because he'll be hitting the ground with a golden parachute so big that he'll never have to work again.

According to the latest reports, Fiat will pay Montezemolo 26.95 million euros (nearly $35 million) in severance pay. A little more than half of that will be paid in a lump sum of 13.71 million euros ($17.7M, equivalent to five times his annual salary) on January 31, 2015, with the rest to be paid within the next 20 years.

The payment is contingent on Montezemolo not going to work for a competitor, so don't expect to see him replacing Stephan Winkelmann at Lamborghini or Wolfgang Dürheimer at Bugatti any time soon. At least not until March 2017. Of course with that much cash on hand, the 67-year-old marquis need never work again, but considering how busy he's used to keeping himself, we'd be surprised if he didn't pop up again somewhere.

Ferrari and FCA are officially separated

Mon, Jan 4 2016It's been a long time in the making, but it's officially happened: Ferrari is no longer part of Fiat Chrysler Automobiles. Following the Italian automaker's initial public offering, it has officially split off from its former parent company. As part of the spin-off, FCA's stakeholders will each receive one common share in Ferrari for every ten they hold in Fiat Chrysler. Special voting shares will be distributed in the same proportions to certain shareholders as well. Those shares being distributed will account for 80 percent of the company's ownership. Another ten percent was floated as part of the company's IPO, while the remaining 10 percent is held by Enzo's son Piero Ferrari (pictured above at center), who serves as vice chairman of the company. The shares will continue to be traded under the ticker symbol RACE on the New York Stock Exchange, and will begin trading this week as well under the same symbol on the Mercato Telematico Azionario, part of the Borsa Italiana in Milan. Since the extended Agnelli family headed by chairman John Elkann (above, right) holds the largest stake in FCA, expect it to continue controlling the largest portion of Ferrari shares as well. Between them, nearly half of the shares in the supercar manufacturer – and we suspect a little more than half of the voting rights – will be controlled by the Agnelli and Ferrari families, who are expected to cooperate to ensure the remaining shareholders don't attempt a takeover of the company. Similar to its former parent company, which operates out of Turin and Detroit, the Ferrari NV holding company is nominally incorporated in the Netherlands, but the automaker will continue to base its operations in Maranello, Italy. That's where it's always been headquartered, on the outskirts of Modena. For the time being, Sergio Marchionne (above, left) remains both chairman of Ferrari and chief executive of FCA – a position to which he is not unaccustomed, having previously headed both Fiat and Chrysler before the two officially merged. Related Video: Separation of Ferrari from FCA Completed LONDON, January 3, 2016 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA) and Ferrari N.V. ("Ferrari") (NYSE/MTA: RACE) announced today that the separation of the Ferrari business from the FCA group was completed on January 3, 2016. FCA shareholders are entitled to receive one common share of Ferrari for every 10 FCA common shares held.