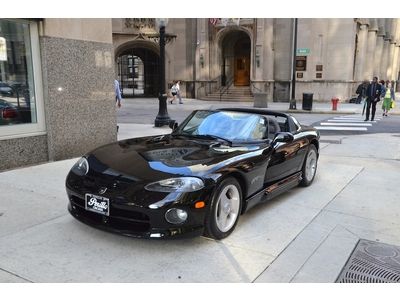

2013 Dodge Srt Viper Gts on 2040-cars

Parkville, Maryland, United States

Engine:8.4L V10

Body Type:Coupe

Vehicle Title:Clear

For Sale By:Dealer

Interior Color: Black GTS Laguna Interior Package

Model: Viper

Number of Cylinders: 10

Trim: GTS

Drive Type: 6 SPEED MANUAL

Mileage: 2

Options: GTS Laguna Interior Package, Track Package, Car Cover by MOPAR, Billet Silver GTS Racing Stripes, Harman Kardon GreenEdge 18 spkr Audio System

Sub Model: In Stock - Immediate Delivery Available

Exterior Color: Venom Black Clear Coat

Warranty: Vehicle has an existing warranty

2013 DODGE VIPER SRT GTS COUPE

BRAND NEW - ONLY 2 MILES

AVAILABLE FOR IMMEDIATE DELIVERY - IN STOCK - ON OUR SHOWROOM FLOOR

BE AMONG THE FIRST TO OWN THE ALL NEW VIPER SRT GTS!!

THIS VIPER IS VERY SELL APPOINTED WITH:

- Venom Black Clear Coat Paint

- Sabelt Laguna Leather Seats

- GTS Laguan Interior Package

- Track Package

- Car Cover by Mopar

- Billet Silver GTS Racing Stripes

- 18 Speaker Harman Kardon GreenEdge Audio System

MSRP - $142,490.00

Call Chad directly toll free at 855-843-0088

Car is located at Heritage Chrysler Dodge Jeep & Ram of Parkville, 9215 Harford Rd, Baltimore MD 21234

Financing is available for qualified buyers. Contact Chad for details of available financing options.

Deposit of $5000.00 required from winning bidder/buyer within 24 hours of end of auction. Deposit is non-refundable and will be applied to purchasers balance due. Price does not include applicable tax, titling, registration, and $199.00 dealer processing fees. Buyer is responsible for transport of vehicle from dealer.

This vehicle is not available for export.

Contact Chad for complete details of purchase terms and conditions.

Dodge Viper for Sale

2003 dodge viper srt-10 convertible 8.3l ultra low miles red(US $49,800.00)

2003 dodge viper srt-10 convertible 8.3l ultra low miles red(US $49,800.00) 1994 dodge viper super low miles , like new call chris @ 630-624-3600(US $37,995.00)

1994 dodge viper super low miles , like new call chris @ 630-624-3600(US $37,995.00) 2013 srt viper launch edition(US $149,998.00)

2013 srt viper launch edition(US $149,998.00) 2013 dodge viper gts(US $151,990.00)

2013 dodge viper gts(US $151,990.00) Copperhead edition convertible 6k miles v10 auto pioneer sound system garaged(US $52,499.00)

Copperhead edition convertible 6k miles v10 auto pioneer sound system garaged(US $52,499.00) 2005 viper roadster, 18k miles, triple black beauty!

2005 viper roadster, 18k miles, triple black beauty!

Auto Services in Maryland

Wiygul Automotive Clinic ★★★★★

Ware It`s At Custom Auto Refinishing ★★★★★

Vehicle Outfitter ★★★★★

Tire World ★★★★★

T & D Automotive Inc ★★★★★

S A Best Tires Inc ★★★★★

Auto blog

2 men die in Dodge Challenger Hellcat crash at Colorado airport

Tue, Sep 12 2017Two friends died in the crash of a Dodge Challenger Hellcat over the weekend after they shot off the end of an airport runway, authorities said. That someone died in a 707-horsepower Hellcat is, sadly, not unexpected. But two aspects of the story are remarkable. First, the men's ages: The Denver Post reports the crash victims were Lynd Fitzgerald, 71, of Colorado Springs, and his passenger, Roger Lichtenberger, 76, of San Marcos, Calif. Second, their speed: The car was likely moving at over 100 miles per hour, authorities said. The men had permission to use the 8,300-foot runway at Central Colorado Regional Airport in Buena Vista. That's more than a mile and a half long. But when the car left the runway, it went 300 feet before flying over a ravine, hitting the ground, becoming airborne again, flipping end over end across a second ravine, and ultimately landing on its wheels 650 feet past the end of the pavement. Responding police officers tried to provide first aid, but the men were declared dead at the scene. "They were just test-driving this car. They went a little too fast. I don't want to surmise. ... They probably got to the end of the runway and, at that speed, didn't realize they were there so fast. And they lost control. It was just too high a speed and they got to the end of the runway," said Chaffee County Sheriff John Spezze. There were skid marks near the end of the runway, but the sheriff didn't know the length. "I've never seen anything like it," Spezze told the newspaper. "They had permission to be there. There were no laws broken." Related Video:

Stellantis lays off salaried workers, cites uncertainty in EV transition

Sat, Mar 23 2024DETROIT — Jeep maker Stellantis is laying off about 400 white-collar workers in the U.S. as it deals with the transition from combustion engines to electric vehicles. The company formed in the 2021 merger between PSA Peugeot and Fiat Chrysler said the workers are mainly in engineering, technology and software at the headquarters and technical center in Auburn Hills, Michigan, north of Detroit. Affected workers were notified starting Friday morning. “As the auto industry continues to face unprecedented uncertainties and heightened competitive pressures around the world, Stellantis continues to make the appropriate structural decisions across the enterprise to improve efficiency and optimize our cost structure,” the company said in a prepared statement Friday. The cuts, effective March 31, amount to about 2% of Stellantis' U.S. workforce in engineering, technology and software, the statement said. Workers will get a separation package and transition help, the company said. “While we understand this is difficult news, these actions will better align resources while preserving the critical skills needed to protect our competitive advantage as we remain laser focused on implementing our EV product offensive,” the statement said. CEO Carlos Tavares repeatedly has said that electric vehicles cost 40% more to make than those that run on gasoline, and that the company will have to cut costs to make EVs affordable for the middle class. He has said the company is continually looking for ways to be more efficient. U.S. electric vehicle sales grew 47% last year to a record 1.19 million as EV market share rose from 5.8% in 2022 to 7.6%. But sales growth slowed toward the end of the year. In December, they rose 34%. Stellantis plans to launch 18 new electric vehicles this year, eight of those in North America, increasing its global EV offerings by 60%. But Tavares told reporters during earnings calls last month that “the job is not done” until prices on electric vehicles come down to the level of combustion engines — something that Chinese manufacturers are already able to achieve through lower labor costs. “The Chinese offensive is possibly the biggest risk that companies like Tesla and ourselves are facing right now,Â’Â’ Tavares told reporters. “We have to work very, very hard to make sure that we bring out consumers better offerings than the Chinese.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.