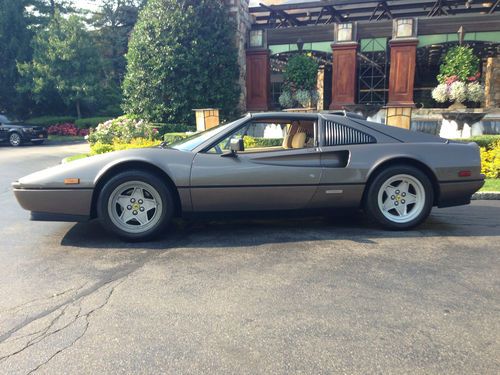

1987 Ferrari 328 Gts 33k Original Miles Just Serviced All Records Since New Look on 2040-cars

Woodbury, New York, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:v8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Ferrari

Model: 328

Warranty: Vehicle does NOT have an existing warranty

Trim: GTS

Options: Cassette Player, Leather Seats

Drive Type: rwd

Power Options: Air Conditioning, Power Windows

Mileage: 33,050

Exterior Color: Brown

Interior Color: Tan

Disability Equipped: No

Number of Cylinders: 8

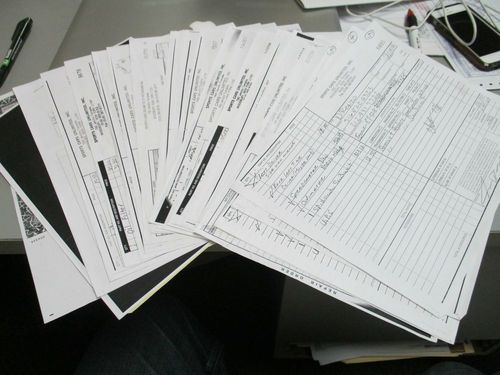

1987 Ferrari 328 GTS In Like New Condition!!! 33k Garage Kept Miles! This car has been serviced by the same person since new and have every bill showing everything done down to every oil change! Just recently the car had a major service done so everything is up to date and ready to go just turn the key and drive away! The exterior is a factory very unique color that is rare to see..... chances are you will never see another one like it in your area! The paint and body are flawless!! The interior looks almost brand new with almost no signs of wear any place! The car runs and drives like new and sounds amazing! This is a fun ferrari that you can buy for the price of a vette! The milage on the car is 33,050 but shows only 15,325 due to a speedometer change at 17,725 I have all the records to show! Perfect first exotic car! Call 631-629-5390 We do accept other sports cars as trades ins so let us know what you have!

Ferrari 328 for Sale

1988 ferrari 328 gts targa,only 11k miles!, just serviced, stunning!(US $74,900.00)

1988 ferrari 328 gts targa,only 11k miles!, just serviced, stunning!(US $74,900.00) 1986 ferrari 328 gts(US $54,000.00)

1986 ferrari 328 gts(US $54,000.00) 89 ferrari 328 gts

89 ferrari 328 gts 1988 ferrari 328gts quite a nice example!!

1988 ferrari 328gts quite a nice example!! 1986 ferrari 328 gts rossa corsa/tan - clean & no reserve

1986 ferrari 328 gts rossa corsa/tan - clean & no reserve 1987 ferrari 328 gts red on black car is immaculate inside and out(US $50,888.00)

1987 ferrari 328 gts red on black car is immaculate inside and out(US $50,888.00)

Auto Services in New York

Willowdale Body & Fender Repair ★★★★★

Vision Automotive Group ★★★★★

Vern`s Auto Body & Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valanca Auto Concepts ★★★★★

V & F Auto Body Of Keyport ★★★★★

Auto blog

Chevy ad compares Spark EV with Ferrari 458 Italia

Thu, 18 Jul 2013Chevrolet's new commercial for the 2014 Spark EV emphasizes the little hatchback's performance over pretty much everything else, and it even goes as far as to compare it to a Ferrari 458 Italia. That's right, the electric bubble is pitched in the commercial as having a higher torque figure than the Ferrari - and it does, with a massive 400 pound-feet ready to be unleashed.

That doesn't translate into a quicker car, however, as the 458's V8 with 570 horsepower and not-exactly-quaint 398 lb-ft gives it a 0-60 time of 3.0 seconds compared to the Spark EV's 7.6-second run.

"We think the fun-to-drive element is an area for us to differentiate ourselves," Sam Basile, executive chief engineer for GM's global minicars and emerging-market vehicles, told Automotive News.

Ferrari threatening to fine journalists $69,000 for breaking LaFerrari embargo?

Tue, 22 Apr 2014In automotive journalism, we deal with embargoes on a regular basis. For the uninitiated, these are agreements between publications like Autoblog and manufacturers. While news embargoes (where pubs are provided with information and images and agree to hold until a predetermined date) are fairly common, today, we're focusing on drive embargoes. These are what we generally end up signing when we attend a vehicle launch. Generally, these are in the media's best interest. As drive programs are spread out over a week or two with multiple different "waves" of media, drive embargoes put the biggest and smallest publications on level footing when it comes to publishing reviews.

According to a report from Autocar's Steve Sutcliffe, Ferrari has taken its drive embargo for the LaFerrari hypercar a bit too far. See, initial reviews from the few publications that attended the drive event for the hybrid-powered monster can hit the newsstand or internet on April 30. Originally, syndicated stories - those sold by freelancers or publications to other outlets - couldn't be published until May 12. These syndicated reviews are big money for larger magazines and, in the case of freelance journalists, are a primary source of revenue. Inexplicably, though, Ferrari has pushed the syndication embargo back to May 26, which is bad news for everyone involved (aside from Ferrari).

This could have been nothing more than an annoyance. The stories would still get sold (although it might be for a bit less coin, considering the initial reviews will be nearly a month old) and you'll still be bombarded by reviews of the LaFerrari not once, but twice, just as Ferrari planned.

Museo Ferrari launches 'Michael 50' exhibit honoring Schumacher

Fri, Jan 4 2019Michael Schumacher turned 50 years old on Thursday, January 3, 2019. To celebrate the racing legend and to show appreciation for all he has done for the brand, Museo Ferrari opened an exhibition that explores his impact and accomplishments throughout his personal life and racing career. Named " Michael 50," the exhibit is now open in Maranello. This is the third showcase to open in recent months, following the announcement of "Driven by Enzo" and "Passion and Legend," which opened in September 2018 to honor the 120th anniversary of the founder of Ferrari. The Prancing Horse company calls Schumacher "The Most Successful Ferrarista in History," and the exhibition focuses on his many victories. The driver raced his way to seven world titles, 91 first-place finishes, and 155 podiums. Ferrari is displaying many of the cars Schumacher raced in, including the 1996 F310, the 1999 F399, the F1-2000, F2002, F2004, and the 2006 248 F1. In addition to race cars, the display also highlights some of the road cars that Schumacher worked on as a developer after he left Formula One. Using his knowledge and experience, he helped shape the dynamics of the 2007 430 Scuderia and the 2008 California. "Michael 50" was created with the help of the Keep Fighting Foundation, which recently launched an app that has a virtual museum and celebrates Michael and his legacy. According to a recent report, Schumacher is currently "in the very best of hands" and continues to battle back from his injuries. Ferrari did not give a specific time period for the exhibition, but mentioned it will be open for a "few months." Fans can buy tickets here.Related Video: