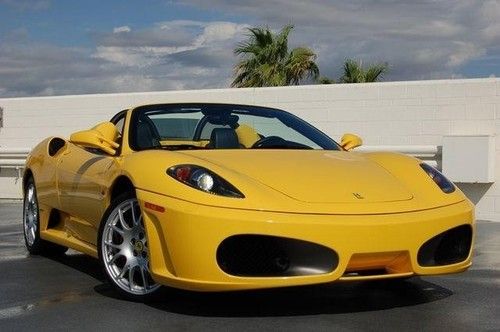

2005 Ferrari F430 Coupe, 6 Speed Manual, Low Miles on 2040-cars

Springfield, Ohio, United States

Body Type:Coupe

Engine:8

Vehicle Title:Clear

Make: Ferrari

Model: 430

Warranty: Vehicle does NOT have an existing warranty

Mileage: 6,890

Safety Features: Anti-Lock Brakes

Sub Model: rerModelID=)

Power Options: Air Conditioning, Power Windows

Exterior Color: Red

Number of doors: 2

Interior Color: Tan

Ferrari 430 for Sale

California pristine ferrari f430 coupe / rare 6 speed / beautiful show car(US $132,900.00)

California pristine ferrari f430 coupe / rare 6 speed / beautiful show car(US $132,900.00) 2008 ferrari f430 spider in a beautiful color combo with warranty!

2008 ferrari f430 spider in a beautiful color combo with warranty! 2006 ferrari 430 roadster! only 11,000 miles! new tires!(US $134,995.00)

2006 ferrari 430 roadster! only 11,000 miles! new tires!(US $134,995.00) 2005 ferrari f430, f1, ceramic brakes, carbon fiber package, loaded(US $124,000.00)

2005 ferrari f430, f1, ceramic brakes, carbon fiber package, loaded(US $124,000.00) 2007 ferrari 430 spider f1! 8k miles! fresh service! full carbon fiber interior!

2007 ferrari 430 spider f1! 8k miles! fresh service! full carbon fiber interior! 2007 ferrari f430 red only 4000 miles loaded many option / with carbon fiber pkg(US $152,800.00)

2007 ferrari f430 red only 4000 miles loaded many option / with carbon fiber pkg(US $152,800.00)

Auto Services in Ohio

Zig`s Auto Service ★★★★★

Zeppetella Auto Service ★★★★★

Willis Automobile Service ★★★★★

Voss Collision Centre ★★★★★

Updated Automotive ★★★★★

Tri C Motors ★★★★★

Auto blog

Ferrari reveals pair of tailor-made specials in Shanghai

Fri, 20 Jun 2014For most people, buying a new Ferrari - heck, even a used one - would be a special occasion all on its own, not to mention a rare privilege. But to make the experience all the more special, the Prancing Horse marque offers its Tailor-Made personalization program. The service just reached the Asia-Pacific region for the first time with the new Tailor-Made Centre in Shanghai, and to mark its inauguration, Ferrari has revealed two new special editions - both based on V12 GTs and inspired by horses - specifically for the Chinese market.

First up is the F12 Berlinetta Polo Edition pictured above. The special F12 is distinguished by a white and blue theme, the exterior decked out in Bianco Italia Opaco (read: fancy white) with navy blue offset racing stripes, and the interior carrying an inverse take on the same featuring dark blue leather upholstering with white stitching, stripes and trim.

Those looking for more traction and versatility might be more intrigued by the FF Dressage Edition. The four-seat, four-wheel special gets a piano black exterior and a reddish saddle brown leather interior with grid-pattern stitching (pictured inset at right).

Watch this Ferrari Enzo get thrown around on farm roads

Tue, 12 Feb 2013Tax the Rich, the YouTubers who seem to have sprung from some mischievous corner of the V for Vendetta universe, have somehow acquired a Ferrari Enzo for their latest trick. Last time we checked in with them, they were opposite-locking a Rolls-Royce Phantom at high speed all over a wet, muddy field. Perhaps knowing that if they repeated that with the Ferrari they'd end up with a dead stallion and a field full of carbon fiber parts, they kept the action to a mostly paved farm access road.

But still - using an Enzo for a tarmac rally stage is something we would not have though of, and there's a fair bit of water and mud, too. As Joseph Campanella used to say way back when, "What will they think of next?" Check out the video below and prepare to gaze in equal measures of shock, wonder and horror.

Exotic cars caught on video racing on neighborhood streets in Beverly Hills

Thu, Sep 17 2015A pair of supercars caught on camera racing around a quiet Beverly Hills neighborhood last week has residents fearing for their safety. The video shows a white Porsche 911 and a yellow Ferrari LaFerrari as they clipped parked cars and blew through stop signs while residents of the upscale community watched in horror. Freelance cameraman Jacob Rogers shot the video of the supercar shenanigans. He later confronted a man outside the house where the Ferrari eventually parked. He asked the man if he cared that he was endangering people's lives. The man became combative and claimed he had diplomatic immunity. "He told me verbatim, 'I could have you killed and get away with it,'" Rogers told NBC Los Angeles. "I told him, 'the press is allowed to be here on the sidewalk on a public street.' He said, '(Expletive) America' and threw a cigarette at me." The Ferrari's plates are from the oil-rich country of Qatar. The race ended with the Ferrari pulling into the driveway of a $45,000-per-month rental home, its engine compartment smoking. Police can be seen arriving in the neighborhood. Los Angeles police are currently investigating the incident. Even though the LaFerrari was still smoking when police arrived they haven't filed charges because no officer witnessed the illegal activities. When police approached the owner of the vehicle he denied doing anything illegal and again claimed diplomatic immunity. Police told NBC they are in contact with the State Department about the man's diplomatic status and the legality of the cars in the neighborhood. Beverly Hills isn't the only swanky zip code plague by hotshot supercar owners. Some of the most expensive homes in London can be found In the Knightsbridge neighborhood - and some of the most expensive cars as well. This summer, the local council of Knightsbridge and nearby Chelsea began exploring a Public Space Protection Order that would fine drivers who rev their engines, drag race on residential streets or blare music, according to Reuters UK. News Source: NBC Los Angeles Government/Legal Ferrari Porsche Racing Vehicles Supercars Videos illegal