F1 Rwd Convertible Premium on 2040-cars

Fort Lauderdale, Florida, United States

Vehicle Title:Clear

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Interior Color: Red

Make: Ferrari

Model: F430

Warranty: No

Trim: Spider Convertible 2-Door

Drive Type: RWD

Number of Doors: 2 Doors

Mileage: 12,350

Sub Model: Spider F1

Number of Cylinders: 8

Exterior Color: Gray

Ferrari 430 for Sale

2008 ferrari f430 scuderia grigio medio f1 carbon fiber ipod 6k miles

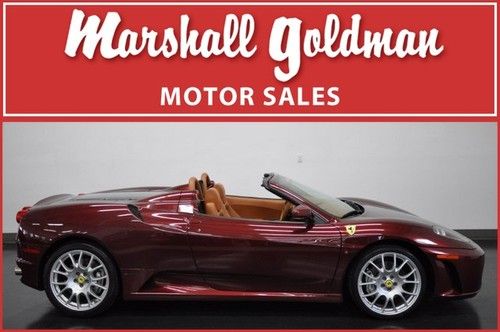

2008 ferrari f430 scuderia grigio medio f1 carbon fiber ipod 6k miles 2005 ferrari f430 spider rosso rubino/natural only 9300 miles(US $142,900.00)

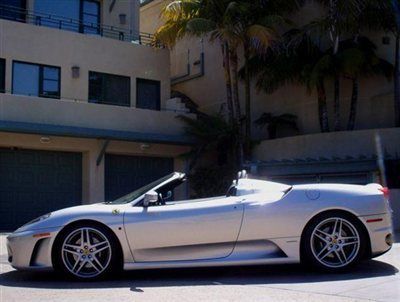

2005 ferrari f430 spider rosso rubino/natural only 9300 miles(US $142,900.00) 2007 ferrari 430 spider f1 low low mile loaded like new excellent great price!(US $139,900.00)

2007 ferrari 430 spider f1 low low mile loaded like new excellent great price!(US $139,900.00) 2006 ferrari f430 pristine condition! rare tour de france blue color!

2006 ferrari f430 pristine condition! rare tour de france blue color! 2006 ferrari 430 coupe(US $179,000.00)

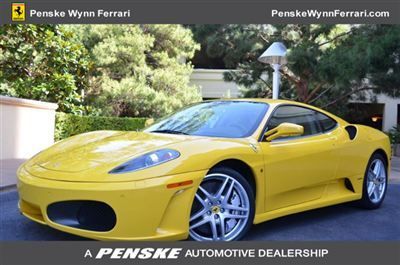

2006 ferrari 430 coupe(US $179,000.00) 2008 ferrari 430 coupe f1 giallo modena penske wynn ferrari 702-770-2000(US $150,000.00)

2008 ferrari 430 coupe f1 giallo modena penske wynn ferrari 702-770-2000(US $150,000.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Ferrari IPO may turn out to be good news for enthusiasts

Tue, Oct 27 2015Sergio Marchionne's strategy to spin off Ferrari from FCA and make the Italian automaker a publicly traded company has been met with ire from a vocal contingent of enthusiasts ever since rumors about the plan began to surface a few years ago. Some of these particularly pessimistic automotive pundits have voiced fears that with stockholders in the mix, it would not only spell the demise of the exclusive Italian supercar maker as we know it, but would in fact "ruin" the company. Call me dense, but I fail to see what the issue is. That isn't to say that I don't understand what's causing the fear. When profitability becomes a higher priority for a brand that's historically relied on exclusivity to keep its products in the highest echelons of desirability, there's a high potential for internal philosophical conflict. And then there are concerns about the sorts of products that Ferrari might develop that aren't the high-performance sports cars that the brand is known for. But individuals with those apprehensions seem to forget that Ferrari has already lent its name to a multitude of things that are not LaFerraris, 488 GTBs, or F12 Berlinettas, including clothing, headphones, and even laptops. But let's assume for a moment that the core anxiety is about future vehicles – including the unspeakable notion that Ferrari might develop an SUV. Why wouldn't Ferrari build an SUV, especially after seeing how incredibly successful that endeavor has been for Porsche? I think it's likely that Ferrari will put engineers to task creating some sort of crossover or high-rolling cruiser with room for the whole family at some point in the near future. And why wouldn't it, after seeing how incredibly successful that endeavor has been for Porsche? After all, the Cayenne accounted for more US sales in 2013 than the Boxster, Cayman, 911, and 918 combined, and it only gave up about a thousand units of sales last year to make room for the Macan crossover, the latter of which Porsche sold nearly as many of as it did Boxsters and Caymans. People want these vehicles, and they're willing to pay quite a bit of money for them. If we use Porsche's recent trajectory as a foreshadowing metric for what's in store for Ferrari, the future actually looks pretty good. After all, those SUV sales keep plenty of cash in Porsche's coffers for the low-volume projects that we enthusiasts love, like the 918 Spyder and the 911 GT3 RS.

Why Italians are no longer buying supercars

Wed, 08 May 2013Italy is the wound that continues to drain blood from the body financial of Italian supercar and sports car makers. The wound was opened by the country's various financial police who decided to get serious about superyacht-owning and supercar-driving tax cheats a few years ago, by noting their registrations and checking their incomes. When it was found that a rather high percentage of exotic toy owners had claimed a rather low annual income - certain business owners were found to be declaring less income than their employees - the owners began dumping their cars and prospective buyers declined to buy.

Car and Driver has a piece on how the initiative is hitting the home market the hardest. Lamborghini sold 1,302 cars worldwide in 2010, 1,602 cars in 2011 and 2,083 cars in 2012 - an excellent surge in just two years. In Italy, however, it's all about the ebb: in 2010, the year that Italian police began scouring harbors, Lamborghini sold 96 cars in Italy, the next year it sold 72, last year it sold just 60. The declines for Maserati and Ferrari are even more pronounced.

Head over to CD for the full story and the numbers. What might be most incredible isn't the cause and effect, but where the blame is being placed. A year ago the chairman of Italy's Federauto accused the government of "terrorizing potential clients," this year Luca di Montezemolo says what's happening has created "a hostile environment for luxury goods." Life at the top, it ain't easy.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.