2013 Dodge Viper Srt Gts 8.4l V10 Venom Black on 2040-cars

Fort Lauderdale, Florida, United States

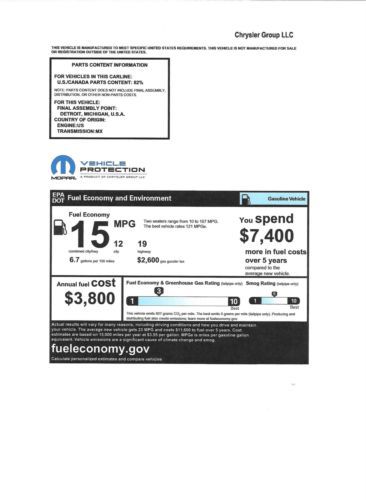

Fuel Type:Gasoline

For Sale By:Dealer

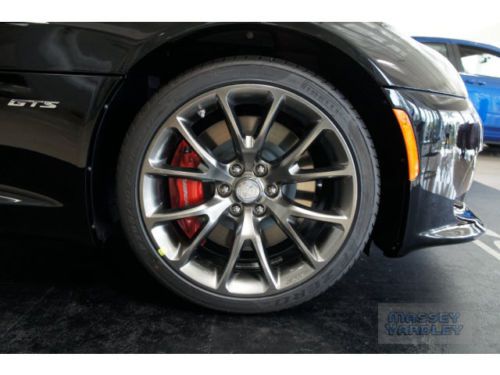

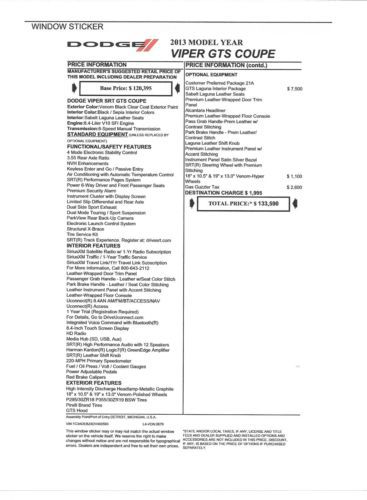

Engine:8.4L 8448CC 515Cu. In. V10 GAS OHV Naturally Aspirated

Transmission:Manual

Body Type:Coupe

New

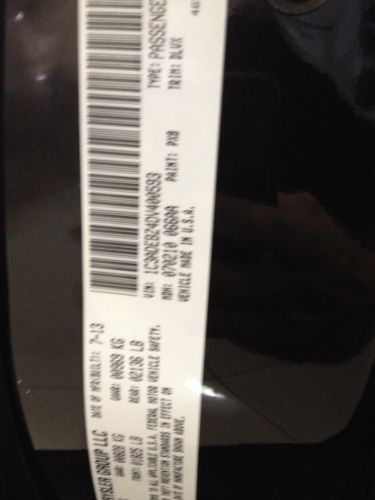

Year: 2013

Warranty: Vehicle has an existing warranty

Make: Dodge

Model: Viper

Mileage: 0

Sub Model: SRT GTS

Trim: GTS Coupe 2-Door

Exterior Color: Black

Interior Color: Black

Drive Type: RWD

Number of Cylinders: 10

Dodge Viper for Sale

2003 dodge viper srt-10 conv- black/black - only 12k miles! 500 hp! very clean!(US $42,997.00)

2003 dodge viper srt-10 conv- black/black - only 12k miles! 500 hp! very clean!(US $42,997.00) #71 of 200 moton coilovers borla exhaust k&n upgraded 2 piece rotors new tires(US $57,900.00)

#71 of 200 moton coilovers borla exhaust k&n upgraded 2 piece rotors new tires(US $57,900.00) 2005 dodge viper silver mamba edition #153 of 200 6-speed manualtrans stick

2005 dodge viper silver mamba edition #153 of 200 6-speed manualtrans stick 2008 dodge viper acr acr-x conversion new motor, new trans, new clutch 3k miles(US $69,995.00)

2008 dodge viper acr acr-x conversion new motor, new trans, new clutch 3k miles(US $69,995.00) Gts new manual coupe 8.4l navigation rattler wheels(US $126,600.00)

Gts new manual coupe 8.4l navigation rattler wheels(US $126,600.00) 1996 dodge viper rt/10 roadster

1996 dodge viper rt/10 roadster

Auto Services in Florida

Zip Auto Glass Repair ★★★★★

Willie`s Paint & Body Shop ★★★★★

Williamson Cadillac Buick GMC ★★★★★

We Buy Cars ★★★★★

Wayne Akers Truck Rentals ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Hellcat motor 'fits like a glove' in the Wrangler and Gladiator, says Jeep

Tue, Apr 9 2019Just like "technically correct" is the best kind of correct, "technically possible" is the best kind of possible. Specifically, it's technically possible to slot a Hellcat crate motor into the Jeep Wrangler and Gladiator, as confirmed by Jeep brand chief Tim Kuniskis. Speaking to Australian media last week, Kuniskis went on to say that "everybody" keeps asking him if the supercharged, 6.2-liter Hellcat V8 fits in the Wrangler and Gladiator, and that the answer is yes. "It fits like a glove," said Kuniskis. But — there is a but — the fitment is so close for comfort, it makes the combination one that Jeep can never produce. "There's no air space around the engine [...] so you have no crush space, you have nothing that can be used to absorb energy in a crash. It's not a problem to put it in — other than emissions and fuel economy — except it would never pass any crash tests, and that's a problem," as Kuniskis told Drive. However, since the Hellcat is now out of the bag, it's probably only a matter of time until hobbyists with access to these engines will start putting them into Wranglers and Gladiators. And with the time-honored piece of advice — just don't crash into anything — it'd be a combination worth seeing and hearing. Just to throw it out there, a "Hellcrate" engine costs less than $20,000 new. Kuniskis also said that Jeep is "gauging interest" for the J6 concept, one of the Easter Jeep Safari concepts that were just revealed. "[The J6] is just a concept at this stage. But that doesn't mean we're not going to gauge interest for it." However, he said justifying its production is apparently "tough."

2013-14 Dodge Viper recalled over faulty door handles

Fri, Apr 10 2015The 2013-14 Dodge Viper is getting a voluntary recall affecting 1,762 cars worldwide to replace their door-handle assemblies. Of the affected vehicles, FCA US reports there are 1,451 in the US, 160 in Canada, 17 in Mexico and 59 of them outside of NAFTA. After receiving three reports of doors either not closing or opening while driving a low speeds, FCA US engineers found a new sealant from a supplier didn't provide sufficient moisture protection to the electronic switches for the door latches. If the parts get wet, this can potentially cause a short circuit. The automaker is quite clear that are no reports of accidents of injuries from this problem. As always, the recall repairs will be done at no cost to owners, and FCA US will be getting in touch with customers soon about the problem. Related Video: Statement: Door-handle Assemblies April 9, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 1,762 cars globally to replace their door-handle assemblies. FCA US launched an investigation after the Company received three warranty claims linked to doors that failed to close or opened inadvertently while vehicles were moving at low speed. The Company is unaware of any related injuries or accidents. Engineers determined a sealant, newly adopted by a supplier, provided inconsistent moisture protection to the electronic switches that control the door latches. Switches exposed to moisture may short-circuit. Affected are approximately 1,451 model-year 2013-14 Dodge Viper SRT cars in the U.S.; 160 in Canada; 17 in Mexico and 59 outside the NAFTA region. Affected customers will be notified and advised when they may schedule service, which will be performed at no cost. Customers with questions may call the FCA US Customer Information Center at 1-800-853-1403.

These are the cars being discontinued for 2024 and beyond

Fri, Jun 21 2024While we get new and updated car models every year, its inevitable that we'll need to say goodbye to some nameplates as well. This time around, it feels like we have confirmation or reports of an unusually large number of vehicles being discontinued in 2024 and the coming years. We shouldn't be surprised. A large number of automakers are approaching their various target dates for electrification of their fleets. As such, some beloved internal combustion cars are going away, sometimes with appropriate fanfare like special editions. Others are slinking away quietly, killed by slowing sales and changing consumer trends. Of course, the end of production doesn't necessarily mean permanent death. Some of these models could be resurrected in later years ... and probably as an EV. With that in mind, here are the vehicles that are being discontinued in 2024 and beyond.  Alfa Romeo Giulia Quadrifoglio and Stelvio Quadrifoglio Alfa Romeo ended the production of its combustion-only Quadrifoglio models in April 2024 as the Italian automaker moves toward an electrified future. This isn't the end of the Quadrifoglio entirely, though, with Larry Dominique, Alfa Romeo senior vice president and head of North America, writing, "I look forward to presenting the next chapter in the four-leaf clover’s journey."  Chevrolet Camaro GM is ending production of the Chevy Camaro after 2024, but is sending it off in style with a CollectorÂ’s Edition. WouldnÂ’t it be cool, though, if Chevy brought it back as an EV?  Chevrolet Malibu Rumors of its demise have been around for a while, but now itÂ’s official. GM will end production of the Chevy Malibu in November of 2024. The assembly line in Kansas will be retooled to build the replacement for the Chevy Bolt.  Dodge Durango The three-row Durango is slated to be replaced by the Stealth nameplate after 2024. The Durango name could make a comeback later, according to rumors, on a body-on frame SUV based on the Jeep WagoneerÂ’s platform.  Ford Edge This is the last year for the Edge in the U.S., with the final unit rolling off the assembly line in April. On sale since 2007, the Edge topped 100,000 sales in all but three full years of production.  Ford Escape Newly refreshed for the 2023 model year, FordÂ’s popular Escape compact SUV is reportedly taking its leave in 2025 in order to usher in — you guessed it — an EV in its place.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.032 s, 7937 u