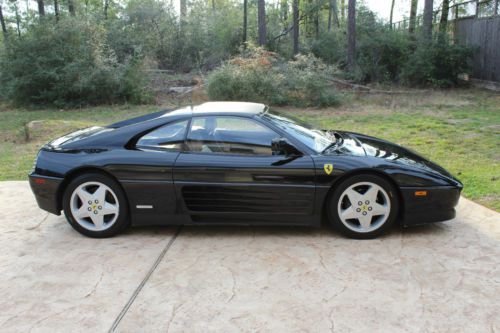

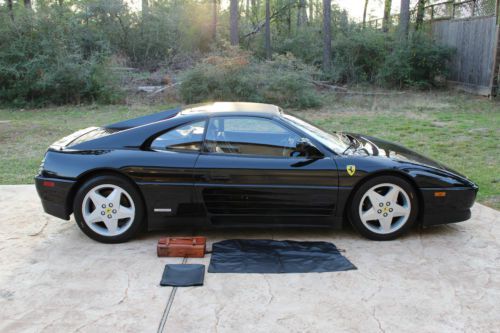

Beautiful Black - Fast And Sleek on 2040-cars

Spring, Texas, United States

|

This is my 1990 Ferrari 348 TS that has been a great joy to own. I am the 4th owner of this wonderful black beauty and have put about 5,000 of the 35,000 miles on this car. The last owner told me he had the 30k service performed which would have been about 7 years ago. It has been garage kept, and covered its entire life. The body is in great shape, the paint looks very good, the interior is in good shape with a little bit of wear on the drivers seat. This car has had it's fluids changed at least once per year, and its last inspection the inspector said its emissions were better than a 3 year old Mercedes that had been in previously that day. The car runs and drives great on its Perelli P Zero tires. The engine and transmission work and sound great!The A/C & heater work well, and a new battery was installed a little while ago. The stereo has been updated to a Sony CD player with all new speakers, and it has a joy stick remote mounted between the front seats. This car also has a VIPER alarm system with remote door unlock, this is very nice, and very rare. As you can see from the pictures, the factory original tool kit is in great shape, and even has the tire inflation bottle that is VERY HARD to find. The targa top is in great shape, and has its storage pouch, and also included is the bikini top when you are away from the hard top. I have loved owning this vehicle but with a new little boy, there is no where for the baby seat :).

|

Ferrari 348 for Sale

1994 ferrari 348gts spyder(US $36,999.00)

1994 ferrari 348gts spyder(US $36,999.00) 348 spider

348 spider 1993 ferrari 348 ts serie speciale #36(US $52,000.00)

1993 ferrari 348 ts serie speciale #36(US $52,000.00) 91 ferrari 348 manual 50k(US $30,995.00)

91 ferrari 348 manual 50k(US $30,995.00) Ferrari 348 1991 tb(US $58,000.00)

Ferrari 348 1991 tb(US $58,000.00) 1990 ferrari 348 ts base coupe 2-door 3.4l(US $35,000.00)

1990 ferrari 348 ts base coupe 2-door 3.4l(US $35,000.00)

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

Ferrari 250 GTO could fetch as much as $75 million at auction

Wed, 13 Aug 2014Last month we reported on a Ferrari 250 GTO heading for the auction block at Pebble Beach. We knew at the time it would break records and bring in tens of millions of dollars. But now that the gavel is about to drop, it looks like even our projections could fall short.

According to a report on Bloomberg, citing the classic car authorities at Hagerty Insurance, the GTO in question (pictured above) could fetch upwards of $60 million and as much as $75 million when the auction takes place two days from now in Monterey, CA.

Hagerty's reported estimate would not only blow the previous records out of the water, but would eclipse the pre-sale estimate attributed to Bonhams, the auction house handling its sale, which placed its value between $30 million and $40 million.

Race Recap: 2015 Hungarian Grand Prix is Magyar for 'What a race!'

Mon, Jul 27 2015Every driver on the Formula 1 grid dreams of taking home the silverware, but only one driver each year can do it. Barring disaster in 2015 it looks like it's going to be Lewis Hamilton. The Brit has been so dominating at the front of the grid on Saturday, we can't see how he'll miss out on winning the second annual FIA Pole Position Trophy. That's the accolade introduced last season in another manufactured attempt to give drivers something to work for on Saturday, since the FIA felt leading into the first corner didn't have the pull it used to. Hamilton took his ninth pole of the season in Hungary for Mercedes-AMG Petronas with a crushing lap that put him almost six tenths ahead of his teammate Nico Rosberg in second. All Hamilton needs is one more spot at the top of the grid this season, and he's the Pole Position trophy winner. Thrilling stuff. Behind Rosberg the gaps stayed smaller, Sebastian Vettel in the Ferrari a little more than a tenth behind Rosberg, Daniel Ricciardo in the Infiniti Red Bull Racing less than four one-hundredths behind Vettel. We feel almost as vexed watching Kimi Raikkonen as he feels driving – he's finally got a good Ferrari, now he can't get a good weekend. The front wing broke on his car in Free Practice 1, then a water leak in Free Practice 3 robbed him of setup time on the soft tire. He lines up in fifth about two tenths behind Ricciardo. The slow, tight Hungaroring didn't agree with the Williams chassis, Valtteri Bottas the first of the Grove team drivers in sixth, his teammate Felipe Massa two places back. Between them is Daniil Kvyat in the second Red Bull in seventh. Teenager Max Verstappen put in a good showing in the Toro Rosso to grab ninth, while Romain Grosjean in a wriggling, squishy, sliding Lotus classified his appearance in Q3 at all as "a miracle." As for the race that followed, we don't expect to see another like it for a long time – it was the real thrilling stuff, one shock after another. The drama began after the first parade lap, when Felipe Massa lined up out of position and the start was aborted. The drivers did another parade lap, then lined up with everyone in place. Mercedes got swamped as soon as the lights went out. Vettel ran around both of them and led the race into the first turn, Raikkonen had come from fifth to third by Turn 1, then got the inside line on Rosberg through Turn 2 to take second place.

Steve McQueen's Ferrari 275 GTB/4 to be auctioned in Monterey

Sat, 10 May 2014We know from many, many years of watching classic car auctions, that there are certain qualities that ensure big money. For example, putting tiny silver horses and/or yellow badges on a red car will probably bring in a lot of cash. This is doubly true if said car hails from the 1950s or 1960s, and it's triply true if some dude drove it around in circles or if a celebrity owned it. That, friends, is how you make the serious dosh at auction.

Considering that, we should expect big, big things when this 1967 Ferrari 275 GTB/4 crosses the block at the big RM Auctions event during the festivities surrounding the 2014 Pebble Beach Concours d'Elegance.

Terrence Steven McQueen, better known as Steve McQueen and even better known as the coolest actor of the 1960s and 1970s, originally purchased this car while filming Bullitt in San Francisco, which should provide a big boost to its sale price.