2001 Dodge Viper R/t-10 Convertible 2-door 8.0l on 2040-cars

Austin, Texas, United States

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

Transmission:Manual

Body Type:Convertible

Fuel Type:GAS

For Sale By:Private Seller

Number of Doors: 2

Make: Dodge

Mileage: 8,112

Model: Viper

Sub Model: RT10

Trim: R/T-10 Convertible 2-Door

Exterior Color: Yellow

Interior Color: Black

Drive Type: RWD

Number of Cylinders: 10

Options: Leather Seats, CD Player

Safety Features: Anti-Lock Brakes

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

2001 DODGE VIPER RT-10 THAT WAS IN AN ACCIDENT ABOUT 10 YEARS AGO. VEHICLE WAS REBUILT, HAS ORIGINAL 8112 MILES ONLY!!!!!!!

Dodge Viper for Sale

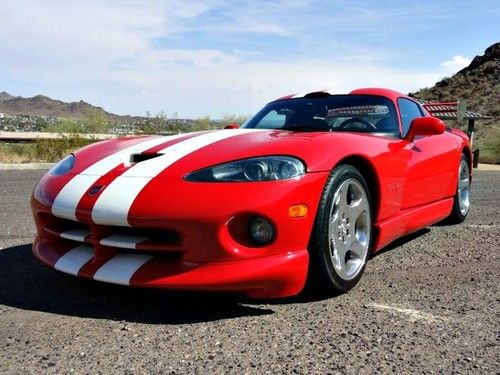

Garage kept 1 original owner dodge viper rt-10 flawless collector condition look(US $54,900.00)

Garage kept 1 original owner dodge viper rt-10 flawless collector condition look(US $54,900.00) No reserve 02 viper gts final edition #278 of 360 w/ only 7,000 miles!!!!!

No reserve 02 viper gts final edition #278 of 360 w/ only 7,000 miles!!!!! 2dr rt/10 co manual convertible cd 4-wheel disc brakes a/c abs adjustable pedals

2dr rt/10 co manual convertible cd 4-wheel disc brakes a/c abs adjustable pedals 2000 dodge viper r/t-10 convertible 2-door 8.0l

2000 dodge viper r/t-10 convertible 2-door 8.0l 2008 dodge viper srt-10 coupe 600hp nav very orange 19k texas direct auto(US $63,980.00)

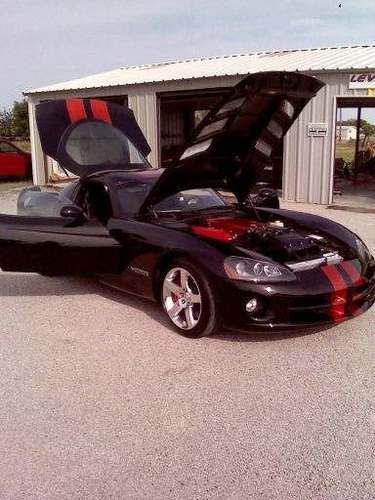

2008 dodge viper srt-10 coupe 600hp nav very orange 19k texas direct auto(US $63,980.00) 2008 dodge viper supercar black w tangeriene kandy racing stripes only 4k miles

2008 dodge viper supercar black w tangeriene kandy racing stripes only 4k miles

Auto Services in Texas

WorldPac ★★★★★

VICTORY AUTO BODY ★★★★★

US 90 Motors ★★★★★

Unlimited PowerSports Inc ★★★★★

Twist`d Steel Paint and Body, LLC ★★★★★

Transco Transmission ★★★★★

Auto blog

Dodge revamping lineup with AWD Challenger and lighter Charger

Tue, Sep 6 2016Dodge's current lineup is aging rapidly. The Charger, for example, is going on 5 years old but its platform dates back to 2006. FCA, according to Automotive News, is working on revitalizing Dodge's lineup with the first of some new models debuting later this year. The report reveals plans for the majority of FCA's brands, but the most interesting bit of information is an all-wheel-drive model for the Dodge Challenger, which is being referred to as the GT AWD. Mopar unveiled the Challenger GT AWD Concept at SEMA last year as a concept, but it looks like the idea stuck. The vehicle is set to make its debut this fall and will lead the way for a wide-body, Hellcat-powered version that will be released in 2017. That model will be called the Challenger ADR. The entire Challenger lineup will be redesigned in 2018, which includes switching over to the lighter Giorgio platform - the same one that underpins the Alfa Romeo Guilia Dodge will also redesign the Charger to accommodate the new Giorgio platform in 2018. A new two-door convertible could debut in 2021, resurrecting the Barracuda moniker. The aging Dodge Durango will get a light refresh in 2017 with the addition of an SRT model, which Automotive News reports will feature a 6.4-liter V8 engine. Other changes are in store for other FCA brands, including the debut of full-size crossover in 2018 for Chrysler, which will be followed by a midsize crossover in 2019. The Jeep Compass and Wrangler will get a redesign for 2017, with the Cherokee getting a light makeover, as well. The Wrangler-based pickup truck, which we recently spotted testing, is set for its debut in 2018, while the Wagoneer will come out a year later. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2014 Dodge Durango bows with eight-speed auto, updated looks [w/video]

Thu, 28 Mar 2013Dodge has significantly updated its full-size Durango for the 2014 model year, giving the seven-passenger hauler a fresh look and a well-rounded boost of competitive features as it enters its fourth year in the showroom.

Cosmetically, it is hard to miss the revised front end with projector-beam headlamps and LED daytime running lamps, "floating" crosshair grille, a taller front bumper and a new lower fascia. The rear end of the facelifted Durango has been redesigned with the automaker's now-signature LED "racetrack" taillamps and resculpted rear fascia. All of the wheels are new too, with 18- and 20-inch options for each trim level with a variety of factory finishes.

Inside the cabin, buyers can select the automaker's latest Uconnect infotainment system with a full suite of infotainment features and connectivity accessed through an 8.4-inch touchscreen. Other optional goodies include a heated steering wheel, heated second-row seating and a Blu-Ray player capable of running unique programs on the twin individual rear monitors.

Defiance Dodge Charger, saving Earth from aliens isn't clean work [w/video]

Fri, 08 Feb 2013You'll be forgiven for not having heard about the TV show Defiance - it actually hasn't aired its first episode yet. The new science fiction show about an alien war against Earth in the near future seems like a perfect fit for the SyFy channel, and, apparently one that Dodge saw as a slick marketing opportunity for its Charger sedan.

Here in Chicago, Dodge has given a large corner of its show stand to the Defiance Charger, a car that won't be skipped by any Mad Max fans in attendance at this year's show. The Charger boasts one hell of a gnarly patina under a confusingly welded cage of tube steel, as well as window bars, a grille guard in front, and big, knobby truck tires. There aren't any obvious guns or turrets on the outside of the vehicle, so we can only hope that the characters driving it go well-armed.

Look for the Charger to make its star turn in Defiance when the series premieres on SyFy on April 15 at 9:00 PM EST. Also, there's said to be a Defiance video game in the works, too, so you may get a chance to steer the burly Dodge for yourself. Find a trailer for the show, below, as well.