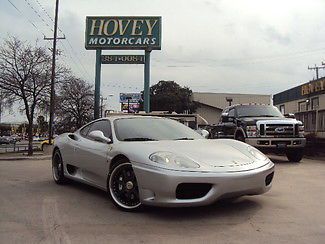

2001 Ferrari 360 Modena F1, Mint 2 Owner Serviced Up,red,sabbia Stiching,18k on 2040-cars

Ridgefield, New Jersey, United States

|

THIS FERRARI IS ONE OF THE CLEANEST IN THE COUNTRY...18,430 MILES ALL KEYS,BOOKS,SERVICE RECORDS SINCE 01, TUBI EXHAUST,FACTORY CAR COVER, FACTORY FERRARI BATTERY CHARGER BUILT IN PLUG, SCUDERIA SHIELDS,3 SPOKE FACTORY WHEELS,RED BRAKE CALIPERS,15K SERVICE COMPLETE, NEW CLUTCH COMPLETE AT AUTHORIZED FERRARI DEALER. RED WITH SABBIA INTERIOR AND RED STICHING THROUHOUT,UPHOLSTERED ROOF AND REAR LEATHER SHELF, FACTORY 6 CD CHANGER. POWER DUAL SEATS.CLEAR 3M FULL FRONT BRA AND SIDE SKIRTS JUST DONE..CLEAN CAR FAX AVAILABLE..

|

Ferrari 360 for Sale

2004 ferrari 360 modena spider+f1+daytona seats+tubi exhaust+19/20 custom wheels(US $89,998.00)

2004 ferrari 360 modena spider+f1+daytona seats+tubi exhaust+19/20 custom wheels(US $89,998.00) Ferrari : 360 modena coupe 2-door 2000 ferrari 360 modena coupe 2-door 3.6l(US $75,500.00)

Ferrari : 360 modena coupe 2-door 2000 ferrari 360 modena coupe 2-door 3.6l(US $75,500.00) 2001 ferrari 360 spider, 27k miles, f1, serviced, comes with everything!!(US $79,850.00)

2001 ferrari 360 spider, 27k miles, f1, serviced, comes with everything!!(US $79,850.00) Ferrari 360 modena 12k miles clean race seats(US $79,995.00)

Ferrari 360 modena 12k miles clean race seats(US $79,995.00) Coupe just completed the service and 1 full year warranty from ferrari dealer!!(US $97,850.00)

Coupe just completed the service and 1 full year warranty from ferrari dealer!!(US $97,850.00) Clean. 6-speed f1 style paddle shift manual trans.daytona style seat trim(US $99,900.00)

Clean. 6-speed f1 style paddle shift manual trans.daytona style seat trim(US $99,900.00)

Auto Services in New Jersey

Vitos Auto Electric ★★★★★

Town Auto Body ★★★★★

Tony`s Auto Svc ★★★★★

Stan`s Garage ★★★★★

Sam`s Window Tinting ★★★★★

Rdn Automotive Repair ★★★★★

Auto blog

How not to unload the 1 of 1 Ferrari P4/5 Competizione from a trailer

Mon, 28 Oct 2013Believe it or not, unloading a car from a transport vehicle is a delicate science. It's alarmingly easy to damage a car in the tight, elevated confines of a dedicated car hauler, but as these gentlemen at the Monterey car week found out, even getting a car off a flatbed comes with its own unique set of challenges.

When the car you're moving off said flatbed is the only Ferrari P4/5 Competizione in existence, meticulously built to the specifications of Ferrari collector James Glickenhaus, we imagine the stress level is even greater. Yes, this is an unloading gone wrong, although it could have always been worse. The movers have the right idea, working boards underneath the car, but simply didn't account for the car moving them. The result is a racecar, resting ever so gracefully, on its carbon-fiber nose. Getting the car out of such a precarious position safely requires nearly as much skill as getting it off in the first place.

Take a look below for the full, cringe-inducing video.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Marchionne's FCA-GM merger might come after Ferrari spinoff

Sat, Sep 5 2015Sergio Marchionne is continuing to rumble about working out a merger with General Motors, but don't expect anything big to happen before at least early next year. That's because Marchionne would likely wait for the Ferrari spin-off to be complete before beginning his next big deal, according to Automotive News. While the Ferrari IPO on the New York Stock Exchange is expected in the coming weeks, that only concerns 10 percent of the shares. The remaining 80 percent of stock is being distributed among shareholders in 2016. Piero Ferrari holds the final 10 percent with no intention to sell. This strategy allows FCA to claim 80 percent of the Prancing Horse's profits in the automaker's 2015 financial results. According to Automotive News, the tactic has other advantages, as well. FCA would be flush with cash by waiting for the spin-off to be complete, and it would keep Ferrari separate if a GM merger actually happens. Marchionne thinks Ferrari could be valued at over $11 billion in the IPO, and it could make FCA $3.3 billion richer when complete. Marchionne believes a combined FCA/GM could sell 17 million vehicles a year globally and rake in $30 billion in earnings. In the CEO's opinion, the two automakers are wasting money by developing components to do the same things on their vehicles. Although, so far the General's top execs are rebuffing all of his advances.