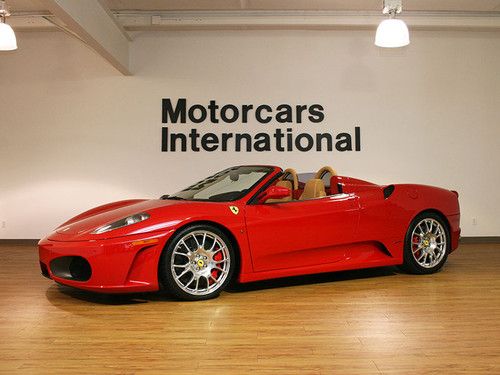

2006 Ferrari 430 Spider on 2040-cars

West Chester, Pennsylvania, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Make: Ferrari

Model: F430

Disability Equipped: No

Trim: Spider Convertible 2-Door

Doors: 2

Drive Train: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 7,814

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari 430 for Sale

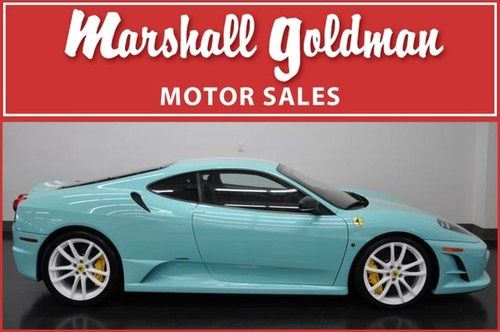

2009 ferrari f430 scuderia special order tiffany blue/blk only one made 700 mile(US $239,900.00)

2009 ferrari f430 scuderia special order tiffany blue/blk only one made 700 mile(US $239,900.00) 2008 ferrari 430 coupe(US $158,900.00)

2008 ferrari 430 coupe(US $158,900.00) 2005 spider 4.3l silver(US $126,795.00)

2005 spider 4.3l silver(US $126,795.00) Amazing f430 spider with a huge list of options and lots of carbon fiber!

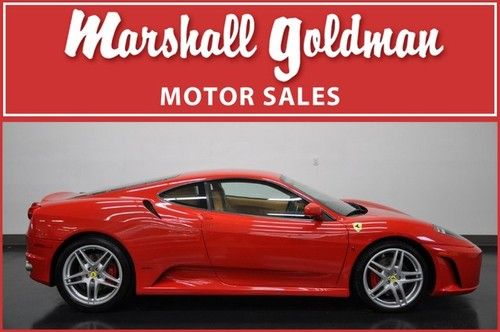

Amazing f430 spider with a huge list of options and lots of carbon fiber! 2007 ferrari f430 coupe red/tan only 8500 miles(US $137,900.00)

2007 ferrari f430 coupe red/tan only 8500 miles(US $137,900.00) 2006 ferrari 430 roadster! only 11,000 miles! new tires!(US $144,995.00)

2006 ferrari 430 roadster! only 11,000 miles! new tires!(US $144,995.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

World Class Transmission Svc ★★★★★

Wood`s Locksmithing ★★★★★

Trust Auto Sales ★★★★★

Steele`s Truck & Auto Repair ★★★★★

South Hills Lincoln Mercury ★★★★★

Auto blog

Sebastian Vettel's 13-race losing streak reflects Ferrari's struggles

Sat, May 25 2019MONACO — Sebastian Vettel's barren spell with Ferrari stretches to a dismal 13 Formula One races without a win, dating back to the Belgian Grand Prix last August. The veteran driver still holds No. 1 status at Ferrari mainly because of his experience. At times this season he has been slower than Charles Leclerc, his young and highly-motivated colleague keen to make an impression in his first season with the team. When asked if Vettel's performances had fallen below expectations for a four-time world champion, team boss Mattia Binotto defended him and said the problems were not down to the 31-year-old German. "First we need a good car ... which is performing sufficiently well to win," Binotto said. "It may be frustrating for him, no doubt. But first it's our duty to give him (one) that he can perform well (in)." The car is apparently not an issue Ferrari had anticipated. After strong performances in pre-season testing, it was touted as the team to beat, and even five-time champion Lewis Hamilton — winner of the past two championships — said so. But Hamilton and Mercedes teammate Valtteri Bottas have won all five races this season while Ferrari has a measly three podium places. The team's last win was by Kimi Raikkonen at the United States GP last October, two months after Vettel's victory in Spa. While Mercedes is all about smooth running, Ferrari's car is blighted by a front suspension issue, a deficit in cornering speed and such basic trouble as getting enough heat into the tires quickly enough. Ferrari's passionate tifosi fans, who are waiting for a first drivers' title since Raikkonen in 2007, are not happy with the current standings. Vettel is fourth, nearly 50 points behind championship leader Hamilton, while Leclerc is fifth. "After winter testing our confidence in the performance was higher than today," Binotto said with an air of resignation. "There are a lot of points to recover." Binotto has been with Ferrari a long time and was promoted from chief technical officer to team principal in January. He took over the role from Maurizio Arrivabene after two frustrating years in which Ferrari blew the title race, due to a bizarre combination of panicky errors from Vettel and a string of baffling strategical and technical mistakes within the team. Now there are worrying echoes of 2016 — when Ferrari failed to win a single race and Mercedes crushed its rivals.

Can the Dark Knight pull off Enzo Ferrari?

Sun, Aug 23 2015Christian Bale is taking another role where he gets to be in close contact with cool cars. The former Batman has reportedly been cast as Enzo Ferrari in a biopic about the legendary automotive figure that's being directed by Michael Mann, according to Deadline Hollywood. Production is set to begin next summer. The film allegedly takes place in 1957 and is possibly related to the fatalities of 11 people that year in a Ferrari crash at the Mille Miglia. According to Road & Track, the story also might be based on the book Enzo Ferrari: The Man, The Cars, The Races, The Machine. Mann has been trying to get the tale of the sports car magnate made for years, and had previously been negotiating to direct a movie adapting the book Go Like Hell about Ford and Ferrari's epic rivalry at Le Mans in the '60s. Bale's casting seems like a challenge, though. The British actor certainly doesn't look much like Ferrari. Also, he's currently 41, whereas il Commendatore was 59 in 1957. Mann's film already has challenger, too. Robert de Niro is also developing a Ferrari biopic in Italy, and he's taking the starring role. That movie would reportedly tell the story of the sports car company from its founding through Enzo's death in 1988. Here's hoping both of them make it to theaters; the auto industry titan's life is plenty fascinating enough to support more than one big-screen tale. Related Video:

Ferrari recalling 85 LaFerraris under two separate campaigns [UPDATE]

Tue, Jun 23 2015Of the recalls we see on a regular basis, million-dollar exotic supercars don't often pop up. But that's exactly what we have on our hands today as Ferrari North America and the National Highway Traffic Safety Administration have issued a pair of recalls for all 85 examples of the flagship LaFerrari hybrid hypercar in the United States. The first of the recall campaigns revolves around the headrests, which "may not absorb the required amount of energy" and therefore fail to comply with the federal safety requirements. The issue involves the larger L32 seat supplied by Lear, fitted as standard for the passenger and optional for the driver's seat. Addressing the issue will require dealers to replace the headrests. The second recall involves the Tire Pressure Monitoring System, which – in the event of a puncture – will display the wrong message. Instead of telling the driver not to proceed on the punctured tire, as apparently required under federal regulations, the system would (as currently programmed) tell the driver to keep driving, but not above 50 miles per hour. Ferrari dealers will need to update the software to fix the problem. These recalls do not represent the first time Ferrari has called in the hybrid hypercar over a potential safety issue. This past March, owners were offered the opportunity to have the fuel tanks replaced. However, unlike these latest campaigns that are being handled in coordination with the NHTSA, Ferrari insisted that the previous fuel tank issue did not constitute a recall. UPDATE: Ferrari North America confirms that no accidents or injuries have been reported to have resulted from either of these issues, which will be addressed in other markets as well - including Canada, where a further 11 units are affected. In order to fix the seat issue, "a small insert will be added to the back of the (large size only) seat headrest." Rectifying both issues "will take approximately an hour of service." Related Video: RECALL Subject : Headrest Impact Energy Absorbtion/FMVSS 202a Report Receipt Date: MAY 22, 2015 NHTSA Campaign Number: 15V305000 Component(s): SEATS Potential Number of Units Affected: 85 Manufacturer: Ferrari North America, Inc. SUMMARY: Ferrari North America, Inc. (FNA) is recalling certain model year 2014-2015 LaFerrari vehicles manufactured May 15, 2014, to March 4, 2015. The affected vehicles have L32 seats as standard equipment for the passenger seat and as optional equipment for the driver seat.