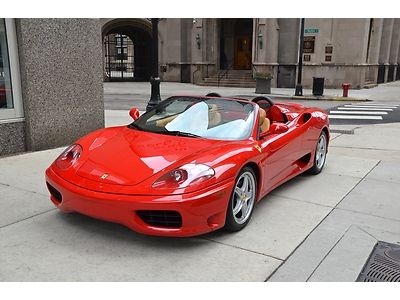

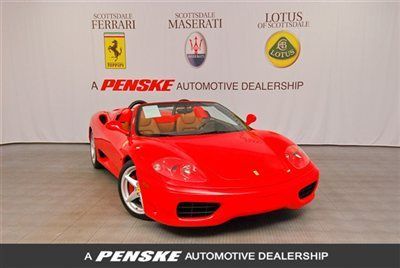

2004 Ferrari 360 Spider F1 Red/tan 2 Owner Car 10k Miles Extremely Clean!!! on 2040-cars

Chicago, Illinois, United States

Vehicle Title:Clear

Engine:3.6L 3586CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle does NOT have an existing warranty

Model: 360

Trim: Spider Convertible 2-Door

Options: Cassette Player

Power Options: Power Locks

Drive Type: RWD

Mileage: 10,388

Number of Doors: 2

Sub Model: 2dr Converti

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari 360 for Sale

2003 ferrari 360 spider convertible 2-door 3.6l(US $70,000.00)

2003 ferrari 360 spider convertible 2-door 3.6l(US $70,000.00) 2004 ferrari 360 spider 6-spd~recent major service~daytona's~shields~ like 2003(US $106,000.00)

2004 ferrari 360 spider 6-spd~recent major service~daytona's~shields~ like 2003(US $106,000.00) 2000 ferrari 360 modena coupe, f1, red/tan, tubi exhaust, only 18k miles!!

2000 ferrari 360 modena coupe, f1, red/tan, tubi exhaust, only 18k miles!! 2005 ferrari 360 spider convertible 2-door 3.6l **3 pedal car** very rare!(US $127,500.00)

2005 ferrari 360 spider convertible 2-door 3.6l **3 pedal car** very rare!(US $127,500.00) Black on black spider f1 convertible 3.6l(US $119,900.00)

Black on black spider f1 convertible 3.6l(US $119,900.00) Ferrari 360 spider modena 2003 low mileage 17,983 miles black convertible 3.6l(US $96,995.00)

Ferrari 360 spider modena 2003 low mileage 17,983 miles black convertible 3.6l(US $96,995.00)

Auto Services in Illinois

Zeigler Fiat ★★★★★

Wagner`s Auto Svc ★★★★★

US AUTO PARTS ★★★★★

Triple D Automotive INC ★★★★★

Terry`s Ford of Peotone ★★★★★

Rx Auto Care ★★★★★

Auto blog

Beautiful Ferrari 250 California poised to break hearts, records

Mon, Apr 27 2015If you think buying a new Ferrari is expensive, just look at the prices collectors pay at auction for some of the brand's most desirable classics. The figures regularly delve well into eight figures. As in, tens of millions of dollars. One of the most sought-after is the Ferrari 250 GT SWB California Spider, and the one you see here looks poised to raise the bar yet again. One of only 56 made (and just 16 with open headlights), chassis number 2505 GT is an exceptional example of the breed in Blu Scuro with Pelle Beige interior. Unlike most Californias that were sent to the US, this particular one was delivered new within Italy, where it remained until 1974 when it moved to Switzerland for 20 years. Since undergoing full restoration by Ferrari's own Classiche department, it won top honors at the Cavallino Classic and honorable mention at the Concorso d'Eleganza Villa d'Este, it's been displayed at the Ferrari Museum in Maranello and was even driven by Luca di Montezemolo himself in the parade at the Finali Mondiali in Valencia a few years ago. Now it's going up for auction by RM Sotheby's at Villa d'Este next month, where it is sure to fetch a pretty penny or two. (And by "two," we mean "bajillion.") It's got quite an act to follow: the last time a California Spider traded hands, it sold for a record $18.5 million – and that was an unrestored barnfind – eclipsing the pristine example Gooding sold last summer for over $15 million. The records at Sports Car Market demonstrate that California Spiders hold the top spots for the most expensive variants of the iconic 250 GT ever sold at auction, and though pre-sale estimates place its value between $12 and 14 million, we wouldn't be surprised to see it fetch much more once the gavel drops. Though surely the most valuable, it's not the only collectible Ferrari up for grabs at the event on Lake Como this year. The California will be joined by a 1950 Ferrari 195 Inter Berlinetta along with an enviable quartet of Prancing Horse supercars (288 GTO, F40, F50 and Enzo) as well as a rare 599 GTB with a six-speed and HGTE package and a single-owner 575 Superamerica.

Buy a McLaren P1 GTR, Porsche 918 Spyder, and a Ferrari LaFerrari all in one place

Fri, Apr 21 2017The McLaren P1, Porsche 918 Spyder, and Ferrari LaFerrari, are arguably the three greatest hypercars yet. Of course, their extremely limited production meant that some ultra-wealthy individuals may have missed out on picking one up. In fact, to get a LaFerrari, you needed to have owned a certain number of Ferraris, and be in good graces with the company. However, if there are any super-rich car enthusiasts reading this right now, your chance to buy one or all of these three supercars is coming up next month at the RM Sotheby's Villa Erba auction in Italy. It will occur on May 27, and feature a McLaren P1 GTR, Porsche 918 Spyder Weissach, and Ferrari LaFerrari. 2016 McLaren P1 GTR McLaren fans, will RM Sotheby's won't offering just any McLaren P1, but rather the hardcore, track-prepped GTR variant. In fact, the GTR is so hardcore that it isn't legal for the street. This particular version went to specialist Lanzante to be converted for road use. Take note that it's only road legal in the UK, and it may not meet laws for other countries. However, that's still more than most GTRs can boast, and if you have the money for this, you shouldn't have any issue taking it to the UK to unleash the P1 GTR's 986 horsepower on public roads. This car could use some driving, too, as it only has about 223 miles on it, some of which included just one track event. RM Sotheby's expects this McLaren to go for between $3.4 million and $3.85 million. 2015 Porsche 918 Spyder Weissach View 31 Photos The Porsche 918 Spyder going up for auction is a special one as well. The first difference you'll notice is that it has been painted a custom color called "Arrow Blue," a hue specially mixed up as part of Porsche's custom paint service. It also features the lightweight Weissach package, which loses a few extra pounds by replacing an assortment of parts for lighter components. Among them are magnesium wheels and wheel bearings, carbon fiber roof, windshield frame, rear fenders, and rear view mirrors, and even titanium-backed brake pads. According to RM Sotheby's those pads have been replaced with fresh 918-spec pieces. The previous owner clearly enjoyed his or her 918, as it has just over 6,800 miles. In case you're interested in a well-loved 918, the auction house expects it to sell for just under $1.3 million to about $1.5 million.

This 1987 Ferrari F40 LM is for the millionaire who dares to be different

Thu, Jan 31 2019Throughout the past decade, the Ferrari F40 has become one of the most highly regarded and highly coveted supercars ever built. When cars become so iconic, any red model no longer excites. It's the specialty models, such as this stunning light blue Le Mans example, that catch the real attention at an auction house. This 1987 Ferrari F40 LM is expected to go for up to perhaps $6,280,000 at the upcoming RM Sotheby's in Paris on February 6 during Retromobile week. According to RM Sotheby's, the Pilot exterior livery makes this one of the most recognizable F40 LMs ever built, although that pool is extremely small. Only 19 F40s were ever created by Michelotto to LM or Competizione spec. Chassis No. ZFFGJ34B000074045 is reported to be only the third F40, not just of LM F40s, of all F40s built. It was a pre-production prototype, and the car's insane history doesn't stop there. It also participated in the 24 Hours of Le Mans in 1995 and 1996, yet finished only 12th in 1995 (it did win the 1995 Anderstorp 4 Hours). That's shocking considering the engineering and power this car is known for. In Michelotto LM spec, the twin-turbocharged V8 was uprated to more than 700 horsepower using enlarged turbochargers, bigger intercoolers, and a better Weber-Marelli fuel injection system. Using tech learned from the Group B 288 GTO Evoluzione development, it also had a stiffer chassis, an upgraded transmission, better brakes, and altered exterior aero equipment. Rated at about 2,350 pounds, it was one of the fastest cars on the planet at the time. Wherever this car goes, we hope the owner takes advantage of its eligibility for numerous racing events. Several other Ferraris will also roll across the auction stage, including a 1996 F50, a 1966 275 GTB/6C Alloy Berlinetta, a 2011 SP30, a 599 SA Aperta, a 2003 Enzo, and a 2006 Superamerica. Outside the Ferraris, the 1994 Bugatti EB110 Super Sport is catching our eye. Featured Video: