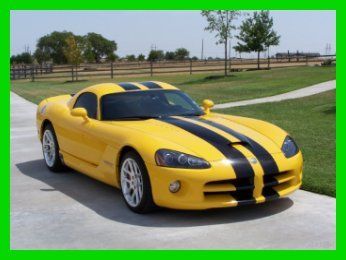

2006 Srt10 Used 8.3l V10 20v Manual Rwd Coupe Premium on 2040-cars

Georgetown, Texas, United States

Vehicle Title:Clear

Engine:8.3L 8275CC 505Cu. In. V10 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Interior Color: Black

Make: Dodge

Model: Viper

Warranty: No

Trim: SRT-10 Coupe 2-Door

Drive Type: RWD

Number of Doors: 2 Doors

Mileage: 5,700

Sub Model: SRT10

Number of Cylinders: 10

Exterior Color: Yellow

Dodge Viper for Sale

Srt viper(US $105,340.00)

Srt viper(US $105,340.00) Acr edition+super clean+carbon fiber+bose sound

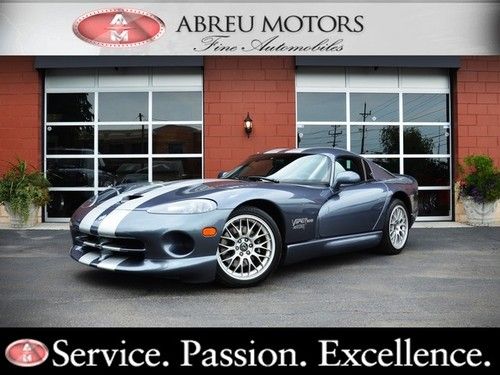

Acr edition+super clean+carbon fiber+bose sound 1996 dodge viper gts coupe 2-door 8.0l(US $38,900.00)

1996 dodge viper gts coupe 2-door 8.0l(US $38,900.00) 2000 dodge viper acr competition 6 speed manual * 6k miles! pristine!!!!(US $59,895.00)

2000 dodge viper acr competition 6 speed manual * 6k miles! pristine!!!!(US $59,895.00) 2005 dodge viper srt10 convertible, xenon, kenwood, jl audio, manual, backup cam(US $58,999.00)

2005 dodge viper srt10 convertible, xenon, kenwood, jl audio, manual, backup cam(US $58,999.00) Navigation dual silver painted stripes floor mats gen iv 6-speed manual tremec

Navigation dual silver painted stripes floor mats gen iv 6-speed manual tremec

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

2019 Dodge Challenger SRT Hellcat Redeye priced $14,000 below Demon

Mon, Jul 2 2018Steve Beahm, head of Passenger Car Brands at Dodge, SRT, Chrysler, and Fiat, told Motor Trend that the 2019 Dodge Challenger SRT Hellcat Redeye is "a Hellcat that's been possessed by a Demon." Turns out the Hellcat Redeye was also possessed by The Ghost of Great Deals. Dodge just released pricing for the Challenger line, the crimson-eyed terror at the top starting at $69,650, which is $13,645 less dear than the $83,295 MSRP for the 2018 Challenger SRT Demon. The asterisk: the Redeye needs the same $1,345 destination charge and $1,700 gas guzzler tax as the 2018 Demon, so the difference still holds once you get the Redeye off the dealer lot. The final tally: $72,995. Torque News acquired a copy of the Challenger dealer order guide, and options on the Hellcat Redeye will run you a little more than the bucket of $1 options on the Demon. Among the list, the summer performance tires add $695, the optional 3.09 rear axle adds $1,095, a painted black hood costs $1,995, and the Widebody package adds $6,000 for it's extra 3.5 inches. According to TN, you can run a standard Hellcat Redeye up to almost $90,000, and push a widebody to $95,000. The standard Challenger SRT Hellcat gets touched by the bargain bogeyman, too: the price goes down by $5,645 for 2019 to $58,650, even though it's been uprated by ten horsepower to 717 hp, and by six pound-feet to 656 lb-ft. Out-the-door price after a $1,700 gas guzzler tax and $1,345 destination fee is $61,695. Before including destination, there's a long way down to the next model, the 485-horsepower Challenger R/T Scat Pack at $38,995. Buyers who choose the six-speed manual for this trim will pay a $1,000 gas guzzler tax. The V6-powered, 305-hp Challenger GT in two-wheel drive starts at $29,995. Sending power to all four of the GT's wheels needs $32,995 before destination. The base model, two-wheel drive SXT gets the Challenger doors open at $27,295, the all-wheel drive model costing $30,295. Related Video:

FCA recalling Chrysler and Dodge minivans, Dodge Nitro SUVs for faulty airbag covers

Fri, Jul 10 2020Fiat Chrysler Automobiles said on Friday it would recall about 925,239 of its older model vehicles in the United States to replace airbag covers on their steering wheels after 14 potentially related injuries. The recall is limited to 2007-2011 Dodge Nitro SUVs, 2008-2010 Chrysler Town & Country and Dodge Grand Caravan minivans, the Italian-American automaker said. The move follows an FCA investigation that found these vehicles were equipped with certain clips that may loosen and disengage over time, and in case of a driver-side airbag deployment the clips could act as projectiles. Fiat Chrysler said none of the potential injuries involved occupants of front-passenger or rear seats and that the airbags were not supplied by Takata. Reporting by Sanjana Shivdas in Bengaluru; Editing by Amy Caren Daniel. Related Video: Â Recalls Chrysler Dodge Minivan/Van SUV

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.